LG 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

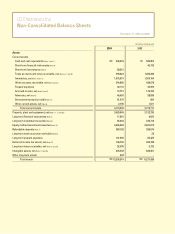

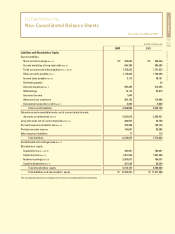

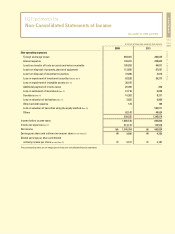

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

Application of the Statements of Korean

Financial Accounting Standards

The Korean Accounting Standards Board has published

a series of Statements of Korean Financial Accounting

Standards (“SKFAS”), which will gradually replace the existing

financial accounting standards established by the Korean

Financial Supervisory Commission. As SKFAS No. 2 Interim

Financial Reporting, through No. 9 Convertible Securities,

became applicable to the Company on January 1, 2003, the

Company adopted these Standards in its financial statements

covering periods beginning on or after this date. As SKFAS

Nos. 10 Inventories, 12 Construction-Type Contracts and 13

Debt Restructuring and Rescheduling, became applicable to

the Company on January 1, 2004, the Company adopted these

Standards in its financial statements as of and for the year

ended December 31, 2004.

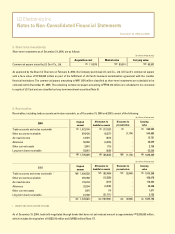

Revenue Recognition

Revenues from finished products and merchandise are

recognized when most of the risks and benefits associated

with the possession of goods are substantially transferred.

Accordingly, sales of finished products are recognized when

inspection is completed, and sales of merchandise are

recognized when delivered. Revenue from installation service

contracts is recognized using the percentage-of-completion

method.

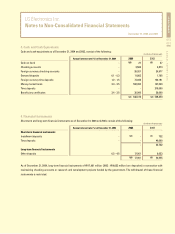

Cash and Cash Equivalents

The Company considers cash on hand, bank deposits

and highly liquid marketable securities with original maturities

of three months or less to be cash and cash equivalents.

Securities

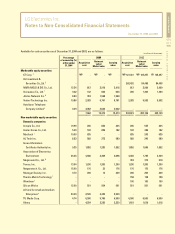

The Company accounts for equity and debt securities

under the provisions of SKFAS No. 8, Investments in Securities.

This statement requires investments in equity and debt

securities to be classified into three categories: trading,

available-for-sale and held-to-maturity.

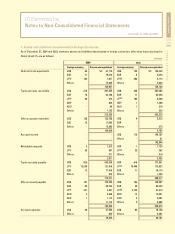

Securities are initially carried at cost, including

incidental expenses, with cost being determined using the

gross average method. Debt securities, which the Company

has the intent and ability to hold to maturity, are generally

carried at cost, adjusted for the amortization of discounts or

premiums. Premiums and discounts on debt securities are

amortized over the term of the debt using the effective interest

rate method. Trading and available-for-sale securities are

carried at fair value, except for non-marketable securities

classified as available-for-sale securities whose fair value may

not be determined, which are carried at cost. Non-marketable

debt securities are carried at a value using the present value

of future cash flows, discounted at a reasonable interest rate

determined considering the credit ratings by independent

credit rating agencies.

Unrealized valuation gains or losses on trading

securities are charged to current operations, and those

resulting from available-for-sale securities are charged to

capital adjustments, the accumulated amount of which shall

be charged to current operations when the related securities

are sold, or when an impairment loss on the securities is

recognized. Impairment losses are recognized in the statement

of income when the recoverable amounts are less than the

acquisition cost of securities or adjusted cost of debt

securities after the amortization of discounts or premiums.