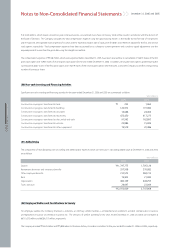

Kia 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

086

KIA MOTORS 2006 Annual Report

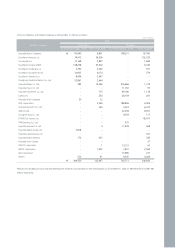

in proper way. However, it is assumed that there will be no substantial effect on the Company’s financial statements. Therefore, the financial statements do not

include any adjustments that might result from the outcome of this uncertainty.

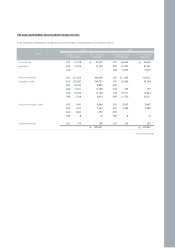

(f) The Company entered into an agreement with its European sales subsidiaries and agents that they are responsible for the projected costs for dismantling and

recycling vehicles sold in corresponding countries to comply with European Parliamentary directive regarding End-of-Life vehicles (ELV).

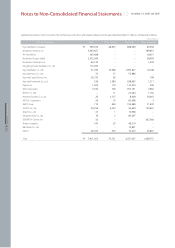

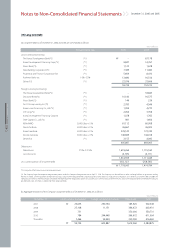

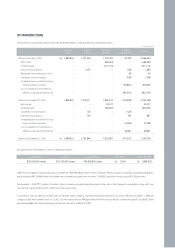

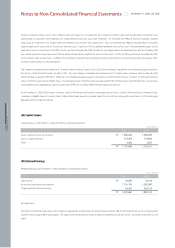

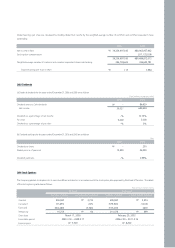

(20) Derivative Instruments

The Company has entered into range forwards to hedge the foreign currency exposure to variability in the functional-currency-equivalent cash flows associated

with a fluctuation risk of foreign exchange rates. Range forwards as of December 31, 2006 are as follows:

The Company’s estimated period of its exposure to the variability of cash flows related to the above contracts is from February 2007 to March 2007. The contract is

recorded at fair value with the unrealized gains recorded in the statements of income. Unrealized gains are ₩111 million and ₩3,050 million as of December 31,

2006 and 2005, respectively.

Under the derivative instruments, the Company recognized a derivatives transaction gain and loss of ₩4,695 million and ₩7,179 million, respectively.

EUR 20,000,000 2006.12.01 2007.02.07~2007.03.07 111

Maturity dateContract dateContract amountBank Fair value

CALYON Financial

Won (millions)

December 31, 2006 and 2005

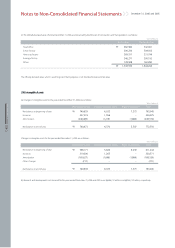

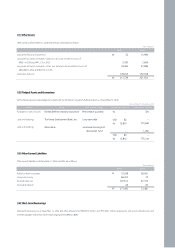

Notes to Non-Consolidated Financial Statements