Kia 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

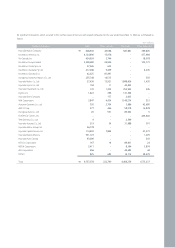

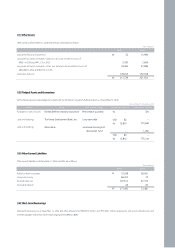

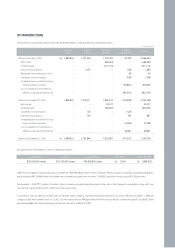

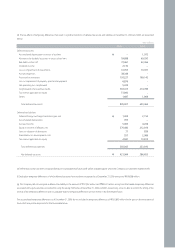

(18) Retirement and Severance Benefits

Changes in retirement and severance benefits for the years ended December 31, 2006 and 2005 are summarized as follows:

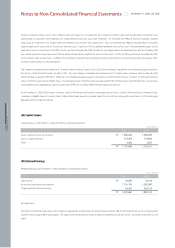

The Company maintains an employees’ severance benefit insurance arrangement with the Samsung Life Insurance Co., Ltd. and others. Under this arrangement,

the Company has made a deposit in the amount equal to 60.48% and 61.34% of the reserve balances of retirement and severance benefits as of December 31, 2006

and 2005, respectively. This deposit is to be used to guarantee the required payments to the retirees and accounted for as a reduction of the reserve balances.

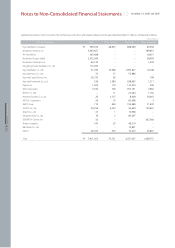

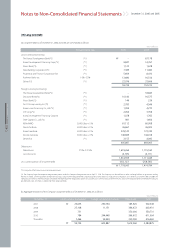

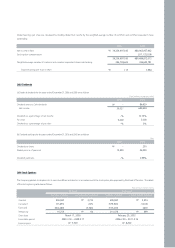

(19) Commitments and Contingencies

(a) The Company has provided guarantees of ₩14,221 million to the banks which provide customer financing for long-term installment sales as of December 31,

2006. These guarantees are all covered by insurance contracts for the customer and the Company as contractor and beneficiary, respectively.

(b) As of December 31, 2006, 34 blank checks, 96 blank promissory notes and two promissory notes totaling ₩1,820 million have been provided as collateral to

Standard Chartered First Bank Korea Ltd. and others for the Company’s certain debts and agreements.

(c) The Company is involved in 34 lawsuits and claims for alleged damages aggregating ₩4,584 million and ₩7,884 million as of December 31, 2006 and 2005,

respectively, which arose in the ordinary course of business. Management is of the opinion that the foregoing lawsuits and claims will not have a material adverse

effect on the Company’s financial position, operating results or cash flows.

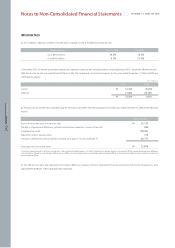

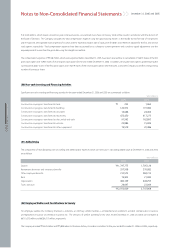

(d) The Company is involved in lawsuits, in Brazilian court, pertaining to the disputes with the Brazilian shareholders of Asia Motors Do Brasil S.A. (AMB) and AMB,

which was established as a joint venture by Asia Motors with a Brazilian investor. In 2002, the Company brought the case to the International Court of Arbitration to

settle the disputes pursuant to the terms of contract signed at the time of the inception of the joint venture, which stipulates that in case the business has been

adversely affected by a party’s failure to comply with contract terms and other reasons, the matter should be taken before the International Court of Arbitration for

settlement and parties shall be held accountable according to the results. The case was decided in favour of the Company in the International Count of Arbitration

on July 22, 2004. In addition, the Company, a shareholder of AMB, has already written off this investment of ₩14,057 million. Although the outcome of these

matters is not currently predictable, management believes that the resolution of these matters will not have a material adverse effect on the operations or financial

position of the Company.

(e) As of December 31, 2006, the Company has an ongoing litigation for certain executives regarding the Company’s certain past transactions of fund. It is

impossible for the board of directors of the Company to estimate the possible outflow of resources as a result of this lawsuit and the possible loss that may be

sustained from this lawsuit in proper way. However, it is assumed that there will be no substantial impact on the Company’s financial statements. Thus, the financial

statements do not include any adjustments that might arise from the outcome of this uncertainty.

In addition, the Company is under investigation from the Korean Fair Trade Commission about a series of management activities. It is impossible for the board of

directors of the Company to estimate the possible outflow of resources as a result of this investigation and the possible loss that may be sustained from this lawsuit

1,522,784

357,508

10

(472,676)

1,407,626

(24,788)

(851,383)

531,455

₩

₩

2006 2005

1,437,076

270,082

891

(185,265)

1,522,784

(34,418)

(934,041)

554,325

Net balance at beginning of year

Provision for retirement and severance benefits

Transfer-in from affiliate companies

Payments

Estimated retirement and severance benefits accrual at end of year

Transfer to National Pension Fund

Deposit for severance benefit insurance

Net balance at end of year

Won (millions)