IBM 2001 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

100

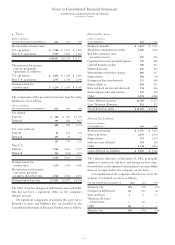

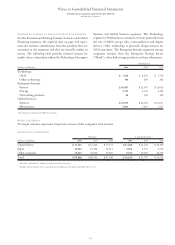

The net periodic postretirement benefit cost for the

U.S. plan for the years ended December 31 include the fol-

lowing components:

(dollars in millions) 2001 2000 1999

Service cost $«««65 $«««50 $«««48

Interest cost 437 449 424

Expected return on

plan assets —(2) (6)

Amortization of

prior service costs (148) (147) (143)

Recognized actuarial losses 22 24 19

Net periodic post-

retirement benefit cost $«376 $«374 $«342

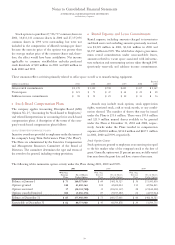

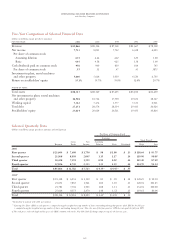

The changes in the benefit obligation and plan assets of the

U.S. plan for 2001 and 2000 are as follows:

(dollars in millions) 2001 2000*

Change in benefit obligation:

Benefit obligation at beginning

of year $««6,443 $««6,178

Service cost 65 50

Interest cost 437 449

Actuarial (gains)/losses (183) 363

Participant contributions 71 23

Benefits paid from trust (68) (110)

Direct benefit payments (617) (510)

Benefit obligation at end of year 6,148 6,443

Change in plan assets:

Fair value of plan assets at

beginning of year 4105

Actual return on plan assets 1(14)

Participant contributions 71 23

Benefits paid (68) (110)

Fair value of plan assets at end of year 84

Benefit obligation in excess

of plan assets (6,140) (6,439)

Unrecognized net actuarial losses 781 986

Unrecognized prior service costs (653) (801)

Accrued postretirement benefit

liability recognized in the

Consolidated Statement

of Financial Position $«(6,012) $«(6,254)

*Reclassified to conform with 2001 presentation.

The plan assets primarily comprise short-term fixed-income

investments.

The benefit obligation was determined by applying the

terms of medical, dental and life insurance plans, including

the effects of established maximums on covered costs,

together with relevant actuarial assumptions. These actuarial

assumptions include a projected health care cost trend rate

of 6 percent. The projected health care cost trend rate

assumption is projected to increase to 10 percent in 2002,

and is assumed to decrease gradually to 5 percent by 2007

and remain constant thereafter.

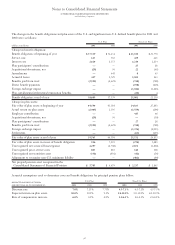

WEIGHTED-AVERAGE ACTUARIAL ASSUMPTIONS

FOR NON-PENSION POSTRETIREMENT

BENEFIT PLANS AS OF DECEMBER 31: 2001 2000 1999

Discount rate 7.00% 7.25% 7.75%

Expected return on

plan assets 5.0% 5.0% 5.0%

The company evaluates its actuarial assumptions on an

annual basis and considers changes in these long-term factors

based upon market conditions and the requirements of SFAS

No. 106, “Employers’ Accounting for Postretirement

Benefits Other Than Pensions.” The discount rate changes

did not have a material effect on net postretirement benefit

cost for the years ended December 31, 2001, 2000 and 1999.

The health care cost trend rate has an insignificant effect

on plan costs and obligations. A one-percentage-point

change in the assumed health care cost trend rate would have

the following effects at December 31, 2001:

One-Percentage- One-Percentage-

(dollars in millions) Point Increase Point Decrease

Effect on total service and

interest cost $«««6 $«««(6)

Effect on postretirement

benefit obligation $«24 $«(29)

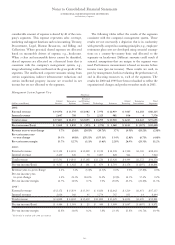

vSegment Information

IBM uses advanced I/T to provide customer solutions. The

company operates primarily in a single industry using several

segments that create value by offering a variety of solutions

that include, either singularly or in some combination, tech-

nologies, systems, products, services, software and financing.

Organizationally, the company’s major operations comprise

a Global Services segment; three hardware product segments

—

Enterprise Systems, Personal and Printing Systems, and

Technology; a Software segment; a Global Financing segment;

and an Enterprise Investments segment. The segments are

determined based on several factors, including customer base,

homogeneity of products, technology and delivery channels.

The Global Services segment is the world’s largest I/T

services provider, supporting computer hardware and soft-

ware products and providing professional services to help

customers of all sizes realize the full value of I/T. The seg-

ment provides value through three primary lines of business:

Strategic Outsourcing Services, BIS and Integrated Technol-

ogy Services. Strategic Outsourcing Services creates

business value through long-term strategic partnerships with