Kia 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

092

KIA MOTORS 2006 Annual Report

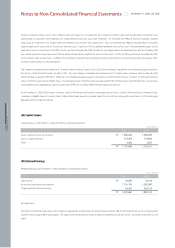

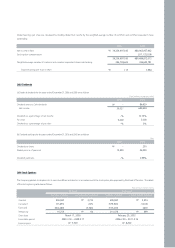

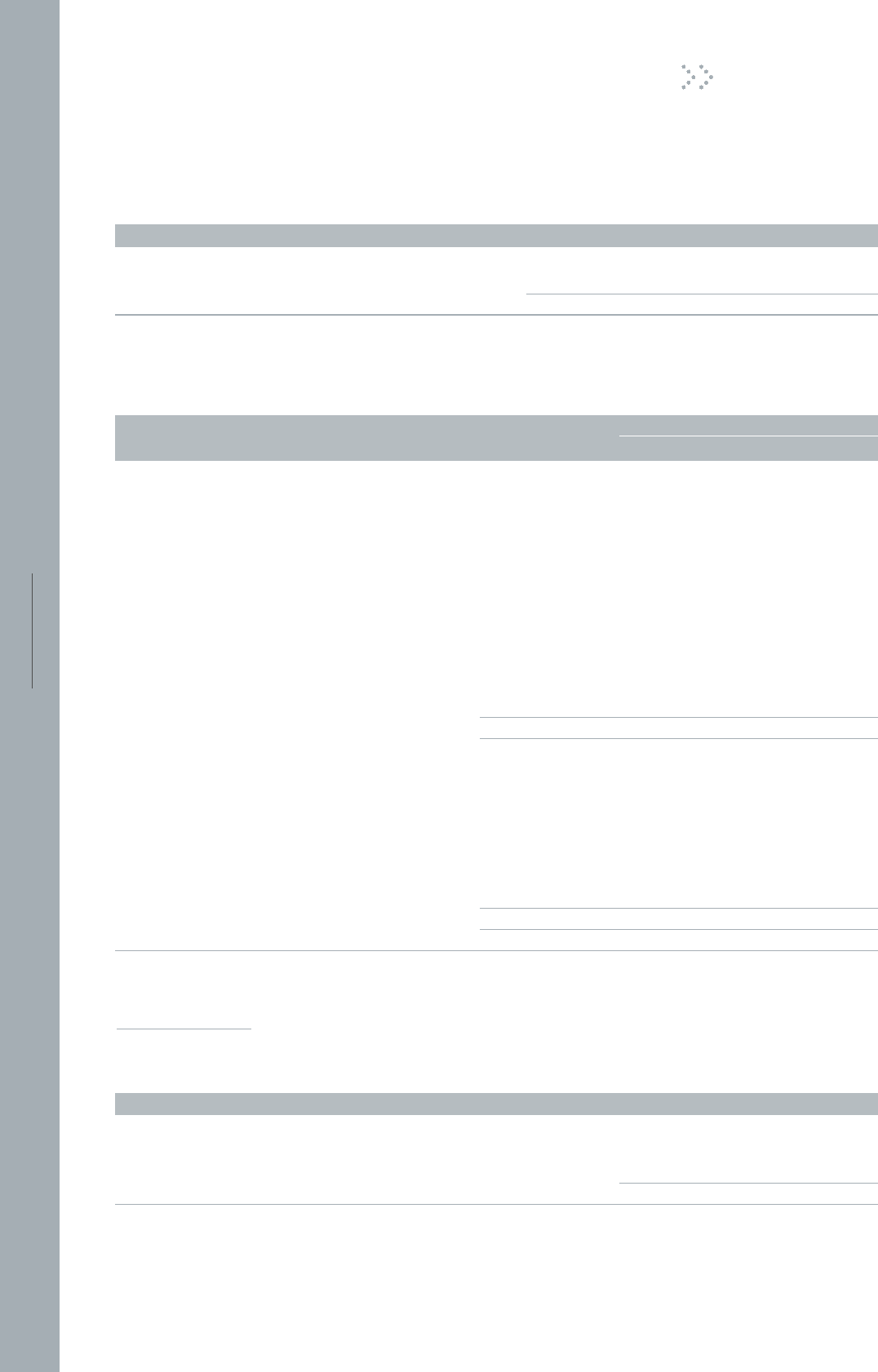

(h) The deferred tax assets and liabilities that were directly charged or credited to capital adjustments as of December 31, 2006 are as follows:

(i) Under SKAS No. 16, the deferred tax amounts should be presented as a net current asset or liability and a net non-current asset or liability. In addition, the

Company is required to disclose aggregate deferred tax assets (liabilities). As of December 31, 2006, details of aggregate deferred tax assets (liabilities) are as follows:

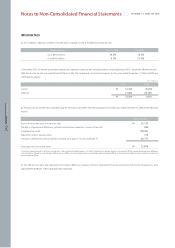

(27) Earnings Per Share

Basic earnings per share are calculated by dividing net income by the weighted-average number of shares of common stock outstanding.

(7,570)

178,799

171,229

₩

₩

Temporary differences Deferred tax assets (liabilities)

(1,950)

49,169

47,219

Unrealized gain on valuation of long-term investment securities

Loss on valuation of investments in affiliates using equity method, net

Won (millions)

217,049

263,495

7,745

343,859

139,440

702,644

25,003

19,312

339,404

211,425

6,131

2,275,507

(3,397)

(5,216)

(18,420)

(1,150,628)

(111)

(2,027)

(29,245)

(1,209,044)

1,066,463

₩

₩

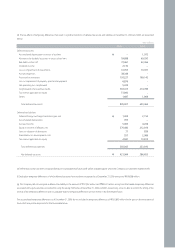

Temporary differences at

December 31, 2006

49,227

-

-

-

-

75,003

-

-

58,551

-

-

182,781

-

-

(5,065)

-

-

-

-

(5,065)

177,716

10,461

72,461

2,130

10,053

38,346

118,224

6,876

5,324

304,864

51,800

1,687

622,226

(935)

(1,434)

-

(370,440)

(31)

(557)

(4,581)

(377,978)

244,248

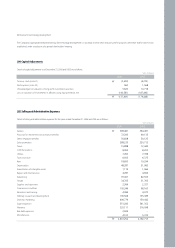

Non-currentCurrent

Deferred tax assets (liabilities)

Assets:

Allowance for doubtful accounts

Bad debts written off

Dividend income

Loss on impairment of investments

Accrued expenses

Provision for warranties

Loss on impairment of property, plant and equipment

Carryforwards of unused tax credits

Net operating loss carryforward

Tax reserve applicable to equity

Others

Liabilities:

Accumulated depreciation

Deferred foreign exchange translation gain, net

Accrued income

Equity in income of affiliates, net

Gain on valuation of derivatives

Amortization on development costs

Tax reserve applicable to equity

Won (millions)

39,336,697,185

346,522,839

114

₩

₩

2006 2005

680,903,937,602

346,224,844

1,967

Net income in Won

Weighted-average number of common shares outstanding

Earnings per share in Won

December 31, 2006 and 2005

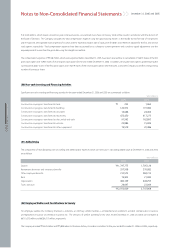

Notes to Non-Consolidated Financial Statements