IBM 2001 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

company stock. The total cost of all of the company’s U.S.

defined contribution plans was $313 million, $294 million

and $275 million for the years ended December 31, 2001,

2000 and 1999, respectively.

Non-U.S. Plans

Most subsidiaries and branches outside the U.S. have defined

benefit and/or defined contribution retirement plans that

cover substantially all regular employees, under which the

company deposits funds under various fiduciary-type

arrangements, purchases annuities under group contracts or

provides reserves. Benefits under the defined benefit plans

are typically based on years of service and the employee’s

compensation, generally during a fixed number of years

immediately before retirement. The ranges of assumptions

that are used for the non-U.S. defined benefit plans reflect

the different economic environments within various countries.

The total non-U.S. retirement plan (income)/cost of these

plans for the years ended December 31, 2001, 2000 and 1999,

was $(209) million, $(198) million and $7 million, respectively.

U.S. Supplemental Executive Retention Plan

The company also has a non qualified U.S. Supplemental

Executive Retention Plan (SERP). The SERP, which is

unfunded, provides defined pension benefits outside the IBM

Retirement Plan to eligible executives, based on average

earnings, years of service and age at retirement. Effective

July 1, 1999, the company adopted the Supplemental

Executive Retention Plan (which replaced the previous

Supplemental Executive Retirement Plan). Some partici-

pants of the pre-existing SERP will still be eligible for

benefits under that plan, but will not be eligible for the

new plan. The total cost of this plan for the years ended

December 31, 2001, 2000 and 1999, was $23 million, $24 mil-

lion and $30 million, respectively. These amounts are

reflected in Cost of other defined benefit plans below. At

December 31, 2001 and 2000, the projected benefit obliga-

tion was $166 million and $163 million, respectively, and the

amounts included in Other liabilities in the Consolidated

Statement of Financial Position were pension liabilities of

$151 million and $131 million, respectively.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

97

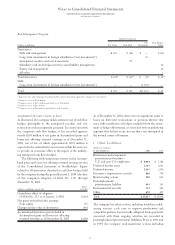

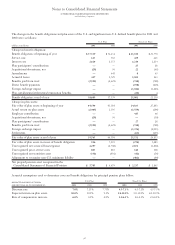

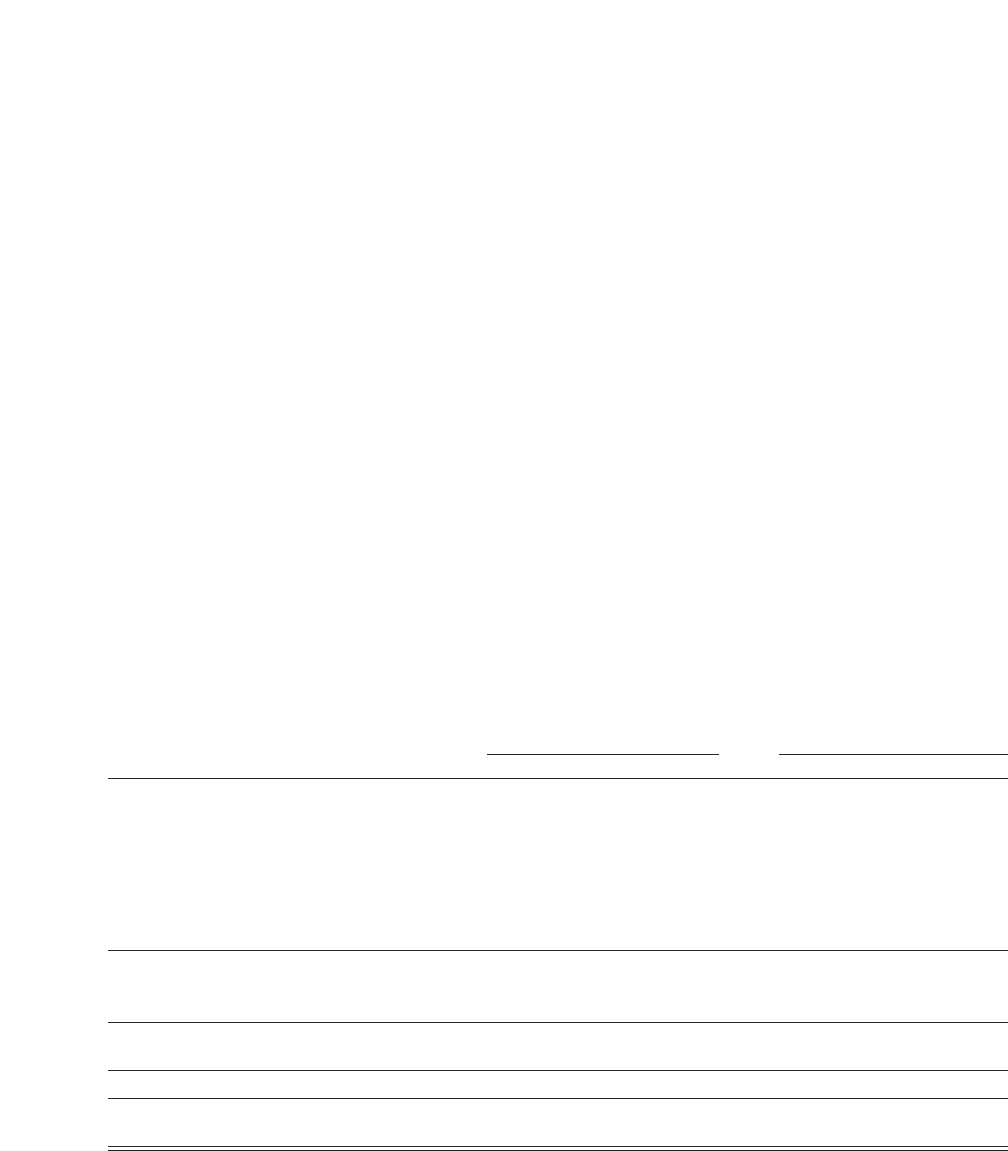

(Income)/Cost of Pension Plans:

U.S. Plans Non-U.S. Plans

(dollars in millions) 2001 2000 1999 2001 2000 1999

Service cost $«««««613 $««««563 $««««566 $««««429 $««««445 $««««475

Interest cost 2,624 2,553 2,404 1,214 1,234 1,282

Expected return on plan assets (4,202) (3,902) (3,463) (2,062) (2,042) (1,937)

Amortization of transition assets (140) (141) (140) (10) (10) (11)

Amortization of prior service cost 80 31 (21) 28 24 25

Recognized actuarial losses/(gains) ——16 (12) 428

Settlement gains ——— (12) (25) (23)

Net periodic pension income

—

U.S. Plan

and material non-U.S. Plans $«(1,025) $«÷(896) $«÷(638) $«÷(425) $«÷(370) $«÷(161)

Cost of other defined benefit plans 80 72 68 54 23 37

To tal net periodic pension income for

all defined benefit plans $««««(945) $÷«(824) $«÷(570) $÷«(371) $«««(347) $«÷(124)

Cost of defined contribution plans $÷«««313 $««««294 $««««275 $÷««162 $÷««149 $««««131

Total retirement plan (income)/cost recognized

in the Consolidated Statement of Earnings $««««(632) $«««(530) $«««(295) $«««(209) $«««(198) $««««««««7

See beginning of note u, “Retirement-Related Benefits,” on page 96 for the company’s total retirement-related benefits

(income)/cost.