Kia 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

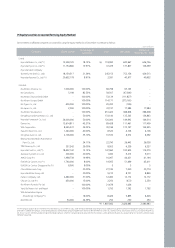

Assets and liabilities of foreign-based companies accounted for using the equity method are translated at current rate of exchange at the balance sheet date while

profit and loss items in the statement of income are translated at average rate and capital account at historical rate. The translation gains and losses arising from

collective translation of the foreign currency financial statements of foreign-based companies are offset and the balance is accumulated as capital adjustment.

Under the equity method of accounting, unrealized gains and losses on transactions with an investee are eliminated to the extent of the investor’s interest in the

investee. However, unrealized gains and losses from a down-stream transaction with a subsidiary are eliminated entirely.

Investments in affiliated companies are reduced when dividends are declared by shareholders’ meeting of the respective affiliated companies.

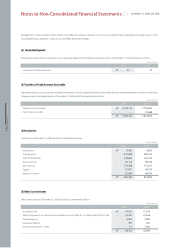

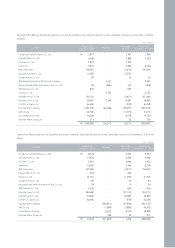

(i) Property, Plant and Equipment

Property, plant and equipment are stated at cost, except in the case of revaluation made in accordance with the old Asset Revaluation Law. However, assets

acquired through exchange, investment in kind or donation are recorded at their fair value upon acquisition.

Significant additions or improvements extending useful lives of assets are capitalized. However, normal maintenance and repairs are charged to expense as

incurred.

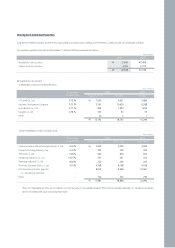

Depreciation is computed by the straight-line method over the estimated useful lives of the assets as follows:

The Company recognizes interest costs and other financial charges on borrowings associated with the production, acquisition, construction of property, plant and

equipment as an expense in the period in which they are incurred.

The Company reviews the property, plant and equipment for impairment whenever events or changes in circumstances indicate that the carrying amount of an

asset may not be recoverable. An impairment loss would be recognized when the expected estimated undiscounted future net cash flows from the use of the

asset and its eventual disposal are less than its carrying amount.

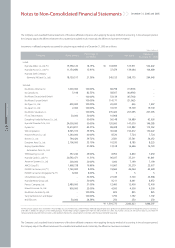

(j) Intangible Assets

Intangible assets are stated at cost less accumulated amortization, as described below:

(i) Research and Development Costs

To assess whether an internally generated intangible asset meets the recognition criteria, the Company classifies the generation process into a research phase

and a development phase. All costs incurred during the research phase shall be expensed as incurred. Costs incurred during the development phase shall be

recognized as assets only if they satisfy all criteria for recognition. An intangible asset shall be recognized only if (1) it is probable that future economic benefits

that are attributable to the asset will flow into the entity and (2) the cost of the asset can be measured reliably. If the costs incurred fail to satisfy all of these

criteria, they shall be recorded as periodic expenses as incurred. Development cost is capitalized and amortized on a straight-line basis over the expected

periods to be benefited, generally three years. The expenditure capitalized includes the cost of materials, direct labor and an appropriate proportion of

overheads.

(ii) Other Intangible Assets

Other intangible assets, which consist of industrial property rights and right of utilization, are stated at cost less accumulated amortization and impairment

losses. Such intangible assets are amortized using the straight-line method over a reasonable period, generally five or ten years, based on the nature of the

asset.

Useful lives (years)

Buildings and structures 20-40

Machinery and equipment 15

Dies, molds and tools 5

Vehicles 5

Other equipment 5