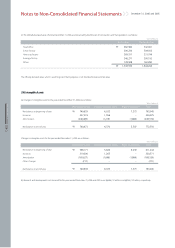

Kia 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

082

KIA MOTORS 2006 Annual Report

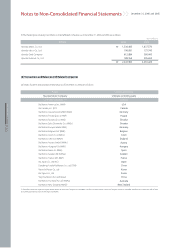

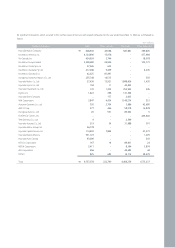

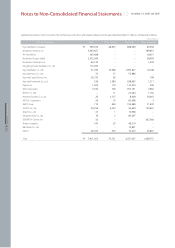

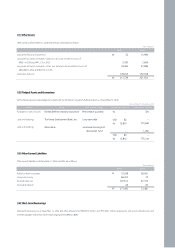

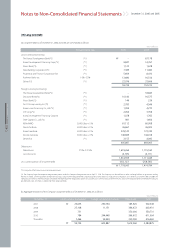

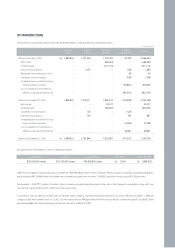

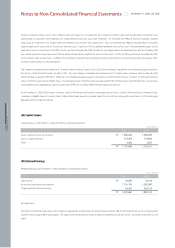

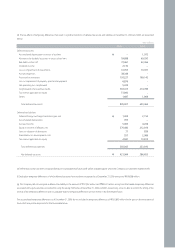

(15) Long-term Debt

(a) Long-term debt as of December 31, 2006 and 2005 are summarized as follows:

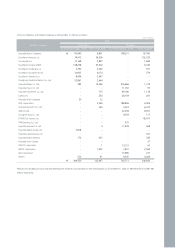

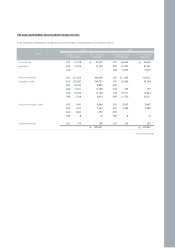

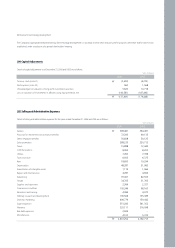

(b) Aggregate maturities of the Company’s long-term debt as of December 31, 2006 are as follows:

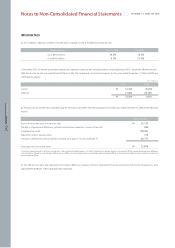

December 31, 2006 and 2005

Notes to Non-Consolidated Financial Statements

-

9,847

1,123

7,389

5,609

13,680

22,076

59,724

-

10,140

146

2,783

1,959

2,054

1,078

981

61,112

36,667

339,143

146,669

3,155

605,887

1,619,264

(4,705)

1,614,559

(502,127)

1,778,043

2006

Lender Annual interest rate 2005

67,178

14,767

1,678

11,082

8,410

16,514

33,606

153,235

18,843

16,575

239

4,549

4,270

3,358

1,762

1,604

60,008

36,005

173,742

144,018

4,092

469,065

1,115,160

(4,111)

1,111,049

(258,565)

1,474,784

Local currency borrowings:

The Korea Development Bank(*2)

Korea Development Financing Corp.(*2)

Woori Bank(*2)

Nara Banking Corporation(*2)

Prudential and Finance Corporation(*2)

Kookmin Bank, etc.

Others(*2)

Foreign currency borrowings:

The Korea Development Bank(*2)

Deutsche Bank(*2)

Woori Bank(*2)

First Citicorp Leasing Inc.(*2)

Korea Lease Financing Co., Ltd.(*2)

CITI Corp.(*2)

Korea Development Financing Corp(*2)

CNH Capital Co., Ltd.(*2)

ABN-AMRO

Deutsche Bank

Korea Eximbank

Societe Generale

Others(*2)

Debentures:

Debentures

Less discounts

Less current portion of long-term debt

(*1)

(*1)

(*1)

(*1)

(*1)

1.0%~5.5%

(*1)

(*1)

(*1)

(*1)

(*1)

(*1)

(*1)

(*1)

(*1)

EURO Libor+1.1%

EURO Libor+1.1%

EURO Libor+1.1%

EURO Libor+1.1%

(*1)

3.73%~9.375%

Won (millions)

₩

₩

(*1) Earning rate of the three-year unwarranted corporate bond.

(*2) The Company began the corporate reorganization process under the Company Reorganization Act on April 15, 1998. The Company was released from its debts including liabilities on guarantees totaling

₩5,482,181 million, and the repayment schedule of the principal amount of the reorganized debts amounting to ₩1,518,942 million was readjusted to be repaid on an installment basis between 2002 and 2008. The

Company pays interest on the debt principal starting from the beginning of the reorganization process on a quarterly basis at the earning rate of the three-year unwarranted corporate bond. Furthermore, the Company

provided blank notes and checks as collateral for these reorganized debts.

25,635

25,108

731

784

7,466

59,724

290,794

11,151

-

244,448

59,494

605,887

185,920

366,672

350,000

366,672

350,000

1,619,264

502,349

402,931

350,731

611,904

416,960

2,284,875

₩

₩

DebenturesForeign currency borrowingsLocal currency borrowingsDecember 31 Total

2007

2008

2009

2010

Thereafter

Won (millions)