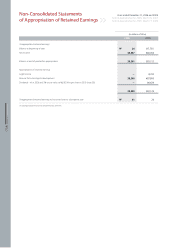

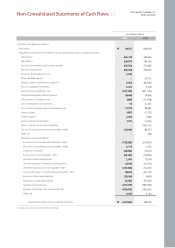

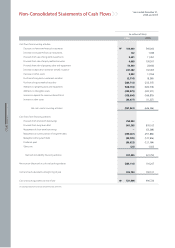

Kia 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

048

KIA MOTORS 2006 Annual Report

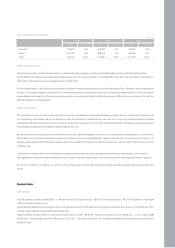

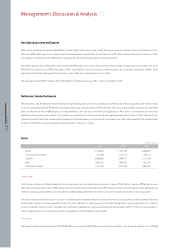

•R&D Trend (% of Revenue)

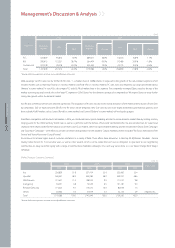

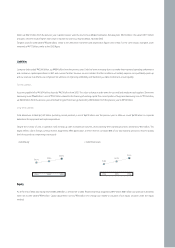

Credit Ratings

There was no change related to credit ratings in 2006. Overseas credit rating maintained a double investment grade (S&P: BBB-, Moody’s: Baa3), and both short-term

and long-term domestic credit ratings remained at the top level (short-term credit rating: A1, long-term credit rating: AA-).

•Credit Ratings Trend

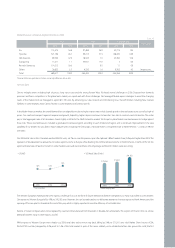

Profitability

Kia had a 0.7% operating loss in 2006. The main causes of this operating were: KRW appreciation, slack domestic demand, and rising marketing expenses

domestically & overseas.

While 90% of the company’s production comes out of Korea, exports represent 76% of total sales. This leaves us exposed to fluctuations in foreign exchange rates.

Revenue losses caused by KRW appreciation eat into operating profits. The Korean Won appreciated 6.7% against the USD in 2006, resulting in an forex fall-out of

around minus ₩800 billion.

Management’s Discussion & Analysis

5.9%

6.9%

4.6%

2004 2005 2006 2004

122

1,554

2005

534

1,911

949

428

2006

635

1,756

799

322

1,055

377

OverseasR&DPP&E

A1+

A1

A1-

A2+

A2

A2-

A3+

A3

A3-

B+

B

B-

C

D

2003. 1.10 2003. 6. 5 2004. 6.25 2004. 9. 7 2006. 6.22 2006.10.19 2004. 6.25 2004. 9. 7 2005. 6.14 2006. 6.22 2006.10.19 2007. 1.17

A2+ A2+

[Domestic]

A1A1 A1 A1

AAA

AA+

AA

AA-

A+

A

A-

BBB+

BBB

BBB-

BB

CCC

CC

C

Korea Investors Service

Short-Term

Korea Investors Service

Long-Term

A+ AA- AA- AA- AA- AA-

•CapEx Trend (KRW in billions)

Aaa

Aa

A1

A2

A3

Baa1

Baa2

Baa3

Ba1

Ba2

Ba3

B

Caa

Ca

C

2001. 6. 1 2002. 7. 4 2003. 5.23 2004. 11.26

[Overseas]

AA

A

BBB+

BBB

BBB-

BB+

BB

BB-

B+

B

B-

CCC

CC

C

D

2001. 6. 8 2002. 6.17 2003. 7.22 2005. 11.2

Moody's

Long-Term

Standard & Poor's

Long-Term

BB-

BBB-

BB BB+

Baa3

Ba3 Ba3 Ba2