Kia 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

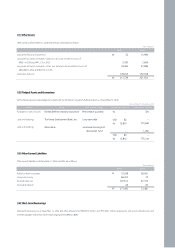

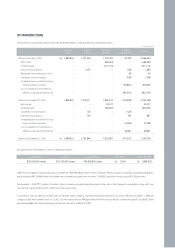

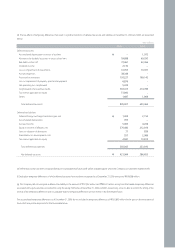

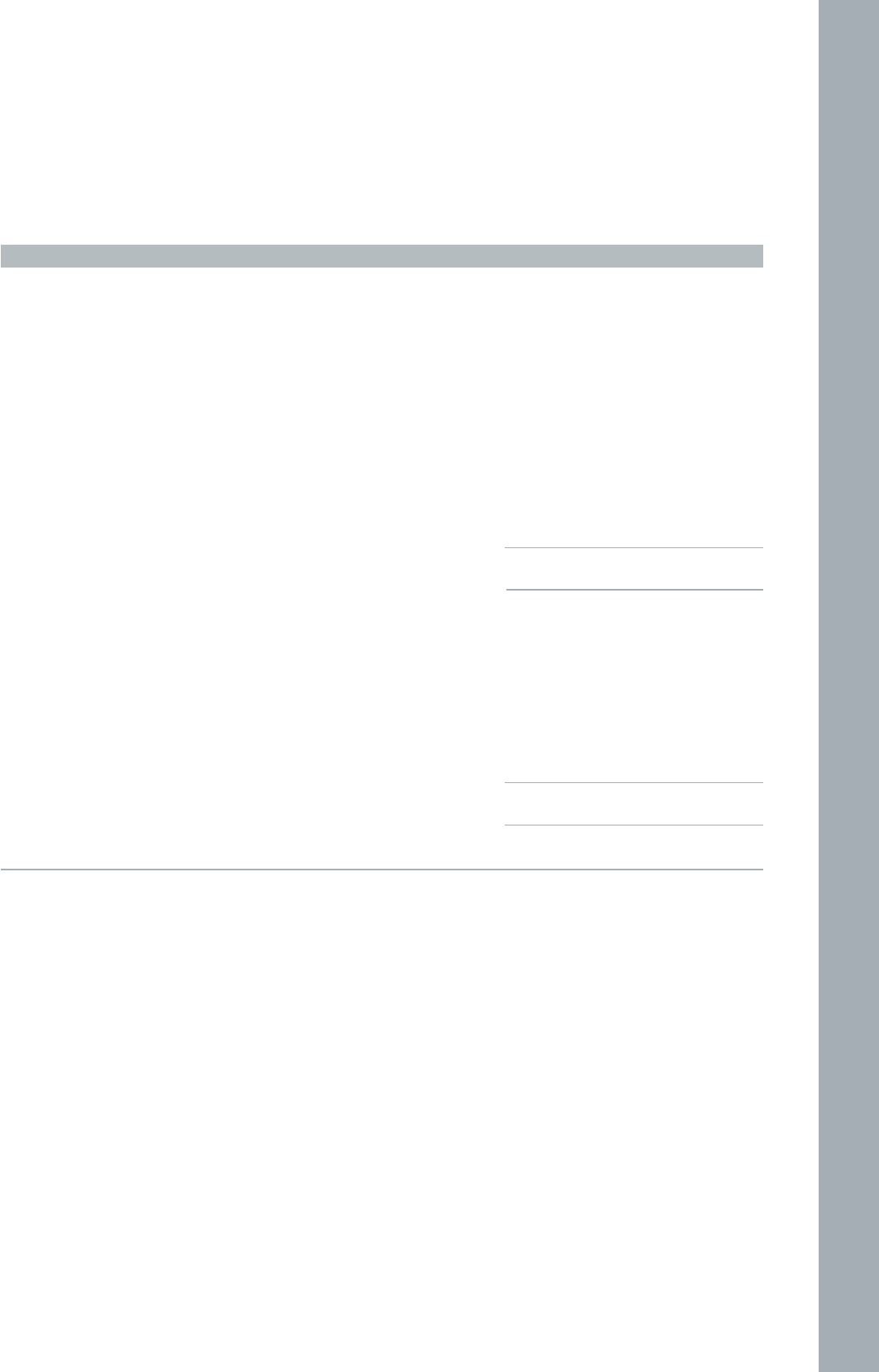

(d) The tax effects of temporary differences that result in significant portions of deferred tax assets and liabilities at December 31, 2006 and 2005 are presented

below:

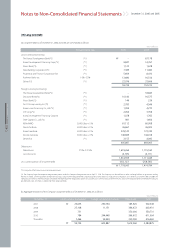

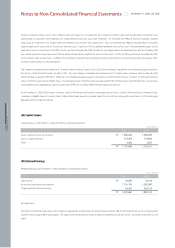

(e) Deferred tax assets have been recognized because it is probable that future profit will be available against which the Company can utilize the related benefit.

(f) Deductible temporary differences of which deferred tax assets have not been recognized as of December 31, 2006 amount to ₩594,508 million.

(g) The Company did not recognize a deferred tax liability in the amount of ₩21,952 million and ₩89,527 million arising from the taxable temporary differences

associated with equity securities accounted for using the equity method as of December 31, 2006 and 2005, respectively, since it is able to control the timing of the

reversal of the temporary differences and it is probable that the temporary differences will not reverse in the foreseeable future.

The accumulated temporary differences as of December 31, 2006 do not include the temporary differences of ₩261,893 million for the gain on the revaluation of

land, which may not be disposed of in the foreseeable future.

-

59,688

72,461

2,130

10,053

38,346

193,227

6,876

5,324

363,415

51,800

1,687

805,007

₩

2006 2005

1,972

69,293

63,366

-

10,037

-

199,142

-

-

274,789

-

1,866

620,465

Deferred tax assets:

Accumulated depreciation in excess of tax limit

Allowance for doubtful accounts in excess of tax limit

Bad debts written off

Dividend income

Loss on impairment of investments

Accrued expenses

Provision for warranties

Loss on impairment of property, plant and equipment

Net operating loss carryforward

Carryforwards of unused tax credits

Tax reserve applicable to equity

Others

Total deferred tax assets

Won (millions)

1,434

935

5,065

370,440

31

557

4,581

383,043

421,964

₩

₩

2,150

-

4,206

212,814

839

2,989

10,812

233,810

386,655

Deferred tax liabilities:

Deferred foreign exchange translation gain, net

Accumulated depreciation

Accrued income

Equity in income of affiliates, net

Gain on valuation of derivatives

Amortization on development costs

Tax reserve applicable to equity

Total deferred tax liabilities

Net deferred tax asset