IBM 2001 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to provide the capacity to meet their obligations to current

and future retirees.

The largest retirement-related benefit plan is the U.S.

Personal Pension Plan (PPP). See page 96 for the impact

that the PPP had on the company’s Income before income

taxes. The following is a discussion of the impacts of recent

changes relating to the PPP on the company’s financial

results. Refer to page 98 for a table containing the actuarial

assumption changes.

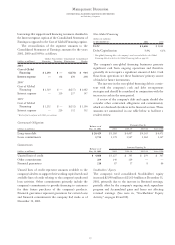

The following is the historical actual average rates of

return on plan assets in the PPP:

2001 2000 1999 1998 1997

Actual annualized

rates of return:

15-year average 10.3% «11.9% ««13.5% «12.8% 13.0%

10-year average 10.0% 12.5% 12.3% 12.7% 12.4%

Expected rate

of return

assumptions 10.0% «10.0% «9.5% 9.5% 9.5%

The company uses long-term historical actual return experi-

ence, the expected investment mix of the plans’ assets, and

future estimates of long-term investment returns to develop

its expected rate of return assumption used in the net periodic

pension calculation. This assumption is reviewed and set

annually at the beginning of each year. Accordingly, the

change for 2000 and the decision to leave the rate unchanged

in 2001 was made at the beginning of each respective year. At

the beginning of 2002, using the process described above, the

company reduced its expected long-term return on the U.S.

plan asset assumption from 10.0 percent to 9.5 percent. This

change and the impact of 2002 changes in the expected long-

term rate of return on plan assets for certain non-U.S. plans

is expected to reduce 2002 net retirement plan income by

approximately $350 million. The change in expected long-

term return on U.S. plan assets in 2000 resulted in an

additional $195 million of net retirement plan income for

the year ended December 31, 2000.

The company annually sets its discount rate assumption

for retirement-related benefits accounting to reflect the rates

available on high-quality, fixed-income debt instruments.

Using this process, the company changed its discount rate

assumption for the PPP from 7.25 percent to 7.0 percent,

effective December 31, 2001. This change is not expected to

have a material effect on the company’s 2002 results of oper-

ations. The change in the discount rate from 7.75 percent to

7.25 percent, effective December 31, 2000, did not have a

significant impact on the company’s results of operations for

the year ended December 31, 2001. Effective January 1,

2001, the company increased pension benefits to certain

recipients who retired before January 1, 1997. The increases

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

63

ranged from 2.5 percent to 25 percent, and are based on the

year of retirement and the pension benefit currently being

received. This improvement resulted in an additional cost to

the company of approximately $100 million in 2001.

The change in discount rate assumption for the 2000 U.S.

plan year did not have a significant impact on the company’s

results of operations for the year ended December 31, 2000.

Future effects of pension plans, including the changes

noted above, on the operating results of the company depend

on economic conditions, employee demographics, mortality

rates and investment performance.

See note v, “Segment Information,” on pages 100 through

105 for additional information about the pre-tax income of

each segment, as well as the methodologies employed by the

company to allocate shared expenses to the segments.

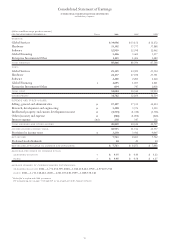

PROVISION FOR INCOME TA X E S

The provision for income taxes resulted in an effective tax

rate of 29.5 percent for 2001, compared with the 2000 effec-

tive tax rate of 29.8 percent and a 1999 effective tax rate of

34.4 percent. The 4.6 point decrease in the 2000 rate from

the 1999 rate was primarily the result of the company’s 1999

sale of its Global Network business and various other actions

implemented during 1999. Had it not been for these 1999

actions, the company’s 1999 effective tax rate would have

been 30 percent (essentially flat from 1998 through 2001).

As reflected in the reconciliation of the company’s effective

tax rate in note o, “Taxes,” on pages 90 and 91, the increased

benefit on the company’s tax rate of the foreign tax differential

in 2000 was principally due to the U.S. tax benefit from the

repatriation of profits previously subject to foreign taxes,

partially offset by a less favorable mix of profits arising in

markets with lower effective tax rates.

Fourth Quarter

In the quarter ended December 31, 2001, the company had

diluted earnings per common share of $1.33, a 10.1 percent

decrease compared with diluted earnings per common share

of $1.48 in the fourth quarter of 2000. Fourth-quarter 2001

net income was $2.3 billion, a 12.7 percent decrease from

$2.7 billion in the year-earlier period. The company’s fourth

quarter 2001 revenue totaled $22.8 billion, down 10.9 per-

cent (8 percent at constant currency) compared with fourth

quarter of 2000.

In the Americas, fourth-quarter revenue was $9.8 billion,

a decrease of 9.1 percent (8 percent at constant currency)

from the 2000 period. Revenue from Europe/Middle East/

Africa was $6.9 billion, down 6.3 percent (6 percent at constant

currency). Asia Pacific revenue declined 9.8 percent (1 per-

cent at constant currency) to $4.5 billion. OEM revenue