IBM 2001 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

83

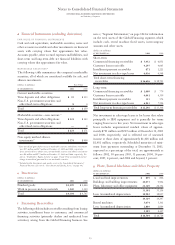

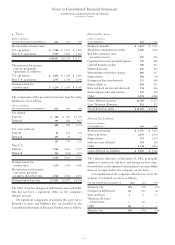

dFinancial Instruments (excluding derivatives)

FAIR VALU E OF FINANCIAL INSTRUMENTS

Cash and cash equivalents, marketable securities, notes and

other accounts receivable and other investments are financial

assets with carrying values that approximate fair value.

Accounts payable, other accrued expenses and liabilities, and

short-term and long-term debt are financial liabilities with

carrying values that approximate fair value.

MARKETABLE SECURITIES*

The following table summarizes the company’s marketable

securities, all of which are considered available for sale, and

alliance investments.

(dollars in millions) Fair Value

AT DE CEMBER 31: 2001 2000

Current marketable securities:

Time deposits and other obligations $«««55 $«153

Non-U.S. government securities and

other fixed-term obligations 86

Total $«««63 $«159

Marketable securities

—

non current:**

Time deposits and other obligations $«124 $«163

Non-U.S. government securities and

other fixed-term obligations —8

Total $«124 $«171

Non equity method alliance

investments** $«574 $«909

*Gross unrealized gains (before taxes) on marketable securities and alliance investments

were $27 million and $47 million at December 31, 2001 and 2000, respectively.

Gross unrealized losses (before taxes) on marketable securities and alliance investments

were $4 million and $175 million at December 31, 2001 and 2000, respectively. See

note m, “Stockholders’ Equity Activity,” on pages 88 and 89 for accumulated and net

change in unrealized gains and losses on marketable securities.

** Included within Investments and sundry assets in the Consolidated Statement of

Financial Position. (See note h, “Investments and Sundry Assets,” on page 84.)

eInventories

(dollars in millions)

AT DE CEMBER 31: 2001 2000

Finished goods $«1,259 $«1,446

Work in process and raw materials 3,045 3,319

Total $«4,304 $«4,765

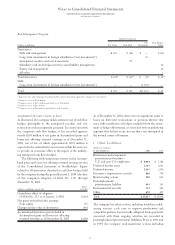

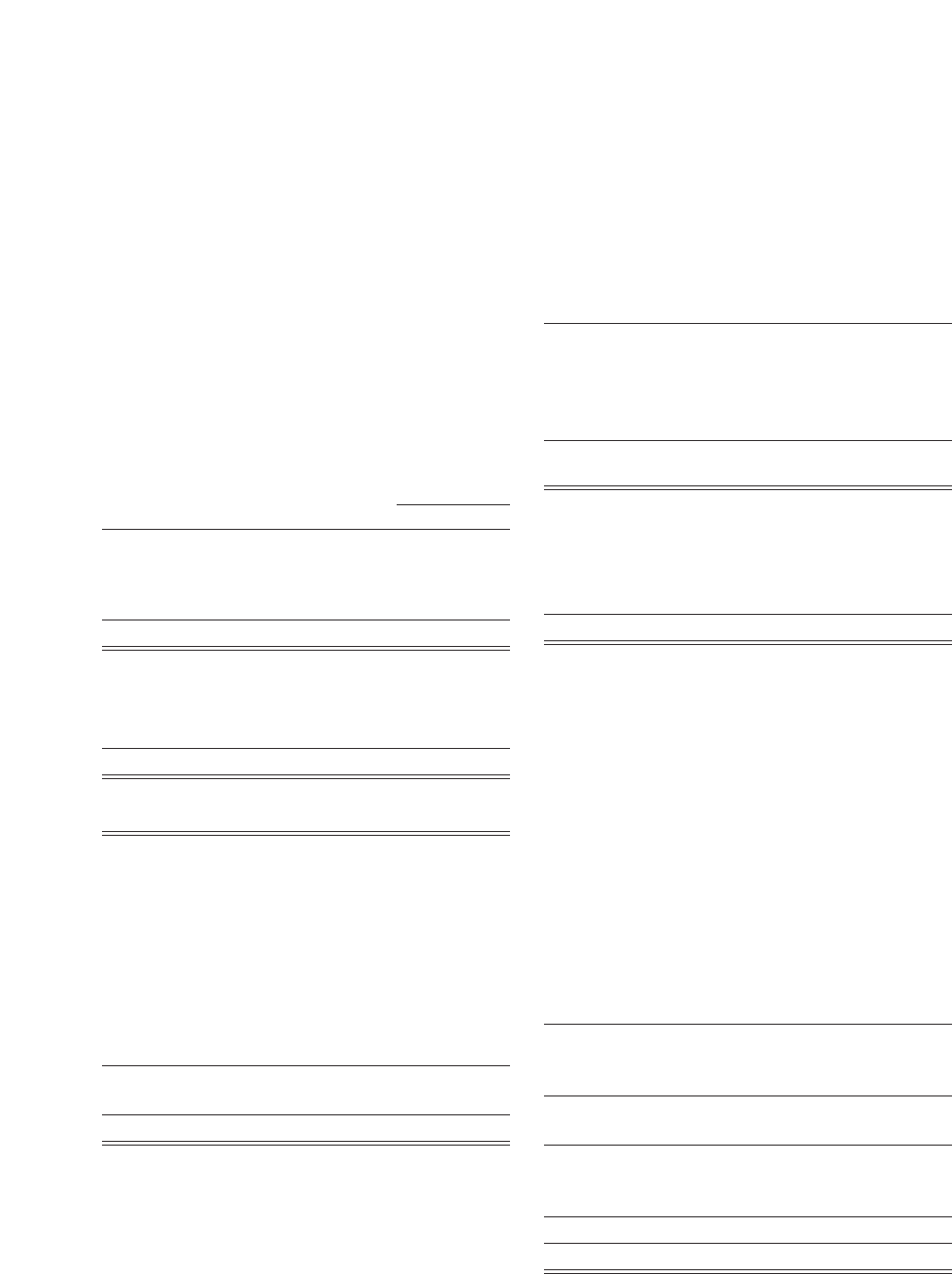

fFinancing Receivables

The following table includes receivables resulting from leasing

activities, installment loans to customers, and commercial

financing activities (primarily dealers and syndicated loan

activities), arising from the Global Financing business. See

note v, “Segment Information,” on page 104 for information

on the total assets of the Global Financing segment, which

include cash, rental machine fixed assets, intercompany

amounts and other assets.

(dollars in millions)

AT DE CEMBER 31: 2001 2000

Short-term:

Commercial financing receivables $«««5,452 $«««6,851

Customer loans receivable 4,297 4,065

Installment payment receivables 871 1,221

Net investment in sales-type leases 6,036 6,568

Total short-term financing

receivables $«16,656 $«18,705

Long-term:

Commercial financing receivables $«««1,009 $««««««779

Customer loans receivable 4,041 4,359

Installment payment receivables 353 574

Net investment in sales-type leases 6,843 7,596

Total long-term financing receivables $«12,246 $«13,308

Net investment in sales-type leases is for leases that relate

principally to IBM equipment and is generally for terms

ranging from two to five years. Net investment in sales-type

leases includes unguaranteed residual values of approxi-

mately $791 million and $785 million at December 31, 2001

and 2000, respectively, and is reflected net of unearned

income at those dates of approximately $1,428 million and

$1,481 million, respectively. Scheduled maturities of mini-

mum lease payments outstanding at December 31, 2001,

expressed as a percentage of the total, are approximately as

follows: 2002, 50 percent; 2003, 31 percent; 2004, 14 per-

cent; 2005, 4 percent; and 2006 and beyond, 1 percent.

gPlant, Rental Machines and Other Property

(dollars in millions)

AT DE CEMBER 31: 2001 2000

Land and land improvements $««««««859 $««««««896

Buildings and building improvements 10,073 9,904

Plant, laboratory and office equipment 22,369 22,354

33,301 33,154

Less: Accumulated depreciation 18,982 18,857

14,319 14,297

Rental machines 5,074 5,301

Less: Accumulated depreciation 2,889 2,884

2,185 2,417

Total $«16,504 $«16,714