Kia 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

062

KIA MOTORS 2006 Annual Report

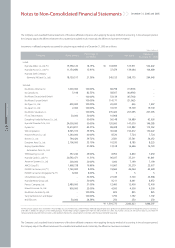

When the recoverable amount of the intangible assets are substantially below the carrying amount of the assets due to obsolescence and sharp decline in its

market value and others, the Company reduces its carrying amount to the recoverable amount and the amount impaired is recognized as impairment loss.

(k) Discount (Premium) on Debentures

Discount (premium) on debentures issued, which represents the difference between the face value and issuance price of debentures, is amortized (accreted) using

the effective interest method over the life of the debentures. The amount amortized (accreted) is included in interest expense.

(l) Retirement and Severance Benefits

Employees who have been with the Company for more than one year are entitled to lump-sum payments based on current salary rates of pay and length of service

when they leave the Company. The Company’s estimated liability under the plan which would be payable if all employees left on the balance sheet date is accrued

in the accompanying non-consolidated balance sheets. A portion of the liability is covered by an employees’ severance benefits trust where the employees have a

vested interest in the deposit with the insurance company in trust. The deposit for severance benefits held in trust is, therefore, reflected in the accompanying non-

consolidated balance sheets as a reduction of the liability for retirement and severance benefits.

Through March 1999, under the National Pension Scheme of Korea, the Company transferred a certain portion of retirement allowances for employees to the

National Pension Fund. The amount transferred will reduce the retirement and severance benefit amount to be payable to the employees when they leave the

Company and is accordingly reflected in the accompanying non-consolidated financial statements as a reduction of the retirement and severance benefits liability.

However, due to the new regulation effective April 1999, such transfers to the National Pension Fund are no longer required.

(m) Valuation of Receivables and Payables at Present Value

Receivables and payables arising from long-term cash loans/borrowings and other similar transactions are stated at present value. The difference between the

nominal value and present value of related receivables or payables is amortized using the effective interest method. The amount amortized is included in interest

expense or interest income.

(n) Foreign Currency Translation

Monetary assets and liabilities denominated in foreign currencies are translated into Korean Won at the rates of exchange on the balance sheet date that are

permitted by the Financial Accounting Standards, with the resulting gains or losses recognized in the results of operations. Non-monetary assets and liabilities

denominated in foreign currencies, which are stated at historical cost, are translated into Korean Won at the foreign exchange rate on the date of the transaction.

(o) Derivatives

Derivative instruments are recorded either as an asset or a liability measured principally at the fair value of rights or obligations associated with the derivative

contracts. The unrealized gain or loss from derivative transactions is recognized in current operations. However, for derivative instruments with the purpose of

hedging the exposure to the variability of cash flows of a forecasted transaction, the hedge-effective portion of the derivative’s gain or loss is deferred as a capital

adjustment, a component of stockholders’ equity. The deferred gain or loss will be adjusted to the related asset or liability resulted from the forecasted transaction,

or adjusted to income when the forecasted transaction affects the income statement. The ineffective portion of the gain or loss is recognized in current operations.

(p) Stock Options

The stock option program allows the Company’s employees to acquire shares of the Company for a specified price at specified times. The option exercise price is

generally fixed at below the market price of underlying shares at the grant date. The Company values equity-settled stock options based upon an option pricing

model under the fair value method and recognizes this value as an expense and capital adjustment over the period in which the options vest. When the options

are exercised, equity is increased by the amount of the proceeds received which is equal to the exercise price. However, compensation cost for cash-settled stock

options is measured each period based on the current stock price and is recognized as an expense and a liability over the service period.

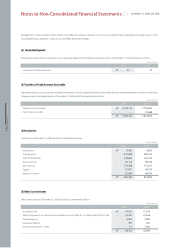

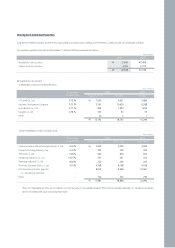

December 31, 2006 and 2005

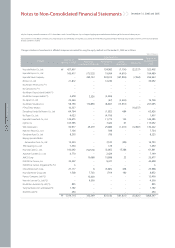

Notes to Non-Consolidated Financial Statements