LG 2004 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

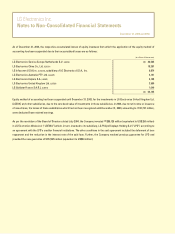

In order to reduce the impact of changes in exchange rates, the Company has also entered into foreign currency option contracts. An

unrealized valuation gain and loss amounting to 12,051 million and 1,422 million, respectively, were recorded to current

operations for the year ended December 31, 2004.

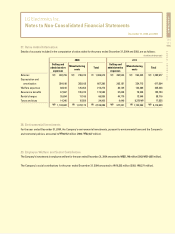

A summary of the terms of outstanding currency option contracts as of December 31, 2004, is as follows:

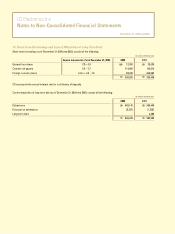

In order to reduce the impact of changes in interest rates and exchange rates, the Company has also entered into a cross currency swap

contract. An unrealized valuation gain of 31,568 million was recorded to current operations for the year ended December 31, 2004.

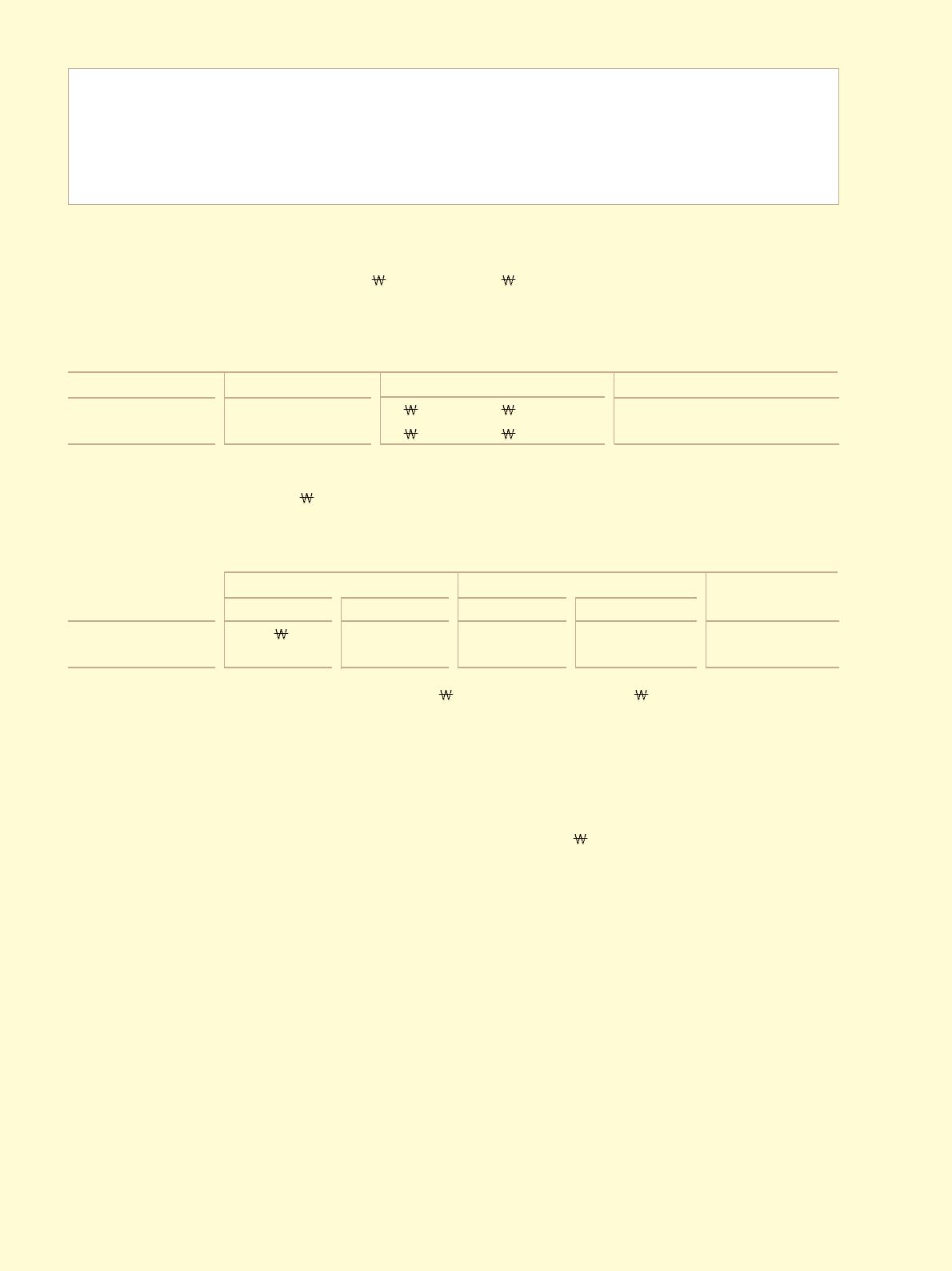

A summary of the terms of the outstanding cross currency swap contract as of December 31,2004, is as follows:

Option type

Put

Call

Amount (in millions)

US$160

US$150

Exercise price

1,035.0/US$ ~ 1,170.0/US$

1,053.1/US$ ~ 1,188.0/US$

Contract due date

January 4, 2005 through June 10, 2005

January 4, 2004 through June 10, 2005

Standard Chartered Bank

Barclays Bank

(in millions)

Disbursement

110,000

117,150

Receipts

US$93

100

Receipts

4.50%

5.00%

Disbursement

3M LIBOR + 0.79%

3M LIBOR + 1.17%

Maturity

November 7, 2005

February 26, 2007

Transaction amount Annual interest rate (%)

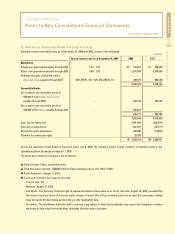

As a result of the above derivatives contracts, a realized gain of 38,367 million and a realized of 12,716 million were recorded as a

non-operating income and expense, respectively, for the year ended December 31, 2004.

As of December 31, 2004, the Company is named as a defendant in legal actions which were brought against the Company by

Matsushita Electric Industrial Co., Ltd. in Japan and AVS Corporation in Canada. In addition, the Company is named as either the

defendant or the plaintiff in various foreign and domestic legal actions arising from the normal course of business. The aggregate

amounts of domestic claims as the defendant and plaintiff amounted to approximately 17,232 million as of December 31, 2004. The

Company believes that the outcome of these legal actions is uncertain but, in any event, they would not result in a material ultimate

loss for the Company.