Kia 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

044

KIA MOTORS 2006 Annual Report

mass-produced model at the Slovakia plant. We’ve been successfully expanding our dealer network by focusing on bringing in more expert dealers and improving

our corporate image.

We’re confident that the various PR and advertising activities that we’ve carried out, including our sports marketing activities such as official sponsorship of the

Spanish pro football team Atletico Madrid and world-famous Spanish tennis star Rafael Nadal will, over time, allow us to garner greater EU market share.

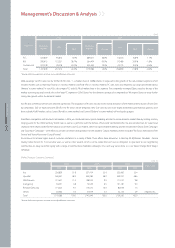

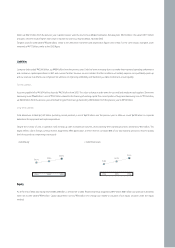

•Europe M/S

In contrast to weak Western European sales, exports to the Eastern European market grew by a healthy 20% - totaling 59,925 units. We improved our sales network

across Russia and favorable sales in Commonwealth of Independent States (CIS), or former Soviet Republic countries, helped as well.

2006 exports to other regions excluding North America and Europe grew by 7.7%, totaling 199,932 units. The breakdown of the numbers is as follows:

Exports to Central & South America reached 55,656 units, representing an impressive 31.6% growth. Resource-rich countries such as Chile and Venezuela enjoyed a

boom in consumption on the back of strong domestic demand. Similarly in certain African & Middle East regions, rising oil prices led to rising prosperity and greater

demand for automobiles. This resulted in a leap of 30% in Kia car sales, or 84,950 units, exported to these regions.

Sales in the Asia-Pacific markets fell significantly; 45,692 units were exported, a fall of 26%. The reasons for this included flatter demand, and new regulations

forbidding the import of CBU (completely built-up vehicles), and stricter environmental laws. Another reason for this low performance is due to the phase-out of

light commercial van.

With respect to Chinese markets like China, Hong Kong and Taiwan, exports slumped to 13,634 units, a 16.4% decrease from 2005 level owing to an economic

slump in Taiwan and Hong Kong. Finally, 2006 retail sales in other regions reached 187,524 units, similar to that of the previous year (188,197 units).

•Exports per Region

Management’s Discussion & Analysis

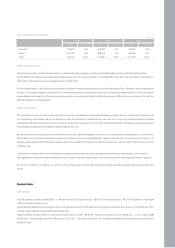

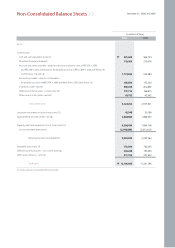

20052006Region 2004

USA 332,287 275,140 301,573

Canada 33,913 26,624 29,134

Western Europe 245,102 302,614 220,161

Eastern Europe/CIS 59,925 49,917 44,251

Latin America 55,656 42,299 40,206

Africa & Middle East 84,950 65,336 59,368

Asia-Pacific 45,692 61,776 54,765

China Region 13,634 16,310 11,328

Total 871,159 840,016 760,786

(Unit)

* Source: ACEA (EU23+EFTA)

1.1%

1.6% 1.4%

2004 2005 2006

191,975

277,833 271,261

2004 2005 2006

* Source: Company data

•Europe Retail Sales (Units)

* CKD excluded