IBM 2001 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

81

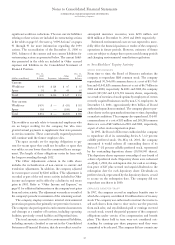

An initial impairment test must be performed in 2002 as of

January 1, 2002. The company completed this initial transi-

tion impairment test and determined that its goodwill is

not impaired.

In August 2001, the FASB issued SFAS No. 143,

“Accounting for Asset Retirement Obligations.” SFAS No.

143 provides accounting and reporting guidance for legal

obligations associated with the retirement of long-lived

assets that result from the acquisition, construction or nor-

mal operation of a long-lived asset. The standard is effective

January 1, 2003. The company is reviewing the provisions of

this standard. Its adoption is not expected to have a material

effect on the financial statements.

In October 2001, the FASB issued SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived

Assets.” SFAS No. 144 addresses significant issues relating to

the implementation of SFAS No. 121, “Accounting for the

Impairment of Long-Lived Assets and for Long-Lived Assets

to Be Disposed Of,” and develops a single accounting model,

based on the framework established in SFAS No. 121 for

long-lived assets to be disposed of by sale, whether such assets

are or are not deemed to be a business. SFAS No. 144 also

modifies the accounting and disclosure rules for discontinued

operations. The standard was adopted on January 1, 2002,

and is not expected to have a material effect on the financial

statements except that any future discontinued operations

may be presented in the financial statements differently

under the new rules as compared to the old rules.

In November 2001, the FASB issued EITF Issue No. 01-14,

“Income Statement Characterization of Reimbursements

Received for ‘Out of Pocket’ Expenses Incurred.” This guid-

ance requires companies to recognize the recovery of

reimbursable expenses such as travel costs on services con-

tracts as revenue. These costs are not to be netted as a

reduction of cost. This guidance was effective January 1,

2002. The company does not expect this guidance to have a

material effect on the financial statements due to the com-

pany’s billing practices. For instance, outside the U.S., almost

all of the company’s contracts involve fixed billings that are

designed to recover all costs, including out-of-pocket costs.

Therefore, the “reimbursement” of these costs are already

recorded in revenue.

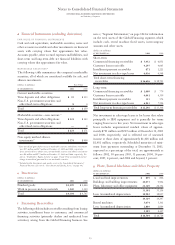

cAcquisitions/Divestitures

ACQUISITIONS

2001

In 2001, the company completed two acquisitions at a cost of

approximately $1,082 million.

The larger was the acquisition of Informix Corporation’s

database software business. In July, the company agreed to

pay $1 billion in cash for the net assets of the business.

Under the terms of the purchase, the company has paid $889

million of the purchase price and will pay the remaining

amount in 2002. The Informix acquisition provides the com-

pany with a database software system for data warehousing,

business intelligence and transaction-handling systems that

are used by more than 100,000 customers. In addition, the

acquisition significantly increased the size of the company’s

UNIX database business. The transaction was completed in

the third quarter of 2001 from which time the results of this

acquisition were included in the company’s consolidated

financial statements.

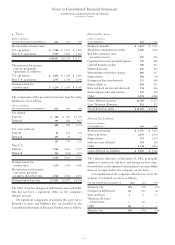

The allocation of the purchase price for the 2001 acqui-

sitions is presented in the following table in the required

SFAS No. 141 format.

Amortization

(dollars in millions) Life (in years) Informix*Other

Current assets $««««156 $«««57

Fixed/long-term assets 41 21

Intangible assets:

Customer lists 5220 «—

Completed technology 3140 «—

Trademarks 210«—

Goodwill «591 «««25

Total assets acquired $«1,158 $«103

Deferred revenue (101) «(2)

Payables/accrued expenses (55) (21)

Total liabilities assumed $«««(156) $««(23)

Net assets acquired $«1,002 $«««80

*During the fourth quarter, the company revised the estimates originally disclosed

in the third quarter. These adjustments resulted in an additional $40 million of

goodwill and a corresponding decrease in tangible net assets acquired. There was

no adjustment in the purchase price or in the company’s earnings.

The overall weighted-average life of intangible assets pur-

chased from Informix is 4.2 years. Goodwill of $591 million

has been assigned to the Software segment. Almost all of the

goodwill is deductible for tax purposes. The primary items that

generated this goodwill are the value of the acquired assembled

workforce and the synergies between the acquired business and

IBM. This transaction occurred after June 30, 2001, and there-

fore, the acquired goodwill is not subject to amortization.

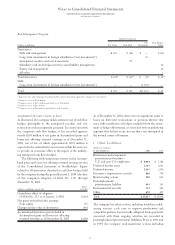

2000

In 2000, the company completed nine acquisitions at a cost

of approximately $511 million.

The largest acquisition was LGS Group Inc. (LGS). The

company acquired all the outstanding stock of LGS in April

for $190 million. LGS offers services ranging from application

development to information technology (I/T) consulting.