LG 2004 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

LG ELECTRONICS ANNUAL REPORT 2004

104

105

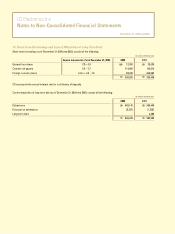

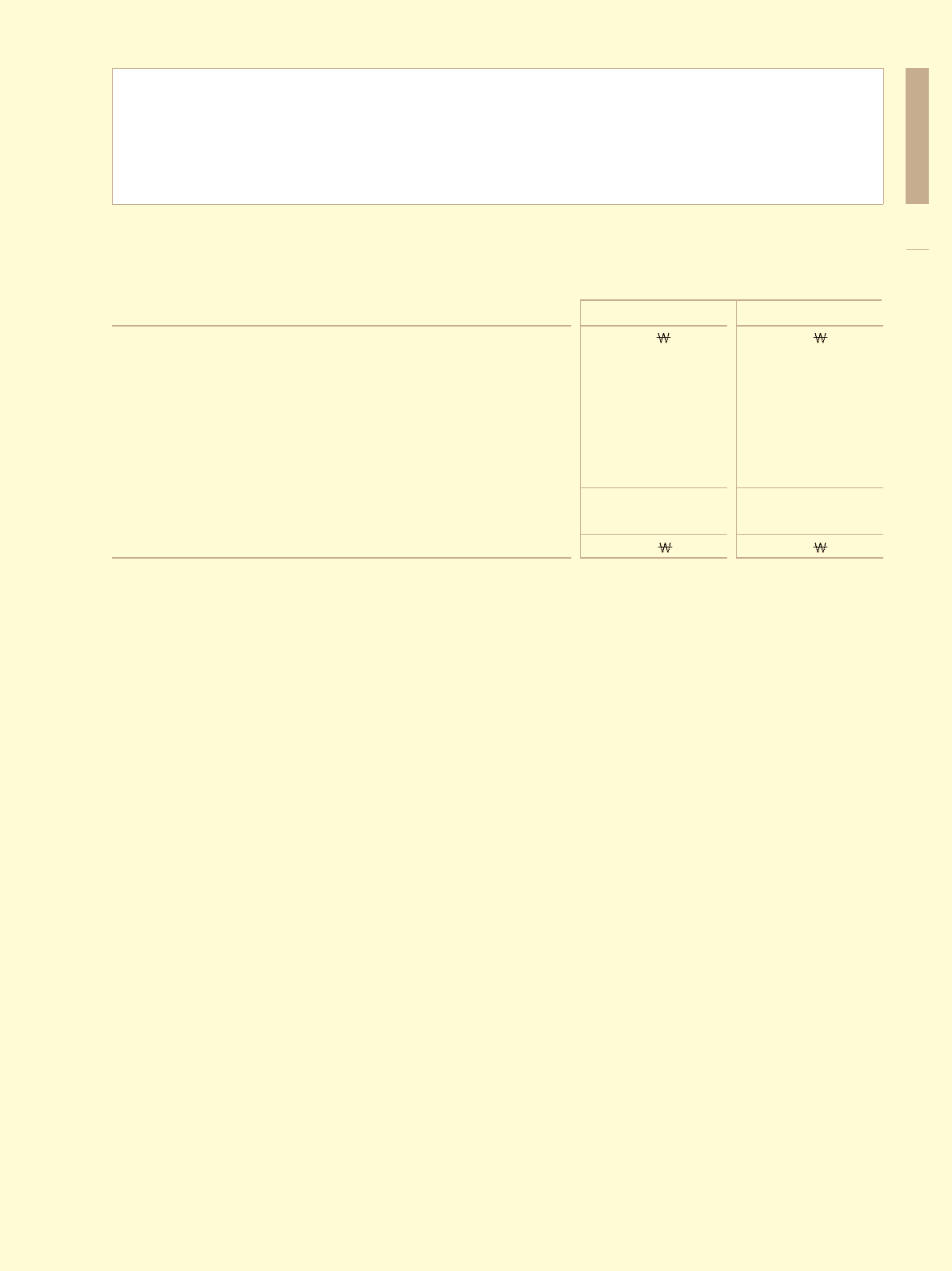

The income tax effects of temporary differences comprising the deferred income tax assets (liabilities) as of December 31, 2004 and

2003, are as follows:

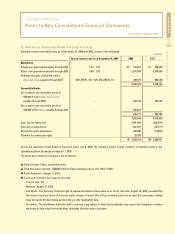

The Company periodically assesses its ability to recover deferred income tax assets. In the event of a significant uncertainty

regarding the Company's ultimate ability to recover such assets, a valuation allowance is recorded to reduce the assets to its

estimated net realizable value. The statutory income tax rate, including resident tax surcharges, applicable to the Company was

approximately 29.7% in 2004 and 2003, and was amended to 27.5% effective for fiscal years beginning January 1, 2005, in accordance

with the Corporate Income Tax Law enacted in December 2003. Deferred income tax assets were computed by applying the present

tax rate of 29.7% for the temporary differences expected to be realized in 2004, and by applying the amended tax rate of 27.5% for the

temporary differences expected to be realized in fiscal years beginning January 1, 2005 and thereafter, except for 29.7% for certain

temporary differences expected to be filed as revision of the prior years’ tax return in 2005.

As a result of tax adjustments, effective tax rate of the Company for the year ended December 31, 2004 is approximately 16.9% (2003: 20.8%).

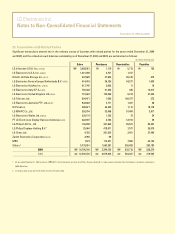

Depreciation

Allowance for doubtful accounts

Product warranty

Amortization of intangible assets

Equity method investment securities

Accrued expenses

Others

Deferred tax from temporary differences

Tax credit carried forward

Deferred income tax assets

(in millions of Korean won)

2004

(42,943)

21,658

40,056

(10,104)

(156,360)

108,978

55,581

16,866

87,899

104,765

2003

1,499

37,829

23,095

(21,470)

169,227

41,006

(1,458)

249,728

-

249,728