LG 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

LG ELECTRONICS ANNUAL REPORT 2004

102

103

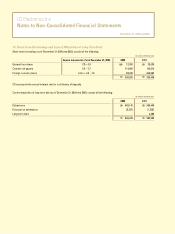

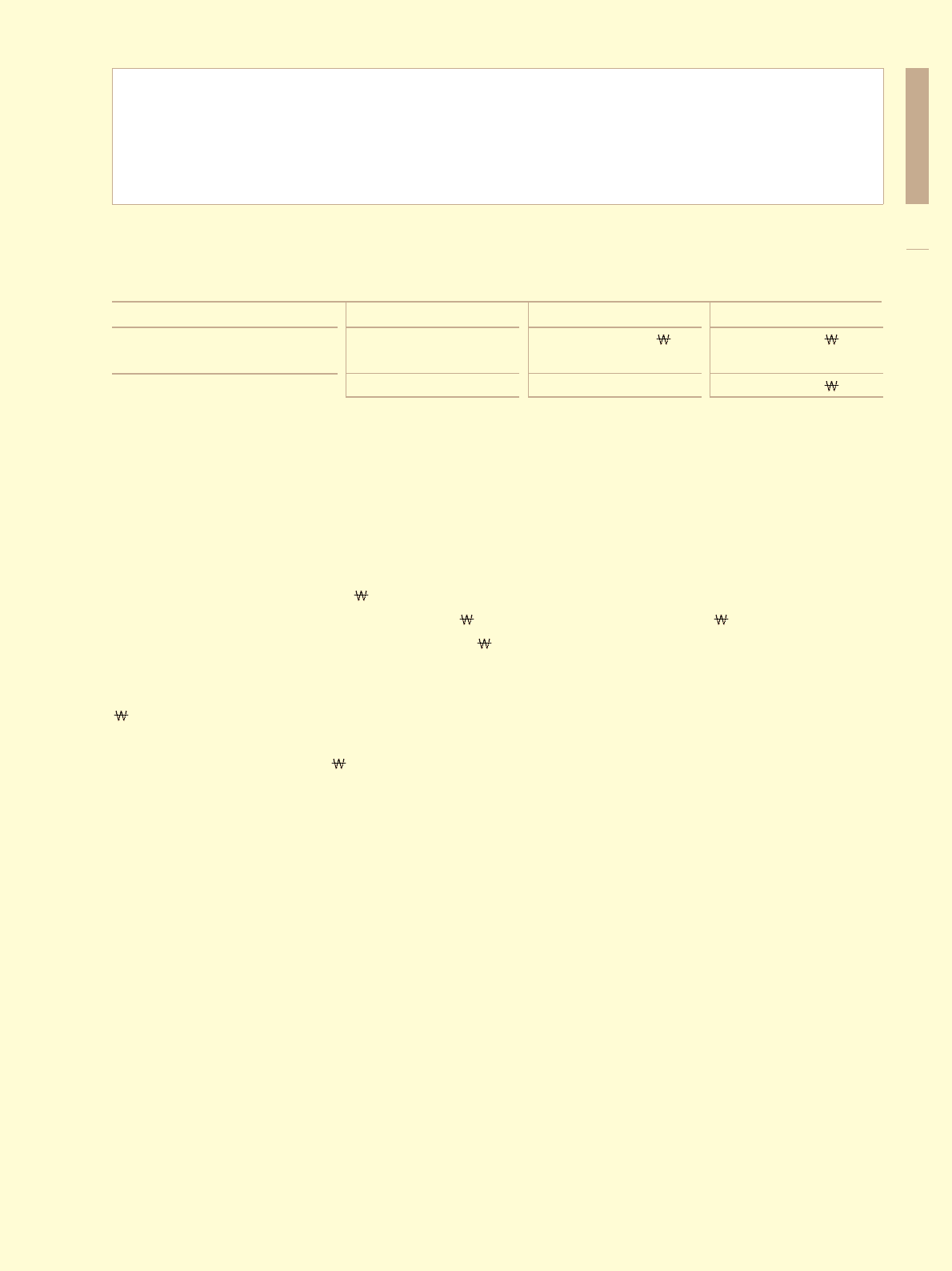

Common stock

Preferred stock 1

Number of shares issued

139,606,263

17,185,992

156,792,255

Par value per share

5,000

5,000

Millions of Korean won

698,031

85,930

783,961

(in millions of Korean won)

18. Capital Stock

Capital stock as of December 31, 2004 and 2003, are as follows:

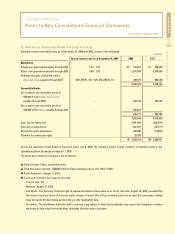

19. Capital Surplus

As a result of the spin-off on April 1, 2002, 1,876,153 million was recorded as capital surplus representing the difference between net

assets transferred from LG Electronics Investment Ltd. of 2,815,707 million, net of capital stock of 783,961 million and capital

adjustments transferred from LG Electronics Investment Ltd. of 155,593 million.

As a result of the issuance of foreign currency convertible bonds in August 2003 and May 2004, a premium for conversion rights of

29,471 million was recorded as a capital surplus representing the difference between the issuance price of convertible bonds and

the present value of bonds under identical conditions without conversion rights. In addition, as a result of disposal of treasury stock,

gains on disposal of treasury stock of 1,919 million were recorded as a capital surplus.

20. Retained Earnings

The Commercial Code of the Republic of Korea requires the Company to appropriate, as a legal reserve, an amount equal to a

minimum of 10% of cash dividends paid until such reserve equals 50% of its issued capital stock. The reserve is not available for the

payment of cash dividends, but may be transferred to capital stock through an appropriate resolution by the Company’s Board of

Directors or used to reduce accumulated deficit, if any, with the ratification of the Company’s majority shareholders.

In accordance with the regulations regarding securities’ issuance and disclosure, the Company is required to appropriate, as a

reserve for improvement of financial structure, a portion of retained earnings equal to a minimum of 10% of its annual income plus at

least 50% of the net gain from the disposal of property, plant and equipment after deducting related taxes, until shareholders’ equity

equals 30% of total assets. This reserve is not available for the payment of dividends, but may be transferred to capital stock through

an appropriate resolution by the Company’s Board of Directors or used to reduce accumulated deficit, if any, with the ratification of

the Company’s majority shareholders.

Pursuant to the Special Tax Treatment Control Law, the Company is allowed to appropriate retained earnings as a reserve for research

and manpower development. This reserve is not available for the payment of dividends until used for the specified purposes or reversed.

As of December 31, 2004, the number of shares authorized is 600 million shares.

1. The preferred shareholders have no voting rights and are entitled to non-participating and non-cumulative preferred dividends at a rate of one percentage point over those for common stock.

This preferred dividend rate is not applicable to stock dividends.