LG 2004 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2004 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc.

Notes to Non-Consolidated Financial Statements

December 31, 2004 and 2003

LG ELECTRONICS ANNUAL REPORT 2004

100

101

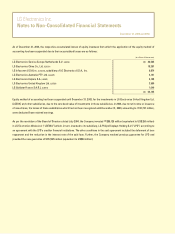

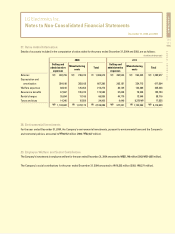

As of December 31, 2004, Hana Bank has provided guarantees of 26,264 million to the Company. The Company is contingently liable

for guarantees approximating 1,766,502 million, including US$1,180 million, on the indebtedness of its subsidiaries and affiliates as

follows:

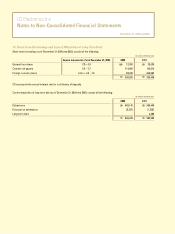

In order to reduce the impact of changes in exchange rates on future cash flows, the Company has entered into foreign currency

forward contracts. As of December 31, 2004, the Company has outstanding forward contracts with ABN-AMRO and others for selling

US dollars amounting to US$198 million at contract exchange rates of 1,035.70 : US$1 ~ 1,180.30 : US$1, with contract due dates of

January through July 2005.

As of December 31, 2004, the Company has outstanding forward contracts with Societe General Bank and others for selling euro and

buying US dollars amounting to €37 million at contract exchange rates of €1.2459 : US$1 ~ €1.3436 : US$1, with contract due dates of

January through March 2005.

As of December 31, 2004, the Company has outstanding forward contracts with UFJ Bank and others for selling US dollars and buying

Japanese yen amounting to US$75 million at contract exchange rates of 102.84 : US$1 ~ 107.08 : US$1, with contract due dates of

January through March 2005.

As a result of the above foreign currency forward contracts, an unrealized valuation gain and loss amounting to 11,097 million and

2,201 million, respectively, were charged to current operations for the year ended December 31, 2004.

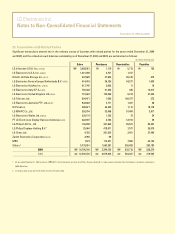

PT LG Electronics Display Device Indonesia (LGEDI)

LG Electronics Wales Ltd. (LGEWA)

LG Electronics Service Europe Netherlands B.V. (LGESE)

LG Electronics Tianjin Appliance Co., Ltd. (LGETA)

LG Electronics Mexico S.A. de C.V. (LGEMS)

LG Electronics Mlawa SP.Zo.O. (LGEMA)

LG Electronics Monterrey Mexico S.A. de C.V. (LGEMM)

LG Electronics Gulf FZE (LGEGF)

PT LG Electronics Indonesia (LGEIN)

LG Electronics Japan Inc. (LGEJP)

LG Electronics da Amazonia Ltda. (LGEAZ)

LG Electronics de Sao Paulo Ltda. (LGESP)

LG.Philips Displays Holding B.V.

LG Electronics U.S.A., Inc. (LGEUS)

LG Electronics Italy S.P.A. (LGEIS)

Zenith Electronics Corporation

Others

(in millions of Korean won)

171,183

134,045

125,065

123,820

99,186

88,906

72,168

55,321

54,800

54,486

52,190

52,190

52,190

40,708

28,963

6,263

555,018

1,766,502