IBM 2001 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

79

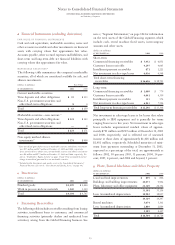

CUSTOMER LOANS RECEIVABLE

Global Financing is one of many sources of funding from

which customers can choose. Customer loans receivable, net

of allowances, comprise almost entirely loans made by the

company’s Global Financing segment, primarily to finance

the purchase of the company’s services and software.

Separate contractual relationships on these financing agree-

ments are generally for terms ranging from one to three

years requiring straight-line payments over the term. These

agreements do not represent extended payment terms. Each

financing contract is priced independently at competitive

market rates. An allowance for loan losses is established with

a corresponding charge to SG&A expense based upon man-

agement’s historical collection experience, prevailing economic

conditions, the present value of estimated future cash flows,

the estimated value of underlying collateral, and specific

situations that may affect a customer’s ability to repay.

ESTIMATED RESIDUAL VALUES OF LEASE ASSETS

The recorded residual values of the company’s lease assets

are estimated at the inception of the lease to be the expected

fair market value of the assets at the end of the lease term.

On a quarterly basis, the company reassesses the realizable

value of its lease residual values. In accordance with gener-

ally accepted accounting principles, anticipated increases in

specific future residual values are not recognized before real-

ization. Anticipated decreases in specific future residual

values that are considered to be other than temporary are

recognized immediately.

SOFTWARE COSTS

Costs that are related to the conceptual formulation and

design of licensed programs are expensed as research and

development. Also, for licensed programs, the company

capitalizes costs that are incurred to produce the finished

product after technological feasibility is established. The

annual amortization of the capitalized amounts is performed

using the straight-line method, and is applied over periods

ranging up to three years. The company performs periodic

reviews to ensure that unamortized program costs remain

recoverable from future revenue. Costs to support or service

licensed programs are expensed as the costs are incurred.

The company capitalizes certain costs that are incurred

to purchase or to create and implement internal-use com-

puter software, which include software coding, installation,

testing and data conversion. Capitalized costs are amortized

on a straight-line basis over two years.

COMMON STOCK

Common stock refers to the $.20 par value capital stock as

designated in the company’s Certificate of Incorporation.

Treasury stock is accounted for using the cost method.

When treasury stock is reissued, the value is computed and

recorded using a weighted-average basis.

EARNINGS PER SHARE OF COMMON STOCK

Earnings per share of common stock

—

basic is computed by

dividing Net income applicable to common stockholders by

the weighted-average number of common shares outstanding

for the period. Earnings per share of common stock

—

assuming dilution reflects the maximum potential dilution

that could occur if securities or other contracts to issue

common stock were exercised or converted into common

stock and would then share in the net income of the com-

pany. See note r, “Earnings Per Share of Common Stock,” on

page 93 for additional information.

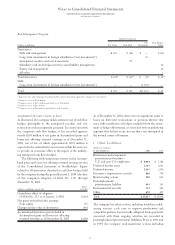

RECLASSIFICATION S

Effective January 1, 2001, interest expense is presented in

Cost of Global Financing in the Consolidated Statement of

Earnings if the related external borrowings to support the

Global Financing business were issued by either the company

or its Global Financing units. In prior years, the Cost of

Global Financing caption only included interest related to

direct external borrowings of the Global Financing units.

Prior periods were reclassified to conform with the current

year presentation. This change was described and disclosed

in the company’s 2001 first quarter report on Form 10-Q.

The company also removed the impact of intellectual

property income, gains and losses on sales and other than tem-

porary declines in market value of certain investments,

realized gains and losses on certain real estate activity and

foreign currency transaction gains and losses from the

SG&A caption on the Consolidated Statement of Earnings.

Custom development income was also removed from the

Research, development and engineering caption on the

Consolidated Statement of Earnings. Intellectual property

and custom development income are now recorded in a

separate caption in the Consolidated Statement of Earnings.

The other items listed above are now recorded as part of

Other income and expense. Prior periods were reclassified to

conform with the current year presentation.

bAccounting Changes

STANDARDS IMPLEMENTED

The company implemented new accounting standards in

2001, 2000 and 1999. These standards did not have a material

effect on the financial position or results of operations of

the company.