IBM 2001 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

89

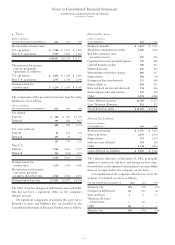

shares for release from the trust during its existence nor were

any shares sold from the trust. The trust would have expired

in 2007. Due to the fact that the company has not used the

trust, nor is it expected to need the trust prior to its expira-

tion, the company dissolved the trust, effective May 31,

2001, and all of the shares (20 million on a split-adjusted

basis) were returned to the company as treasury shares.

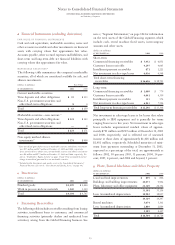

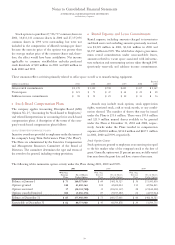

ACCUMULATED GAINS AND LOSSES NOT AFFECTING RETAINED EARNINGS*+

Net Net Accumulated

Unrealized Foreign Minimum Unrealized Gains/(Losses)

Gains on Currency Pension Gains/(Losses) Not Affecting

Cash Flow Translation Liability on Marketable Retained

(dollars in millions) Hedge Derivatives Adjustments Adjustments Securities Earnings

January 1, 1999 $«««— $«1,014 $«(154) $««««51 $«««««911

Change for period —(549) 3 796 250

December 31, 1999 —465 (151) 847 1,161

Change for period —(538) 7 «(925) «(1,456)

December 31, 2000 —(73) (144) (78) (295)

Cumulative effect on January 1, 2001 219 — — — 219

Change for period 77 (539) (216) 92 (586)

December 31, 2001 $«296 $«««(612) $«(360) $««««14 $««««(662)

*Net of tax.

+Reclassified to conform with 2001 presentation.

Dissolution of the trust will not affect the company’s obliga-

tions related to any of its compensation and employee

benefit plans or its ability to settle the obligations. In addi-

tion, the dissolution is not expected to have any impact on

net income. At this time, the company plans to fully meet its

obligations for the compensation and benefit plans in the

same manner as it does today, using cash from operations.

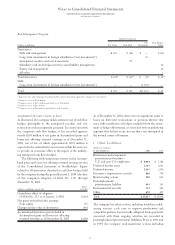

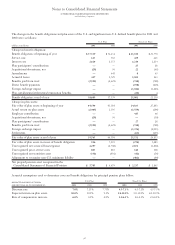

Net Change in Unrealized Gains/(Losses) on Marketable

Securities (net of tax)

(dollars in millions)

AT DE CEMBER 31: 2001 2000

Net unrealized losses arising

during the period $«(154) $«(810)

Less net (losses)/gains included

in net income for the period (246) *115

Net change in unrealized gains/

(losses) on marketable securities $««««92 $«(925)

*Includes write-downs of $287 million.

Unrealized losses arising in 2000 relate primarily to previous

unrealized gains from original cost occurring in prior years.

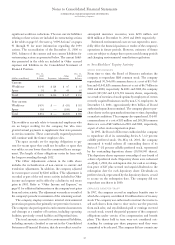

nContingencies and Commitments

CONTINGENCIES

The company is subject to a variety of claims and suits that

arise from time to time in the ordinary course of its business,

including actions with respect to contracts, intellectual

property, product liability, employment and environmental

matters. The company is a defendant and/or third-party

defendant in a number of cases in which claims have been

filed by current and former employees, independent con-

tractors, estate representatives, offspring and relatives of

employees seeking damages for wrongful death and personal

injuries allegedly caused by exposure to chemicals in various

of the company’s facilities from 1964 to the present. The

company believes that plaintiffs’ claims are without merit

and will defend itself vigorously.

While it is not possible to predict the ultimate outcome

of the matters discussed above, the company believes that

any losses associated with any of such matters will not have

a material effect on the company’s business, financial condi-

tion or results of operations.

COMMITMENTS

The company has guaranteed certain loans and financial

commitments. The approximate amount of these financial

guarantees was $218 million and $388 million at December 31,

2001 and 2000, respectively.

The company extended lines of credit, of which the

unused amounts were $4,088 million and $4,235 million at

December 31, 2001 and 2000, respectively. A portion of

these amounts was available to the company’s dealers to sup-

port their working capital needs. In addition, the company

committed to provide future financing to its customers in

connection with customer purchase agreements for approx-

imately $269 million and $129 million at December 31, 2001

and 2000, respectively.