LG 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

LG ELECTRONICS ANNUAL REPORT 2004

094

095

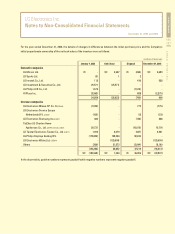

Amortization of intangible assets presented under manufacturing costs and selling and administrative expenses for the years ended

December 31, 2004 and 2003, consists of the following:

Manufacturing costs

Selling and administrative expenses

(in millions of Korean won)

2004

35,660

172,747

208,407

2003

34,631

180,993

215,624

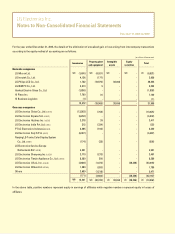

The carrying value of significant intangible assets as of December 31, 2004 and 2003, consists of the following:

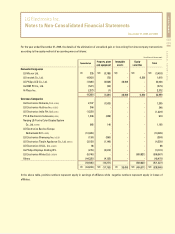

As a result of LG Electronics Investment Ltd. (formerly LG Electronics Inc., now merged into LG Corp.)’s merger with LG Information &

Communications, Ltd. in September 2000, former LG Electronics Inc. recognized goodwill amounting to 393,820 million and acquired

industrial property rights amounting to 578,788 million. At the time of spin-off, such goodwill and industrial property rights were

transferred to the Company. Related amortization expenses of goodwill and industrial property rights approximate 39,382 million and

76,359 million, respectively, for the year ended December 31, 2004.

Research and development costs incurred for the year ended December 31, 2004 amounted to 1,235,008 million (2003: 799,455

million) all of which were charged to current operations as ordinary development costs and research costs.

Goodwill

Industrial property rights

(in millions of Korean won)

2003

254,399

311,531

2004

215,017

197,067

Remaining years for amortization

Six years

One through six years