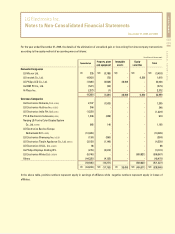

LG 2004 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

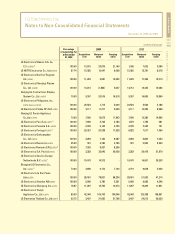

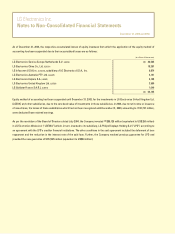

As of December 31, 2004, the respective accumulated losses of equity investees from which the application of the equity method of

accounting has been suspended due to their accumulated losses are as follows:

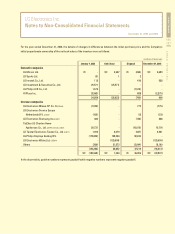

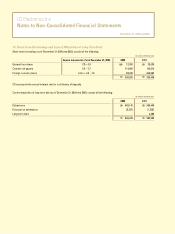

Equity method of accounting had been suspended until December 31, 2003, for the investments in LG Electronics United Kingdom Ltd.

(LGEUK) and other subsidiaries, due to the zero book value of investments in those subsidiaries. In 2004, due to net income or issuance

of new shares, the losses of those subsidiaries which had not been recognized until December 31, 2003, amounting to 51,757 million,

were deducted from retained earnings.

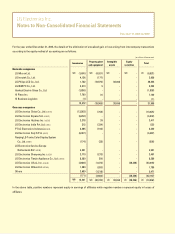

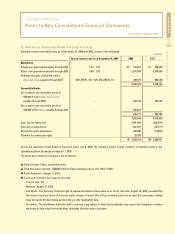

As per the resolution of the Board of Directors dated July 2004, the Company invested 289,125 million (equivalent to US$ 250 million)

in LG Electronics Wales Ltd. (“LGEWA”) which, in turn, invested to its subsidiary, LG.Philips Displays Holding B.V.(“LPD”) according to

an agreement with the LPD’s creditor financial institutions. The other conditions in the said agreement included the deferment of loan

repayment and the reduction in the interest rate of the said loan. Further, the Company revoked previous guarantee for LPD and

provided the new guarantee of 57,825 million (equivalent to US$50 million).

LG Electronics Service Europe Netherlands B.V. (LGESE)

LG Electronics China Co., Ltd. (LGECH)

LG Infocomm U.S.A.Inc. (LGICUS), subsidiary of LG Electronics U.S.A., Inc.

LG Electronics Australia PTY, Ltd. (LGEAP)

LG Electronics Espana S.A. (LGEES)

LG Electronics United Kingdom Ltd. (LGEUK)

LG Goldstar France S.A.R.L. (LGEFS)

(in millions of Korean won)

22,565

18,397

9,874

4,141

4,138

3,990

1,040

64,145