IBM 2001 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

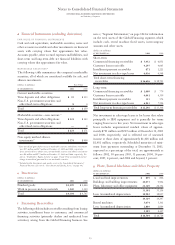

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

78

accounting does not apply under SFAS No. 133 or is not

applied by the company. In these cases, there generally exists

a natural hedging relationship in which changes in fair value

of the derivative, which are recognized currently in net

income, act as an economic offset to changes in the fair value

of the underlying hedged item(s).

Changes in the value of a derivative that is designated as a

fair value hedge, along with offsetting changes in fair value of

the underlying hedged exposure, are recorded in earnings each

period. For hedges of interest rate risk, the fair value adjust-

ments are recorded as adjustments to Interest expense and

Cost of Financing in the Consolidated Statement of Earnings.

For hedges of currency risk associated with recorded assets

or liabilities, derivative fair value adjustments generally are

recognized in Other income and expense in the Consolidated

Statement of Earnings. Changes in the value of a derivative

that is designated as a cash flow hedge are recorded in the

Accumulated gains and losses not affecting retained earnings, a

component of Stockholders’ equity. When net income is

affected by the variability of the underlying cash flow, the

applicable amount of the gain or loss from the derivative that

is deferred in Stockholders’ equity is released to net income

and reported in Interest expense, Cost, SG&A expense or

Other income and expense in the Consolidated Statement of

Earnings based on the nature of the underlying cash flow

hedged. Effectiveness for net investment hedging derivatives is

measured on a spot to spot basis. The effective portion of

changes in the fair value of derivatives and other non derivative

risk management instruments designated as net investment

hedges are recorded as foreign currency translation adjust-

ments in the Accumulated gains and losses not affecting

retained earnings section of Stockholders’ equity. Changes

in the fair value of the portion of a net investment hedging

derivative excluded from the effectiveness assessment are

recorded in Interest expense.

When the underlying hedged item ceases to exist, all

changes in the fair value of the instrument are included in

net income each period until the instrument matures. When

the underlying transaction ceases to exist, a hedged asset or

liability is no longer adjusted for changes in its fair value.

Derivatives that are not designated as hedges, as well as

changes in the value of derivatives that do not offset the

underlying hedged item throughout the designated hedge

period (collectively, “ineffectiveness”), are recorded in net

income each period and generally are reported in Other

income and expense. Refer to note k, “Derivatives and

Hedging Transactions,” on pages 85 through 87 for a

description of the major risk management programs and

classes of financial instruments used by the company.

FINANCIAL INSTRUMENTS

In determining fair value of its financial instruments, the com-

pany uses a variety of methods and assumptions that are based

on market conditions and risks existing at each balance sheet

date. For the majority of financial instruments including most

derivatives, long-term investments and long-term debt, stan-

dard market conventions and techniques such as discounted

cash flow analysis, option pricing models, replacement cost

and termination cost are used to determine fair value. Dealer

quotes are used for the remaining financial instruments. All

methods of assessing fair value result in a general approxima-

tion of value, and such value may never actually be realized.

CASH EQUIVALENTS

All highly liquid investments with a maturity of three

months or less at date of purchase are carried at fair value

and considered to be cash equivalents.

MARKETABLE SECURITIES

Marketable securities included in Current assets represent

securities with a maturity of less than one year. The com-

pany also has Marketable securities, including non equity

method alliance investments, with a maturity of more than

one year. These non current investments are included in

Investments and sundry assets. The company’s Marketable

securities, including certain non equity method alliance

investments, are considered available for sale and are

reported at fair value with changes in unrealized gains and

losses, net of applicable taxes, recorded in Accumulated

gains and losses not affecting retained earnings within

Stockholders’ equity. Realized gains and losses are calculated

based on the specific identification method. Other than tem-

porary declines in market value from original cost are

charged to Other income and expense in the period in which

the loss occurs. In determining whether an other than tempo-

rary decline in the market value has occurred, the company

considers the duration that and extent to which market value

is below original cost. Realized gains and losses and other

than temporary declines in market value from original cost

are included in Other income and expense in the

Consolidated Statement of Earnings. All other investment

securities not described above or in the “Principles of

Consolidation” on page 75, primarily non-publicly traded

equity securities, are accounted for using the cost method.

INVENTORIES

Raw materials, work in process and finished goods are stated

at the lower of average cost or net realizable value.