LG 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROFITS

�This year our gross profit was almost

the same as last year. Sales and administrative

expenses however, increased 24%, while

marketing expenses grew due to the launching

of brand enhancement activities for major

products such as digital appliances and TVs. As

a result, our operating profit margin was 5.1%,

a slight decline from the previous year.

Considering the profits of each

division, the Mobile Communications Division

contributed more to the growth of the

Company's operating profit than any other

division. A full 47% of the Company's total

operating profit was produced by the Mobile

Communications. This was primarily due to

increased sales of WCDMA handsets, and the

timely launching of new handset models.

The Appliance Division made the largest

contribution to the Company's overall

operating profit in 2003. However, due to the

great improvement in sales revenue, as well as

profitability in the mobile handset business,

the Mobile Communications Division has

contributed the most to the Company's overall

operating profit in 2004.

Digital Appliance Division's operating

profit margin stood at 7.2%, contributing 33%

of our total operating profit. This division's

profitability was somewhat lower than in 2003

due to a steep increase in the value of the

Korean currency, elevated raw material prices,

and additional expenses associated with the

recall of rice cookers. However, our Digital

Appliance Division still maintained a higher than

average profitability when compared to other

home appliance companies around the globe.

Digital Display Division's profitability

was relatively low because of oversupply which

led to price declines in PDP modules and PDP

TVs, as well as increased marketing efforts

designed to extend this market's size. In the

Digital Media Division, optical storage business

profitability declined slightly from 2003. Profits

in the PC business however, improved due to

the phasing out of our low margin PC OEM

business. As a result, Digital Media Division's

operating profitability was 4.6% slightly higher

than in 2003.

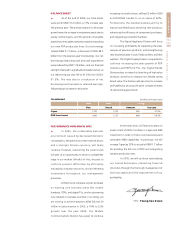

LG Electronics’ recurring profit

skyrocketed to KRW 1.9 trillion, a 122% gain,

and net income rose 133% to KRW 1.6 trillion.

This increase in ordinary and net income is

largely attributable to gains from foreign

currency translations, caused by the elevated

value of the Korean currency, as well as by

equity method gains.

In particular, equity method gains in

2004 totaled 765 billion, a large increase over

2003. Due to large production volume

increases, and higher prices caused by a

shortage of TFT-LCD supply in the first half of

2004, LG.Philips LCD contributed KRW 836

billion through equity method accounting. We

also incurred an equity method loss of KRW 128

billion from LG.Philips Displays in 2004 mainly

due to losses from asset impairment. However,

this loss was much lower than the equity

method loss incurred by LG.Philips Displays in

2003.

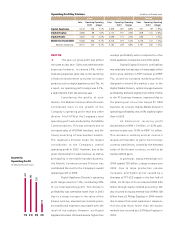

Operating Profit by Division (in billions of Korean won)

2004 2003 Change

Sales Operating Operating Sales Operating Operating Sales Operating Operating

Profit Margin Profit Margin Profit Margin

Digital Appliance 6,216 448 7.2% 5,649 497 8.8% 567 -49 -1.6%p

Digital Display 4,983 89 1.8% 4,174 191 4.6% 809 -102 -2.8%p

Digital Media 3,803 174 4.6% 4,069 173 4.3% -266 1 0.3%p

Mobile Communications 9,484 636 6.7% 6,106 319 5.2% 3,378 317 1.5%p

Mobile Handsets 8,351 530 6.3% 5,184 249 4.8% 3,167 280 1.5%p

1Q 2Q 3Q 4Q

Quarterly

Operating Profit

(in billions of Korean won)

407

95

393

355