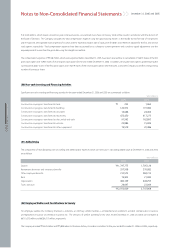

Kia 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

090

KIA MOTORS 2006 Annual Report

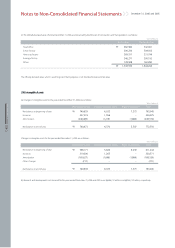

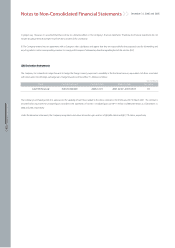

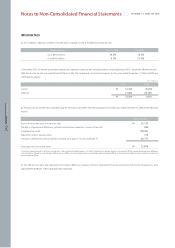

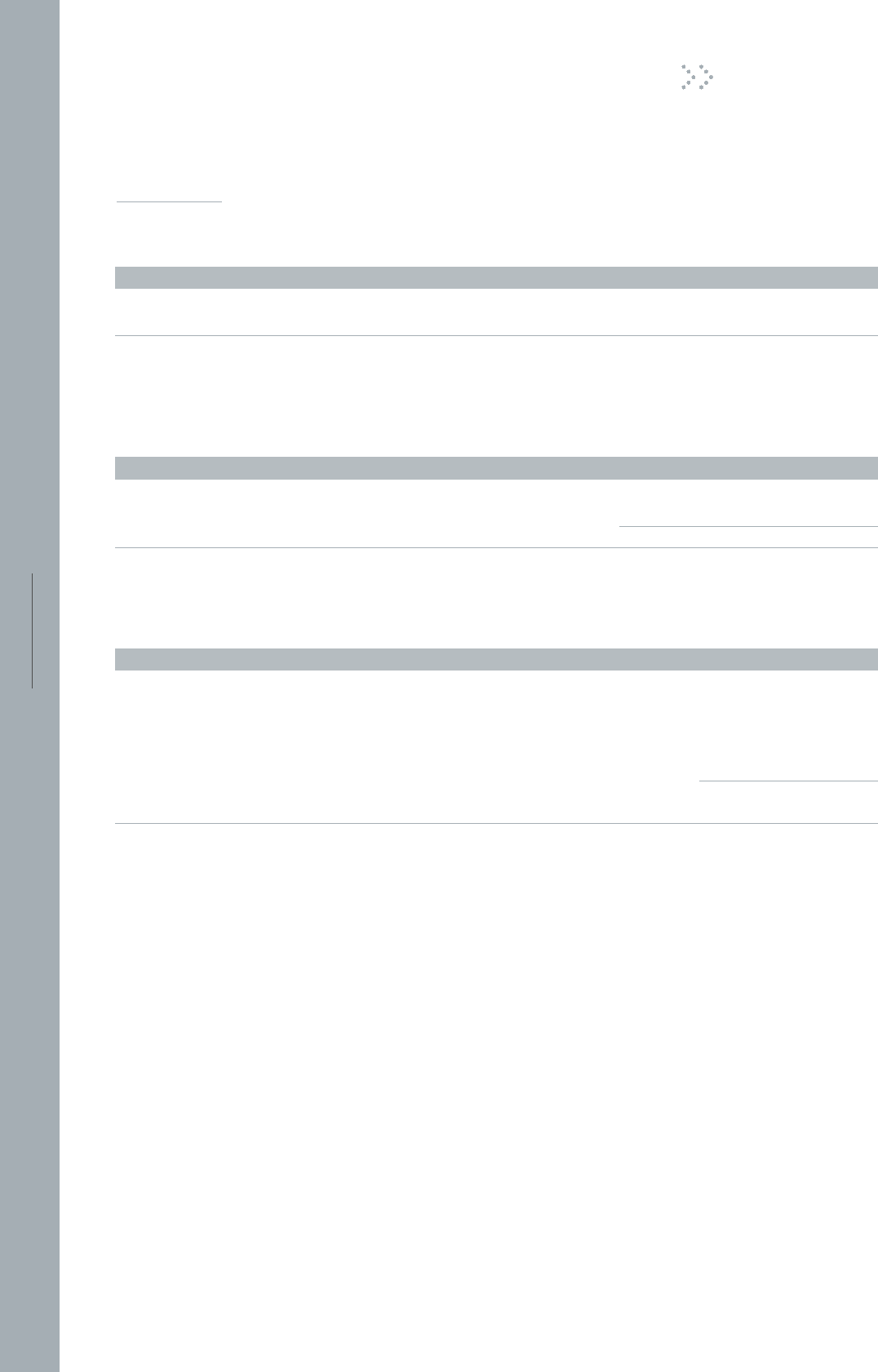

(26) Income Taxes

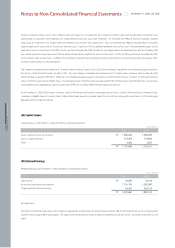

(a) The Company is subject to a number of income taxes on taxable income at the following normal tax rates:

In December 2003, the Korean government reduced the corporate income tax rate (including resident surtax) beginning in 2005. Specifically, effective January 1,

2005, the income tax rate was reduced from 29.7% to 27.5%. The components of income tax expense for the years ended December 31, 2006 and 2005 are

summarized as follows:

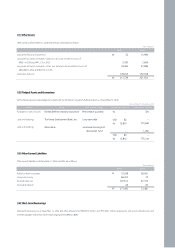

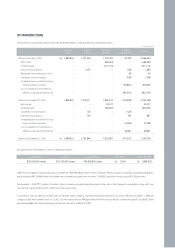

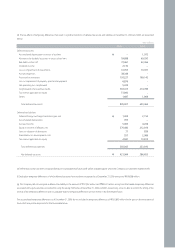

(b) The provision for income taxes calculated using the normal tax rates differs from the actual provision for the years ended December 31, 2006 for the following

reasons:

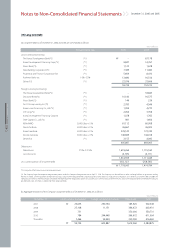

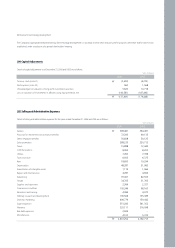

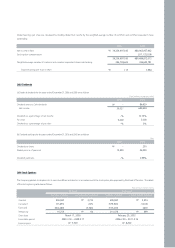

(c) The effective tax rates, after adjustments for certain differences between amounts reported for financial accounting and income tax purposes, were

approximately 46.3% and 1.2% in 2006 and 2005, respectively.

16.5%

9.7%

Prior to 2005Taxable income Thereafter

14.3%

27.5%

Up to ₩100 million

Over ₩100 million

12,274

21,602

33,876

₩

₩

2006 2005

25,262

(16,761)

8,501

Current

Deferred

Won (millions)

Won (millions)

20,120

286

(78,039)

739

90,770

33,876

Provision for income taxes at normal tax rates

Tax effects of permanent differences, primarily entertainment expenses in excess of tax limit

Investment tax credit

Adjustment of prior year tax return

Decrease in deferred income tax liabilities resulting from quity in income of affiliates (*)

Actual provision for income taxes

₩

₩

(*) Under the Corporate Income Tax Act Article 18 paragraph 2, a certain portion of dividend income is not taxable. Therefore, certain portions of equity in net income of affiliates were considered permanent differences

in the calculation of deferred tax assets (liabilities). Effective January 1, 2005, non-taxable dividend income is excluded from equity in income of affiliates in the calculation of deferred income tax liabilities resulting from

equity in income of affiliates.

December 31, 2006 and 2005

Notes to Non-Consolidated Financial Statements