Kia 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

060

KIA MOTORS 2006 Annual Report

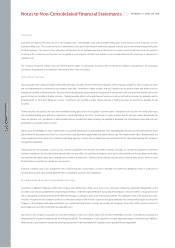

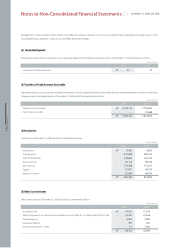

(f) Inventories

Inventories are stated at the lower of cost or net realizable value. Net realizable value is the estimated selling price in the ordinary course of business, less the

estimated selling costs. The cost of inventories is determined on the specific identification method for materials in transit and on the moving-average method for

all other inventories. The amount of any write-down of inventories to net realizable value due to obsolescence or excess inventory and other losses of inventories

occurring in the normal course of business are recognized as cost of goods sold and such valuation losses are deducted from the inventories as allowance for

valuation losses.

The Company recognizes interest costs and other financial charges on borrowings associated with inventories that require a long period in the acquisition,

construction or production as an expense in the period in which they are incurred.

(g) Investments in Securities

Upon acquisition, the Company classifies certain debt and equity securities into one of the three categories: held-to-maturity, available-for-sale, or trading securities

and such determination is reassessed at each balance sheet date. Investments in debt securities that the Company has the positive intent and ability to hold to

maturity are classified as held-to-maturity. Securities that are bought and held principally for the purpose of selling them in the near term (thus held for only a short

period of time) are classified as trading securities. Trading generally reflects active and frequent buying and selling, and trading securities are generally used to

generate profit on short-term differences in price. Investments not classified as either held-to-maturity or trading securities are classified as available-for-sale

securities.

Trading securities are carried at fair value, with unrealized holding gains and losses included in current income. Available-for-sale securities are carried at fair value,

with unrealized holding gains and losses reported as a capital adjustment, net of tax. Investments in equity securities that do not have readily determinable fair

values are stated at cost. Investments in debt securities that are classified into held-to-maturity are reported at amortized cost at the balance sheet date and such

amortization is included in interest income.

The fair value of marketable securities is determined using quoted market prices as of the period end. Non-marketable debt securities are recorded at the fair values

derived from the discounted cash flows by using an interest rate deemed to approximate the market interest rate. The market interest rate is determined by the

issuers’ credit rate announced by the accredited credit rating agencies in Korea. Money market funds are recorded at the fair value determined by the investment

management companies.

Trading securities are classified as current assets, whereas available-for-sale securities and held-to-maturity securities are classified as long-term investments.

However, available-for-sale securities whose maturity dates are due within one year from the balance sheet date or whose likelihood of being disposed of within

one year from the balance sheet date is probable are classified as current assets. Likewise, held-to-maturity securities whose maturity dates are due within one year

from the balance sheet date are classified as current assets.

A decline in market value of any available-for-sale or held-to-maturity security below cost that is deemed to be other-than-temporary results in a reduction in

carrying amount to fair value and the impairment loss is charged to current results of operations.

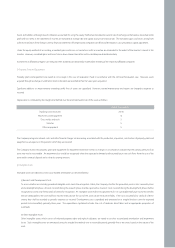

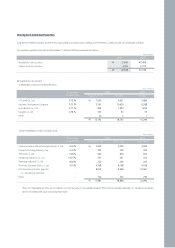

(h) Investment Securities under the Equity Method of Accounting

Investments in affiliated companies of which the Company owns 20% or more of the voting stock or over which the Company has significant management control

are stated at an amount as determined using the equity method. Under the equity method of accounting, the Company’s initial investment is recognized at cost

and is subsequently increased or decreased to reflect the changes in Company’s share of the net assets of investee. The Company’s share of the profit or loss of the

investee is recognized in the Company’s profit or loss and other changes in the investee’s equity are recognized directly in the corresponding equity account of the

Company. If the Company holds other investments such as preferred stock or loans issued by the investee, the Company’s share of loss of the investee continues to

be recorded until such other investments are reduced to zero.

Any excess in the Company’s acquisition cost over the Company’s share of the net fair value of the investee’s identifiable net assets is considered as goodwill and

amortized by the straight-line method over the estimated useful life. The amortization of such goodwill is recorded against the equity in income (losses) of affiliates.

When events or circumstances indicate that carrying amount may not be recoverable, the Company reviews goodwill for any impairment.

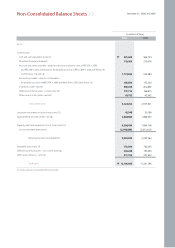

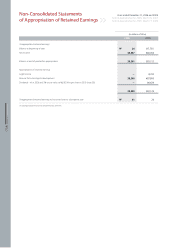

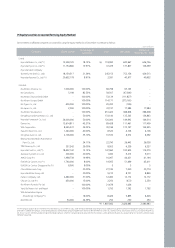

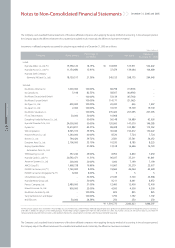

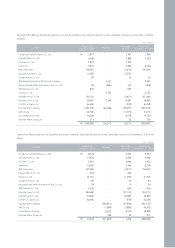

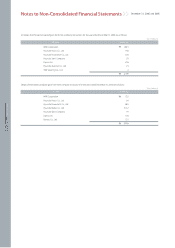

December 31, 2006 and 2005

Notes to Non-Consolidated Financial Statements