Kia 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

038

KIA MOTORS 2006 Annual Report

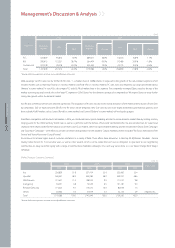

Overview of the Korean Automotive Industry

(1) Characteristics

The automotive industry requires a broad industrial base and influences other sectors through upstream and downstream links. The industry can be categorized

into three phases: production, distribution, ownership & maintenance. Production involves over 20,000 parts and inputs such as steel, chemicals, nonferrous metals,

electrical products, electronics, rubber, glass and plastics. Distribution is carried out by sales subsidiaries, franchise dealers, installment finance companies and

shippers. Maintenance issues, in contrast, fall under the realm of repair shops and after sales parts, as well as insurers.

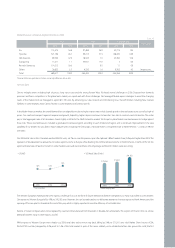

Given its integration with so many other suppliers and related industries, it’s not surprising that the industry represents a good chunk of the national economy. As of

2004, the Korean automotive industry generated

₩

88.1 trillion in production, up 17.6% year on year; this represents 11.1% of the nation’s manufacturing sector and

34.7% of domestic machinery output. The industry contributes greatly to Korean exports. Some US$29.3 billion worth of Korean-made automobiles were sold

overseas in 2005, an 11.0% increase from a year earlier, representing 10.3% of the nation’s export total. With automotive industry employment at around a quarter of

a million people (247,000) in 2004, it comprises 8.8% of entire manufacturing sector employment.

(2) Growth Potential

The Korean automotive industry has grown phenomenally through steady expansion of domestic and overseas operations on the back of favorable government

policies as well as ceaseless R&D efforts. Exports of the Hyundai Pony, the first indigenous Korean passenger car, began in 1976. Korea has produced an aggregate

total of about 50.8 million units between 1976 and 2006, of which 25.6 million units (50.4%) were sold in domestically and 25.2 million units (49.6%) were exported.

After experiencing steady growth, the industry suffered a 50% year-on-year drop in annual sales to some 780,000 units in 1998 because of the Asian financial crisis.

The unprecedented event drove the entire industry to the brink of collapse, forcing some automakers to near bankruptcy. However, the subsequent strong

recovery of the Korean economy boosted domestic demand for cars. Exports increased rapidly to industrialized countries, even while the Asian and Latin American

economies struggled. Thanks to the quick turnaround in sales both at home and abroad, the output of the Korean automotive industry surpassed the 3 million-unit

mark in 2000 for the first time. Sluggish global economic growth caused the Korean economy to slow in 2001, putting downward pressure on automobile

production. The government launched an economic stimulus package in 2001 and the effects began to be felt the following year. Annual domestic auto sales

exceeded the 1.6 million-unit level for the second time in 2001 (the first time was in 1996).

Since 2003, domestic demand for new vehicles has remained stagnant owing to high oil prices, and the aftereffects of the government’s economy-boosting policy.

The government policy, while effective, had in effect brought forth future demand. On the other hand, automobile exports have recorded remarkable growth,

thanks to improved product quality, a better brand image, and the introduction of competitive new models. Total automobile production in 2005 reached a new

record for the third consecutive year despite sluggish domestic sales. Such increase in production was continued in 2006 producing 3.84 million units, a 3.8%

growth rate compared with the previous year, approaching the 4 million mark. This strong performance was due to a narrow increase in domestic consumption

and the continued growth of foreign exports. Forecasted growth is projected to continue moving upward in 2007.

The number of vehicles on Korea’s roads passed 15.9 million in December of 2006. This represents nearly 16 times growth in the past 21 years, since surpassing the

1 million mark in 1985.

Put differently, the ratio of persons per automobile dropped from 36.6 in 1985 to 3.2 in 2006. The figure is still higher than the 1.3 for the US, 1.7 for Japan, and 1.8 for

the EU (2004 data). Recently the number of vehicles on Korea’s roads has modestly risen. However analysts expect that over the long-term, this number will

continue rising until reaching the levels of the U.S., Japan, and the EU.

Overseas sales are also expected to continue growing at a steady clip. In the first half of 2006, Hyundai Motor Company scored 102 on J.D. Power & Associates’ Initial

Quality Study, ranking it the 3rd highest brand, behind only Porsche and Lexus. While overall 2006 automobile industry demand in the US decreased by 2.6% from

the previous year, Hyundai and Kia Motors sales increased by 2.6%, thanks to our enhanced product quality and brand image. In Western Europe, sales continued to

climb, boosted by the introduction of new models designed particularly for the EU and sports marketing activities. Sales growth has also been robust in the

emerging markets of China, India and Russia. The upward trend in overseas sales is likely to be sustained thanks to not only price competitiveness, a traditional

strength, but also rapidly improving quality, consumer satisfaction, and brand recognition, which was boosted by successful sports marketing activities during the

2002 FIFA World Cup Finals and etc. On balance, the Korean automotive industry still has a strong growth potential.

Management’s Discussion & Analysis