Kia 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

066

KIA MOTORS 2006 Annual Report

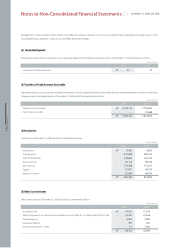

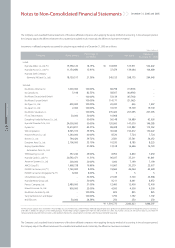

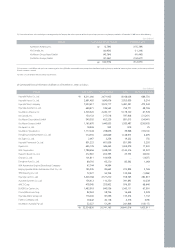

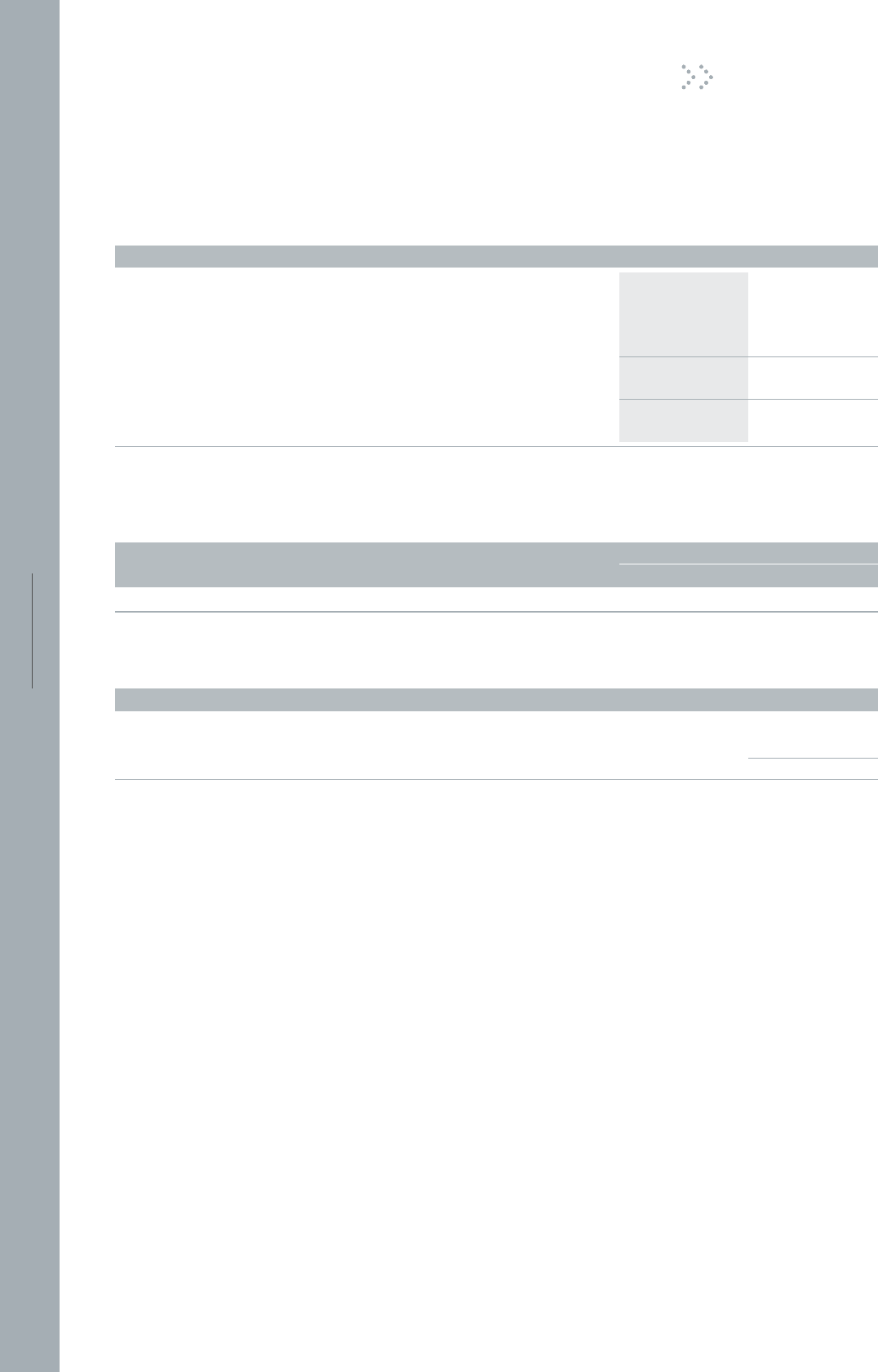

(iii) Changes in unrealized holding gains

Changes in unrealized gains for the years ended December 31, 2006 and 2005 are summarized as follows:

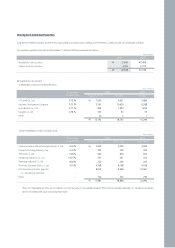

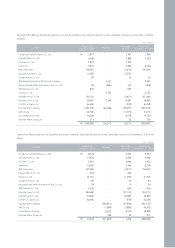

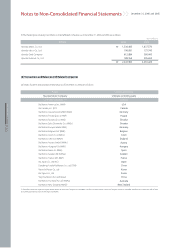

(c) Held-to-maturity securities

Maturities of debt securities classified as held-to-maturity at December 31, 2006 were as follows:

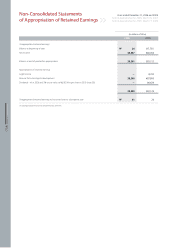

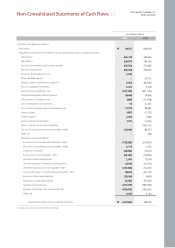

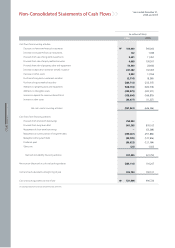

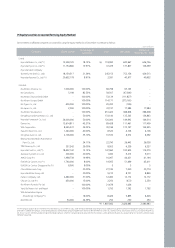

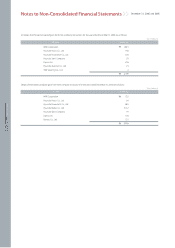

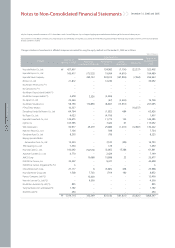

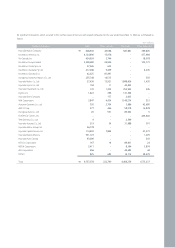

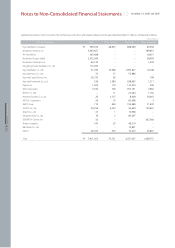

December 31, 2006 and 2005

Notes to Non-Consolidated Financial Statements

14,783

(378)

-

(6,835)

7,570

(1,950)

5,620

₩

₩

2006 2005

140,114

(2,681)

(145,155)

22,505

14,783

(4,065)

10,718

Beginning balance

Realized gains on disposition of securities

Change due to reclassification into equity method (*)

Other changes in unrealized gains and losses

Ending balance

Income tax effect

Net balance at end of period

Won (millions)

₩

₩

Book value

2,847

2,058

4,905

Due after one year through five years

Due after five years

Won (millions)

4,9054,905

₩

2006

Face Value 2005

Book value

2,727

Government and municipal bonds

Won (millions)

(*) Common stock of Hyundai Steel Company (formerly, INI Steel Co., Ltd.) was reclassified from available-for-sale securities into equity-method securities and the related previously unrealized gain was realized in 2005.