Kia 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

094

KIA MOTORS 2006 Annual Report

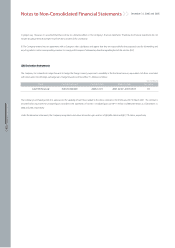

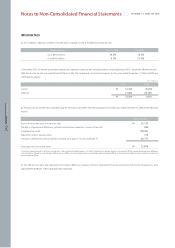

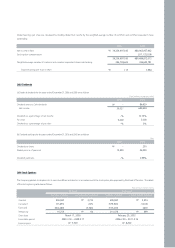

If all stock options, which require at least two-year continued services, are exercised, new shares or treasury stock will be issued in accordance with the decision of

the Board of Directors. The Company calculates the total compensation expense using the option-pricing model. In the model, the risk-free rate of 10.0 percent

and 4.74 percent, the expected exercise period of 5.5 years and the expected variation rate of stock price of 0.8387 and 0.9504 are adopted for the first and second

stock options, respectively. Total compensation expenses have been accounted for as a charge to current operations and a credit to capital adjustments over the

required period of service from the grant date using the straight-line method.

The compensation expenses of ₩128 million, which were expensed before December 31, 2005, have been reversed due to cancellation of 16,655 shares of the first

grant stock option and 14,903 shares of second grant stock option for the year ended December 31, 2006. In addition, among the stock options granted during the

current period, 6,667 shares of the first grant option and 105,019 shares of the second grant option were exercised, so that the Company issued the corresponding

number of its treasury shares.

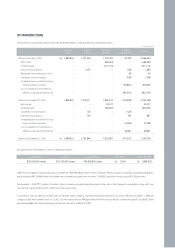

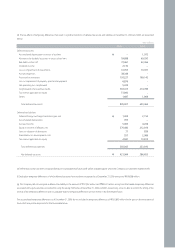

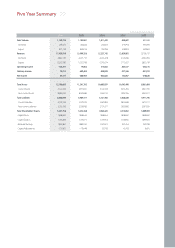

(30) Non-cash Investing and Financing Activities

Significant non-cash investing and financing activities for the years ended December 31, 2006 and 2005 are summarized as follows:

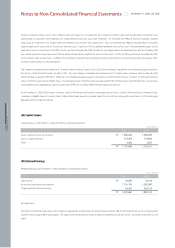

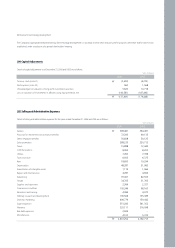

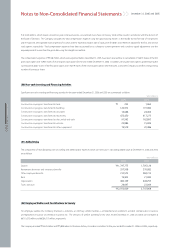

(31) Added Value

The components of manufacturing costs and selling and administrative expenses which are necessary in calculating added value at December 31, 2006 and 2005

are as follows:

(32) Employee Welfare and Contributions to Society

For employee welfare, the Company maintains a refectory, an infirmary, athletic facilities, a scholarship fund, workmen’s accident compensation insurance,

unemployment insurance and medical insurance, etc. The amounts of welfare spending for the years ended December 31, 2006 and 2005 are estimated at

₩310,575 million and ₩284,313 million, respectively.

The Company donated ₩4,524 million and ₩5,858 million to the Korea Archery Association and others for the years ended December 31, 2006 and 2005, respectively.

December 31, 2006 and 2005

Notes to Non-Consolidated Financial Statements

222

122,972

16,688

472,450

91,563

22,884

19,519

₩

2006 2005

1,062

101,982

24,404

417,273

162,893

15,909

20,486

Construction-in-progress transferred to land

Construction-in-progress transferred to buildings

Construction-in-progress transferred to structures

Construction-in-progress transferred to machinery

Construction-in-progress transferred to dies, molds and tools

Construction-in-progress transferred to vehicles

Construction-in-progress transferred to other equipment

Won (millions)

1,797,775

357,508

310,575

19,905

460,149

26,097

2,972,009

₩

₩

2006 2005

1,705,126

270,082

284,313

21,083

444,255

23,009

2,747,868

Salaries

Retirement allowance and severance benefits

Other employee benefits

Rent

Depreciation

Taxes and dues

Won (millions)