IBM 2001 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

80

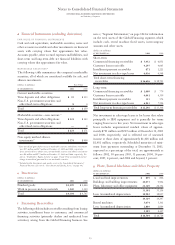

On January 1, 2001, the company adopted SFAS No. 133,

“Accounting for Derivative Instruments and Hedging

Activities,” as amended by SFAS No. 138, “Accounting for

Certain Derivative Instruments and Certain Hedging Activi-

ties.” SFAS No. 133, as amended, establishes accounting and

reporting standards for derivative instruments. Specifically,

SFAS No. 133 requires an entity to recognize all derivatives

as either assets or liabilities in the Statement of Financial

Position and to measure those instruments at fair value.

Additionally, the fair value adjustments will affect either

stockholders’ equity or net income depending on whether

the derivative instrument qualifies as a hedge for accounting

purposes and, if so, the nature of the hedging activity. As of

January 1, 2001, the adoption of the new standard resulted

in a cumulative effect net-of-tax increase of $219 million to

Accumulated gains and losses not affecting retained earnings

in the Stockholders’ equity section of the Consolidated

Statement of Financial Position and a cumulative effect net-

of-tax charge of $6 million included in Other income and

expense in the Consolidated Statement of Earnings.

Effective January 1, 2001, the company adopted SFAS

No. 140, “Accounting for Transfers and Servicing of Financial

Assets and Extinguishments of Liabilities

—

a replacement of

SFAS No. 125.” This statement provides accounting and

reporting standards for transfers and servicing of financial

assets and extinguishments of liabilities and revises the

accounting standards for securitizations and transfers of

financial assets and collateral. The adoption did not have a

material effect on the company’s results of operations and

financial position. The standard also requires new disclo-

sures which were not applicable to the company.

Pursuant to the Securities and Exchange Commission’s

Staff Accounting Bulletin (SAB) No. 102, “Selected Loan

Loss Allowance Methodology and Documentation Issues,”

the company has reviewed its policies related to methodolo-

gies for the determination of, and documentation in support

of its allowance for loan losses and the provision for loan

losses in its Global Financing segment. The company’s

methodology and documentation policies are consistent with

the views expressed within SAB 102. See “Customer Loans

Receivable,” on page 79 for a description of the company’s

policies for customer loans receivable.

In 2000, the Financial Accounting Standards Board

(FASB) issued Interpretation (FIN) No. 44, “Accounting for

Certain Transactions Involving Stock Compensation, an inter-

pretation of Accounting Principles Board Opinion No. 25.”

The requirements of FIN No. 44 are either not applicable to

the company or are already consistent with the company’s

existing accounting policies.

Effective July 1, 2000, the company adopted Emerging

Issues Task Force (EITF) Issue No. 00-2, “Accounting for

Web Site Development Costs.” As a result, the company

changed its accounting policies to capitalize certain phases of

Web site development costs that were previously expensed as

incurred. The company amortizes these amounts on a

straight-line basis over two years.

Pursuant to the Securities and Exchange Commission’s

SAB No. 101, “Revenue Recognition in Financial State-

ments,” the company has reviewed its accounting policies for

the recognition of revenue. SAB No. 101 was required to be

implemented in fourth quarter 2000. SAB No. 101 provides

guidance on applying generally accepted accounting princi-

ples to revenue recognition in financial statements. The

company’s policies for revenue recognition are consistent

with the views expressed within SAB No. 101. See

“Revenue,” on page 75 for a description of the company’s

policies for revenue recognition.

Effective January 1, 1999, the company adopted American

Institute of Certified Public Accountants (AICPA) Statement

of Position (SOP) No. 98-1, “Accounting for the Costs of

Computer Software Developed or Obtained for Internal

Use.” The SOP requires a company to capitalize certain costs

that are incurred to purchase or to create and implement

internal-use computer software. See “Software Costs,” on

page 79 for a description of the company’s policies for

internal-use software.

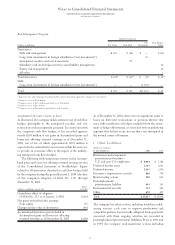

NEW STANDARDS TO BE IMPLEMENTED

In July 2001, the FASB issued SFAS No. 141, “Business

Combinations,” and SFAS No. 142,“Goodwill and Intangible

Assets.” SFAS No. 141 requires the use of the purchase

method of accounting for business combinations and pro-

hibits the use of the pooling of interests method. Under the

previous rules, the company used the purchase method of

accounting. SFAS No. 141 also refines the definition of

intangible assets acquired in a purchase business combina-

tion. As a result, the purchase price allocation of future

business combinations may be different than the allocation

that would have resulted under the old rules. Business com-

binations must be accounted for using SFAS No. 141

beginning on July 1, 2001.

SFAS No. 142 eliminates the amortization of goodwill,

requires annual impairment testing of goodwill and intro-

duces the concept of indefinite life intangible assets. It was

adopted on January 1, 2002. The new rules also prohibit the

amortization of goodwill associated with business combina-

tions that close after June 30, 2001.

These new requirements will impact future period net

income by an amount equal to the discontinued goodwill

amortization offset by goodwill impairment charges, if any,

and adjusted for any differences between the old and new rules

for defining intangible assets on future business combinations.