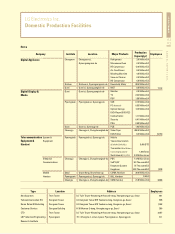

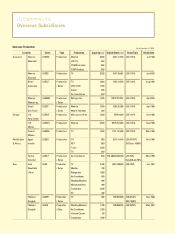

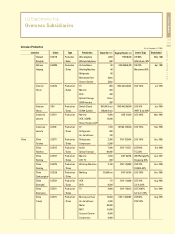

LG 2004 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

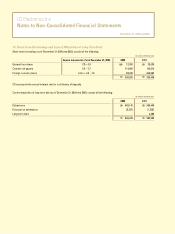

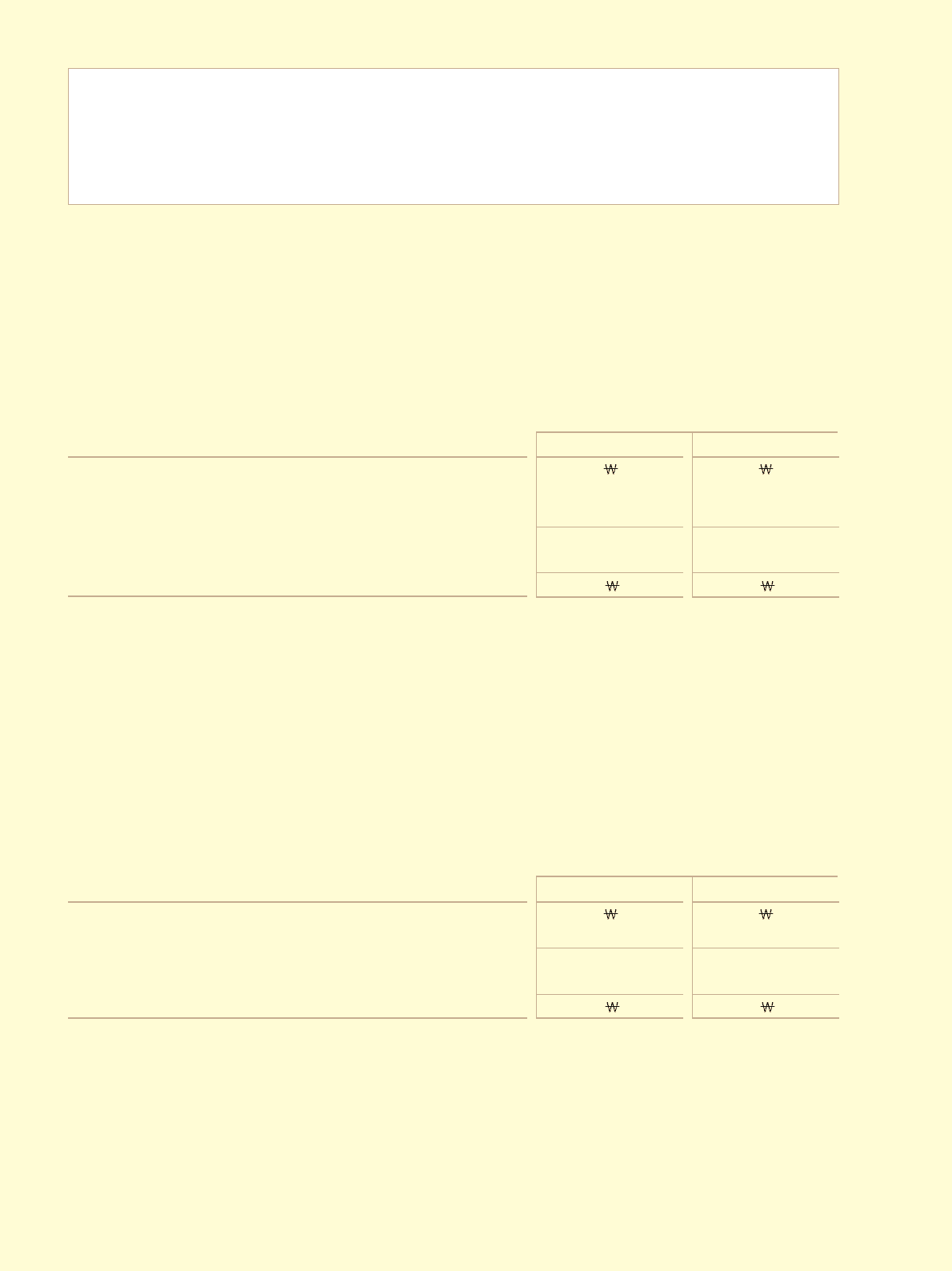

23. Earnings Per Share

Basic earnings per share is computed by dividing net income allocated to common stock by the weighted-average number of common

shares outstanding during the year. Basic ordinary income per share is computed by dividing ordinary income allocated to common

stock, whichis net income allocated to common stock as adjusted by extraordinary gains or losses, net of related income taxes, by the

weighted-average number of common shares outstanding during the year.

Basic earnings per share for the years ended December 31, 2004 and 2003, are calculated as follows:

Basic ordinary income per share is identical to the basic earnings per share since there was no extraordinary gain or loss.

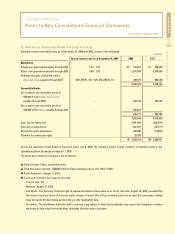

Diluted earnings per share is computed by dividing diluted net income, which is adjusted by adding back the after-tax amount of

interest expense on any convertible debt and dividends on any convertible preferred stock, by the weighted-average number of

common shares and diluted securities outstanding during the year. Diluted ordinary income per share is computed by dividing diluted

ordinary income allocated to common stock, which is diluted net income allocated to common stock as adjusted by extraordinary

gains or losses, net of related income taxes, by the weighted-average number of common shares and diluted securities outstanding

during the year.

Diluted earnings per share for years ended December 31, 2004 and 2003, are calculated as follows:

Net income as reported on the statement of income

Less: Preferred stock dividends (Note 24)

Additional income available for dividends allocated to preferred stock

Net income allocated to common stock

Weighted-average numbern of common shares outstanding

Basic earnings per share and ordinary income per share (in won)

(in millions of Korean won, except per share amounts)

2004

1,545,954

(26,631)

(144,406)

1,374,917

139,016,745

9,890

2003

662,824

(22,336)

(51,154)

589,334

139,357,190

4,229

1. This is computed based on the effective tax rate of 16.9% (2003: 20.8%) for the year ended December 31, 2004 (Note 22).

Diluted ordinary income per share is identical to the diluted earnings per share since there were no extraordinary gains or loss.

Net income allocated to common stock

Add: Interest expense on convertible bonds, net of tax 1

Weighted-average number of common shares and diluted securities outstanding

Diluted earnings per share and diluted ordinary income per share (in won)

(in millions of Korean won, except per share amounts)

2004

1,374,917

14,027

1,388,944

145,949,525

9,517

2003

589,334

2,129

591,463

141,272,019

4,187