LG 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

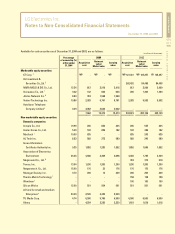

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

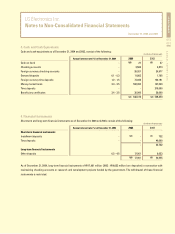

Foreign Currency Translation

Monetary assets and liabilities denominated in foreign

currencies are translated into Korean won at the basic rates in

effect at the balance sheet date( 1,043.8: US$1 as of

December 31, 2004, 1,197.8: US$1 as of December 31, 2003),

and resulting translation gains or losses are recognized in

current operations. However, convertible bonds in foreign

currency are translated into Korean won at the agreed rate of

exchange, considering the exercise of conversion rights by the

creditors.

Derivative Financial Instruments

The Company utilizes several derivative financial

instruments (“derivatives”) such as forward exchanges, swaps

and option contracts to reduce its exposure resulting from

fluctuations in foreign currency and interest rates. The

derivatives are carried at fair market value. Unrealized gains or

losses on derivatives for trading or fair value hedging purposes

are recorded in current operations. Unrealized gains or losses

on derivatives for cash flow hedging purposes are recorded in

current operations for the portion of the hedge that is not

effective. For the portions of cash flow hedges which are

effective, unrealized gains or losses are accounted for in the

capital adjustments account and recorded in current

operations in the period when the underlying transactions

have an effect on operations.

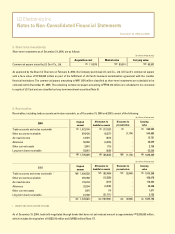

Convertible Bonds

The Company recorded a premium for conversion rights

as a capital surplus representing the difference between the

issuance price of convertible bonds and the present value of

bonds under identical conditions without conversion rights.

The Company offset conversion rights adjustment by the face

value of convertible bonds and add call premium to the face

value of convertible bonds.

Government grants

The Company recognizes government grants, which are

to be redeemed, as liabilities. The government grants, which

are intended to be used for the acquisition of certain assets,

are deducted from the cost of the acquired assets. Before the

acquisition of the assets specified by the grant, the amounts

are recognized as a deduction from the account under which

the asset to be acquired is to be recorded, or from the other

assets acquired as a temporary investment of the grant

received.

The government grants, contributed to compensate for

specific expenses, are offset against the related expenses.

Other government grants, for which the use or purpose is not

specified, are recorded as gains from assets contributed, and

are recognized in current operations.