LG 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

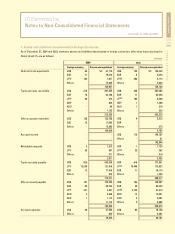

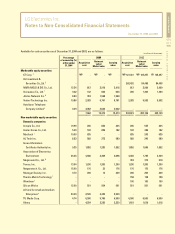

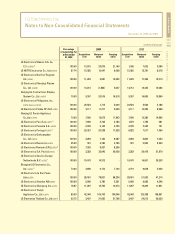

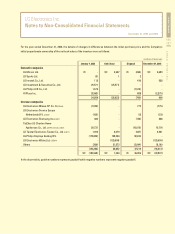

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

LG ELECTRONICS ANNUAL REPORT 2004

084

085

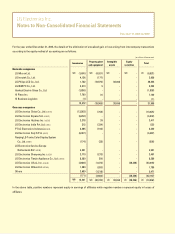

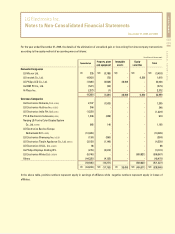

(in millions of Korean won)

42,906

3,910

-

2,649

5,621

5,411

4,096,263

2004

46,437

8,215

952

3,027

5,621

5,411

4,598,247

53,378

8,749

7,139

2,649

5,621

5,411

3,226,666

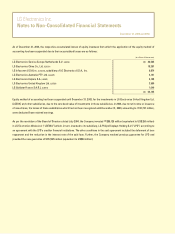

31.82

60.00

100.00

100.00

100.00

100.00

Percentage

of ownership (%)

at December

31, 2004

Net asset

value

Acquisition

cost

Carrying

value

44,496

2,973

-

-

-

-

2,621,879

2003

38,554

1,223

-

-

-

-

3,080,042

38,523

2,973

-

-

-

-

2,969,805

Net asset

value

Acquisition

cost

Carrying

value

LG Holdings (HK) Ltd. 4

Qingdao LG Langchao Digital

Communication Co., Ltd. 4

LG Goldstar France S.A.R.L.(LGEFS) 6

Kunshan LGMS Computer Co., Ltd.

(LGEKS) 6

Goldstar Mobilecomm

France SASU(LGEMF) 5

LG Electronics RUS, LLC(LGERA) 5

1. The equity method of accounting has been suspended due to the investee’s accumulated losses.

2. Investments in small-sized subsidiaries and affiliates whose total assets as of the previous year-end

amounted to less than 7,000 million, or which have just been established in the current period are stated at cost,

in accordance with accounting principles generally accepted in the Republic of Korea.

3. The operations of this subsidiary were suspended as of December 31, 2004.

4. During 2004, the Company purchased additional shares of these subsidiaries.

5. This subsidiary has just been established during 2004.

6. The Company newly purchased the shares of these subsidiaries during 2004.

7. The Company disposed of all the shares of LG Sports Ltd., resulting in a loss amounting to 598 million.

8. During 2004, the Company’s investments in LGEAI, LGICUS and Zenith were all contributed in kind to LGEUS,

making LGEUS the new parent company of the three investees and resulting in a gain of 38,336 million.

However, there was no effect on earnings because the amount was charged to valuation loss using equity method as intercompany transactions.

9. The Company’s percentage of ownership in LG.Philips LCD Co., Ltd. decreased from 50% to 44.57%

because the Company did not participate in issuance of stock for LG.Philips LCD Co., Ltd. A valuation gain of 300,891 million

for the year ended December 31, 2004 using equity method due to the change in percentage of ownership was recorded as capital adjustments.

10. The Company merged a part of PC Division of LG IBM PC Co., Ltd., a joint venture with IBM Korea Inc.

This merger is aimed to optimize business efficiency, align operational strategies, and maximize profitability.

The equity method of accounting is applied based on the affiliates’ most recent available financial statements which have been

audited or which have not been audited.