LG 2004 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

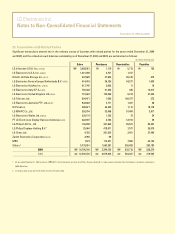

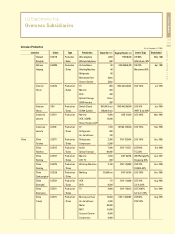

30. Operating Results for the Final Interim Period

Significant operating results for the three-month periods ended December 31, 2004 and 2003, are as follows:

Sales

Cost of sales

Operating income

Net income (loss) for the period

Basic earnings (loss) per share (in won)

Diluted earnings (loss) per share (in won)

(in millions of Korean won, except per share amounts)

2004

6,521,349

5,065,431

94,909

163,381

1,046

1,023

2003

5,417,450

4,144,519

197,694

(17,206)

(164)

(164)

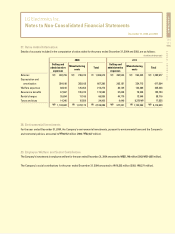

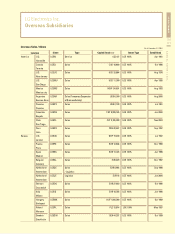

31. Supplemental Cash Flow Information

Significant transactions not affecting cash flows for the years ended December 31, 2004 and2003, are as follows:

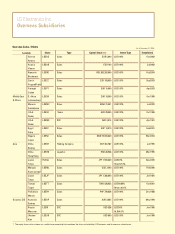

32. Approval of Non-Consolidated Financial Statements

The non-consolidated financial statements of the Company will be approved by the Board of Directors on February 19, 2005.

33. Subsequent Event

On January 1, 2005, the Company merged a part of PC division of LG IBM PC Co., Ltd., a joint venture with IBM Korea Inc. This merger

is aimed to optimize business efficiency, align operational strategies, and maximize profitability.

On January 24, 2005, the Company signed a memorandum of understanding with Nortel Networks Corporation of Canada for

establishment of a joint venture to engage in the field of communication equipment and networking solution.

Reclassification of current maturities of debentures

Transfer to buildings, machinery and others from construction-in-progress

Changes in capital adjustments arising from the equity method

of accounting for investments

Transfer to machinery and equipment from machinery-in-transit

Reclassification of current maturities of long-term debt

Changes in retained earnings arising from deducting organization costs

(in millions of Korean won)

2004

649,140

400,505

136,267

33,933

-

-

2003

985,112

102,259

7,641

108,299

4,468

3,271