IBM 2001 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

CURRENCY RATE FLUCTUATIONS

Changes in the relative values of non-U.S. currencies to the

U.S. dollar affect the company’s results. At December 31,

2001, currency changes resulted in assets and liabilities

denominated in local currencies being translated into fewer

dollars than at year-end 2000. The currency rate changes

had an unfavorable effect on revenue growth of approximately

4 percentage points in 2001, approximately 3 percentage

points in 2000 and minimal effect in 1999.

For non-U.S. subsidiaries and branches that operate in

U.S. dollars or whose economic environment is highly infla-

tionary, translation adjustments are reflected in results of

operations, as required by SFAS No. 52, “Foreign Currency

Tr anslation.” Generally, the company manages currency risk

in these entities by linking prices and contracts to U.S. dollars

and entering into foreign currency hedge contracts.

The company uses a variety of financial hedging instru-

ments to limit specific currency risks related to financing

transactions and other foreign currency-based transactions.

Further discussion of currency and hedging appears in note

k, “Derivatives and Hedging Transactions,” on pages 85

through 87.

On January 1, 2001, the company adopted SFAS No. 133,

“Accounting for Derivative Instruments and Hedging

Activities.” See “Standards Implemented,” on pages 79 and

80 for additional information regarding SFAS No. 133.

MARKET RISK

In the normal course of business, the financial position of the

company routinely is subjected to a variety of risks. In addi-

tion to the market risk associated with interest rate and

currency movements on outstanding debt and non-U.S. dollar

denominated assets and liabilities, other examples of risk

include collectibility of accounts receivable and recoverability

of residual values on leased assets.

The company regularly assesses these risks and has estab-

lished policies and business practices to protect against the

adverse effects of these and other potential exposures. As a

result, the company does not anticipate any material losses

from these risks.

The company’s debt in support of the Global Financing

business and the geographic breadth of the company’s opera-

tions contain an element of market risk from changes in

interest and currency rates. The company manages this risk,

in part, through the use of a variety of financial instruments

including derivatives, as explained in note k, “Derivatives and

Hedging Transactions,” on pages 85 through 87.

To meet disclosure requirements, the company performs

sensitivity analysis to determine the effects that market risk

exposures may have on the fair values of the company’s debt

and other financial instruments.

The financial instruments that are included in the sensi-

tivity analysis comprise all of the company’s cash and cash

equivalents, marketable securities, long-term non-lease

receivables, investments, long-term and short-term debt and

all derivative financial instruments. The company’s portfolio

of derivative financial instruments includes interest rate

swaps, interest rate options, foreign exchange swaps, forward

contracts and option contracts.

To perform the sensitivity analysis, the company assesses

the risk of loss in fair values from the effect of hypothetical

changes in interest rates and foreign currency exchange rates

on market-sensitive instruments. The market values for

interest and foreign currency exchange risk are computed

based on the present value of future cash flows as affected by

the changes in rates that are attributable to the market risk

being measured. The discount rates used for the present

value computations were selected based on market interest

and foreign currency exchange rates in effect at December 31,

2001 and 2000, respectively. The differences in this com-

parison are the hypothetical gains or losses associated with

each type of risk.

Information provided by the sensitivity analysis does not

necessarily represent the actual changes in fair value that the

company would incur under normal market conditions

because, due to practical limitations, all variables other than

the specific market risk factor are held constant. In addition,

the results of the model are constrained by the fact that certain

items are specifically excluded from the analysis, while the

financial instruments relating to the financing or hedging

of those items are included by definition. Excluded items

include leased assets, forecasted foreign currency cash flows,

and the company’s net investment in foreign operations. As

a consequence, reported changes in the values of some of the

financial instruments affecting the results of the sensitivity

analysis are not matched with the offsetting changes in the

values of the items that those instruments are designed to

finance or hedge.

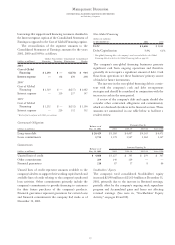

The results of the sensitivity analysis at December 31,

2001, and December 31, 2000, are as follows:

Interest Rate Risk

At December 31, 2001, a 10 percent decrease in the levels of

interest rates with all other variables held constant would

result in a decrease in the fair market value of the company’s

financial instruments of $177 million as compared with a

decrease of $99 million at December 31, 2000. A 10 percent

increase in the levels of interest rates with all other variables

held constant would result in an increase in the fair value of

the company’s financial instruments of $151 million as com-

pared to $83 million at December 31, 2000. Changes in the

relative sensitivity of the fair value of the company’s financial

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies