LG 2004 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

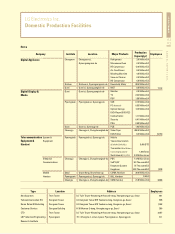

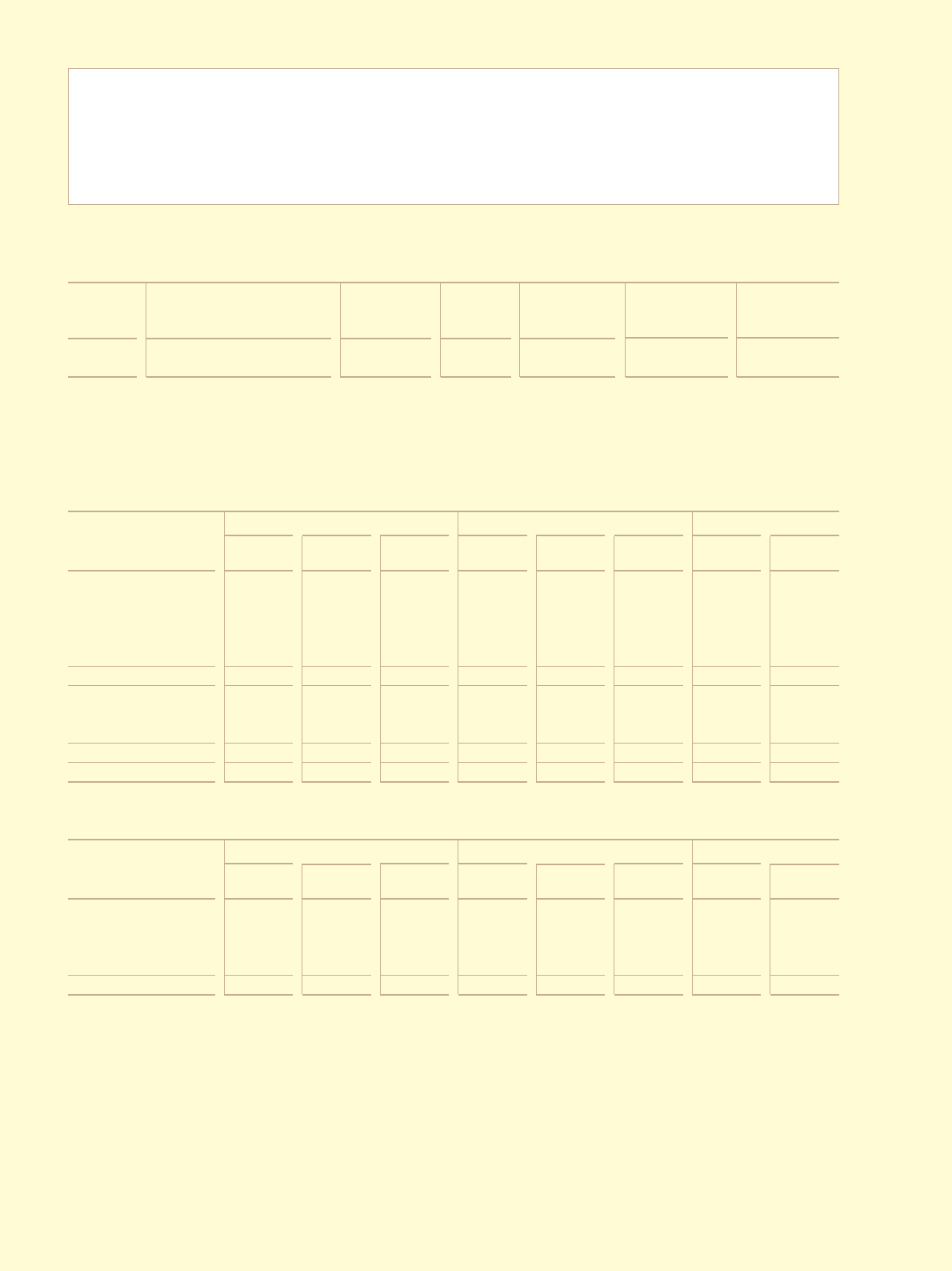

LG Electronics Inc.

Capital Stock / Capital Resources

Capital Resources

Korea

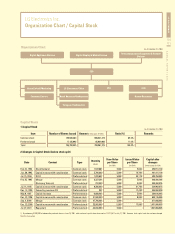

3) Changes in Capital Stock (after stock split and de-merger)

Date Content Type Quantity

(share)

Face Value

per Share

(in KRW)

Issued Value

per Share

(in KRW)

Apr. 1, 2002 Stock split and de-merger Common stock 139,606,263 5,000 - 698,031,315

Preferred stock 17,185,992 5,000 - 85,929,960

Capital Stock

after Changes

(In thousands of KRW)

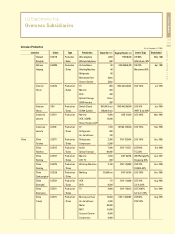

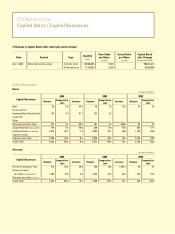

Capital Resources Balance

2004

Composition

ratio Increase Balance

2003

Composition

ratio

2002

Increase Balance Composition

ratio

Bank 22 0.9 -54.0 48 1.9 12.2 43 2.0

Insurance Firm

Investment Bank / Securities Firm

105 4.5 -21.7 134 5.2

Lease Firm

Other

Financial Institution Total 127 5.4 -30.2 181 7.0 325.6 43 2.0

Corporate bond(private placement) 126 5.4 -58.8 306 11.9 -19.5 380 17.4

Corporate bond(public offering) 2,070 89.1 -1.0 2,090 81.1 18.8 1,760 80.6

Capital increase

Capital market Total 2,196 94.6 -8.3 2,396 93.0 12.0 2,140 98.0

Grand Total 2,323 100.0 -9.9 2,577 100.0 18.1 2,183 100.0

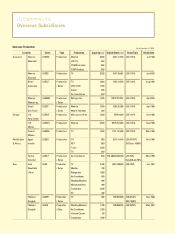

Overseas

Capital Resources Balance

2004

Composition

ratio Increase Balance

2003

Composition

ratio

2002

Increase Balance Composition

ratio

Financial Institutions Total 370 25.4 56.6 236 18.8 1,087.4 20 2.7

Foreign currency

securities (Corporate bond) 1,087 74.6 6.3 1,023 81.2 42.0 720 97.3

Overseas securities (stock, etc.)

Grand Total 1,457 100.0 15.7 1,259 100.0 70.1 740 100.0

(In billions of KRW, %)

(In billions of KRW, %)