LG 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG ELECTRONICS ANNUAL REPORT 2004

044

045

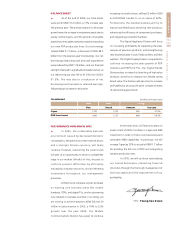

BALANCE SHEET

�As of the end of 2004, our total assets

were worth KRW 13.2 trillion, a 17% increase over

the previous year. The primary reasons for this asset

growth were the increase in investment assets due to

equity method gains, and the growth of tangible

assets from the sizable investment made in extending

our new PDP production lines. Our borrowings

totaled KRW 3.7 trillion, a decrease of KRW 48.2

billion from the previous year's borrowings. Our net

borrowings (deducting cash and cash equivalents)

were reduced by KRW 119 billion, and our financial

strength improved in a gradual but steady manner, as

our debt-to-equity ratio fell to 61.6% from 2003's

91.5%. This was due to a reduction of net

borrowings and increases in retained earnings,

followed by an increase in net income.

PERFORMANCE OUTLOOK IN 2005

�In 2005, the unfavorable business

environment caused by decreased domestic

consumption, elevated oil and raw material prices,

and a stronger Korean currency, will likely

continue. However, overcoming the current crisis

will give us an opportunity to secure a competitive

edge in our market. Mindful of this, we plan to

confront present difficulties by efficiently

managing company resources, and accelerating

innovations throughout our management

processes.

LG Electronics will place utmost emphasis

on existing core business areas like mobile

handsets, PDPs, and digital TVs, and on pioneering

new markets in overseas countries. In so doing, we

are striving to achieve between KRW 28 and 30

trillion in sales revenue in 2005, a 14% to 22%

growth over the year 2004. Our Mobile

Communications Division has a plan to continue

increasing its market share, selling 62 million GSM

and WCDMA handsets, an increase of 40%.

Furthermore, the handset business will try to

improve profitability by launching new products,

enhancing the efficiency of component purchases,

and integrating production facilities.

The Digital Appliance Division will focus

on increasing profitability by expanding the sales

revenue of premium products, and strengthening

new business bases in such fields as driers and dish

washers. The Digital Display Division is expected to

continue increasing the sales growth of PDP

modules and PDP/LCD TVs. Our Digital Media

Division plans to extend its launching of high value

products, as well as to improve our already strong

brand value. The Division will also strive to increase

profitability by securing the price competi-tiveness

of optical storage products.

In the mean time, LG Electronics plans to

invest a total of KRW 3.5 trillion in Capex and R&D

investment in order to foster core businesses and

strengthen R&D capabilities. In particular, we will

increase Capex by 33% to a total of KRW 1.7 trillion

for building the 4th line of PDP and integrating

handset production sites.

In 2005, we will continue rationalizing

our overall businesses, enhancing financial

structures through the thorough management of

working capital and the improvement of our

profitability.

CFO Young-Soo Kwon

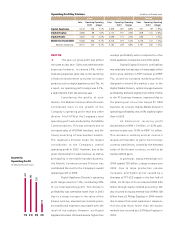

Investment (in billions of Korean won)

2005 2004 Change

Plan Result Amount Increase

Capex 1,700 1,274 426 33.5%

R&D Investment 1,800 1,131 669 59.2%