Kia 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

068

KIA MOTORS 2006 Annual Report

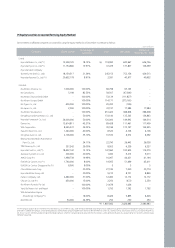

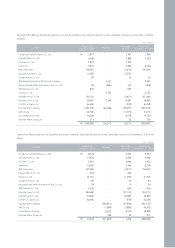

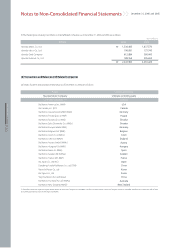

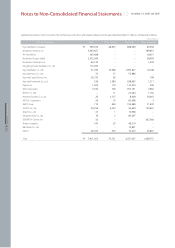

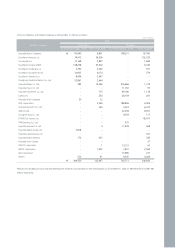

The Company used unaudited financial statements of the above affiliated companies when applying the equity method of accounting. In the subsequent period,

the Company adjusts the difference between the unaudited and audited results. Historically, the differences have been immaterial.

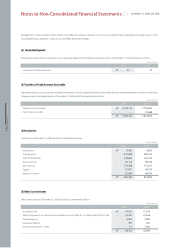

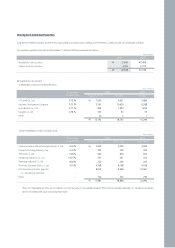

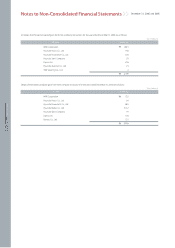

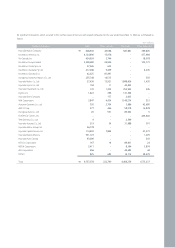

Investments in affiliated companies accounted for using the equity method as of December 31, 2005 are as follows:

The Company used unaudited financial statements of the above affiliated companies when applying the equity method of accounting. In the subsequent period,

the Company adjusts the difference between the unaudited and audited results. Historically, the differences have been immaterial.

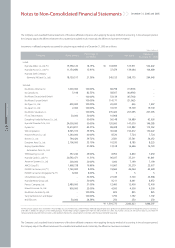

December 31, 2006 and 2005

Notes to Non-Consolidated Financial Statements

15,558,120

11,154,680

18,159,517

1,000,000

5,198

-

-

400,000

2,000

-

30,000

-

24,000,000

13,614,811

8,545,372

1,240,000

794,420

2,106,000

-

357,242

20,592,471

200,000

1,998,738

1,760,000

8,000

-

-

2,480,000

900,000

-

-

50,000

18.15%

13.91%

21.39%

100.00%

82.53%

100.00%

100.00%

100.00%

100.00%

100.00%

30.00%

50.00%

50.00%

45.37%

39.33%

40.00%

39.72%

35.10%

21.04%

29.00%

11.31%

20.00%

19.99%

8.00%

8.00%

30.30%

30.00%

31.00%

25.00%

100.00%

100.00%

24.39%

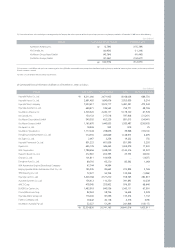

118,993

37,479

245,153

66,798

58,507

53,139

114,171

20,300

33,197

235,422

10,908

56,148

120,000

89,438

30,184

8,520

2,581

10,530

13,518

8,952

96,037

1,000

10,067

19,565

5

27,185

9,211

12,400

4,500

825

1,792

250

1,516,775

515,971

139,064

598,175

(13,939)

(40,956)

(45,764)

(31,062)

(65)

19,709

207,095

-

59,989

147,070

103,882

150,612

7,724

35,541

8,185

16,696

6,830

35,211

7,199

30,279

49,064

5

5,700

8,441

12,400

4,500

825

1,792

250

2,040,423

522,402

104,489

294,943

-

-

-

-

1,907

19,709

207,095

-

63,926

146,385

113,052

130,222

7,724

34,052

8,225

16,720

7,459

61,861

7,199

25,977

42,628

5

23,998

8,652

12,400

4,500

825

1,792

250

1,868,397

₩

₩

Net assetsCost

Percentage of

ownership

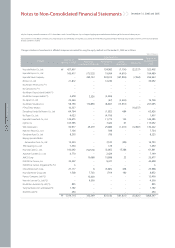

Shares ownedCompany Balance at

December 31, 2005

Listed:

Hyundai Mobis Co., Ltd.(*1)

Hyundai Hysco Co., Ltd.(*1)

Hyundai Steel Company

(formerly, INI Steel Co., Ltd.)

Unlisted:

Kia Motors America, Inc.

Kia Canada, Inc.

Kia Motors Deutschland GmbH

Kia Motors Europe GmbH

Kia Tigers Co., Ltd.

Kia Japan Co., Ltd.

Kia Motors Slovakia S.r.o.

PT. Kia Timor Motors

Dongfeng Yueda Kia Motors Co., Ltd.

Hyundai Powertech Co., Ltd.

Dymos Inc.

WIA Corporation

Haevichi Resort Co., Ltd.

Bontec Co., Ltd.

Donghee Auto Co., Ltd.

Beijing Hyundai Mobis

Automotive Parts Co., Ltd.

TRW Steering Co., Ltd.

Hyundai Card Co., Ltd.(*1)

Autoever Systems Co., Ltd.

AMCO Corp.(*1)

EUKOR Car Carriers, Inc.(*1)

EUKOR Car Carriers Singapore Pte.(*1)

China Millennium Corp.

Hyundai-Motor Group Ltd.

Partecs Company, Ltd.

Haevichi Leisure Co., Ltd.

Kia Motors Australia Pty Ltd.

Yanji Kia Motors A/s and Repair

NGVTEK.com

Won (millions)

(*1) The Company accounts for its investment in Hyundai Mobis Co., Ltd. and AMCO Corp. under the equity method of accounting due to its significant management control even though the Company’s ownership is

under 20%. In addition, the Company and its holding company, Hyundai Motor Company, together own more than 20% of EUKOR Car Carriers, Inc., Hyundai Card Co., Ltd and Hyundai Hysco Co., Ltd. which the

Company generally presumed that the investee is under significant influence, thus accounting for its investment under the equity method of accounting.