IBM 2001 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financing debt, offset by an increase in non-global financing

debt. The decline in Global Financing debt was the result of

the decrease in Global Financing assets.

Effective May 31, 2001, the company arranged global

credit facilities totaling $12.0 billion in committed credit lines,

including an $8.0 billion five-year facility and a $4.0 billion

364-day facility, replacing the company’s $10 billion credit

facility which was due to expire in February 2002. Amounts

unused and available under these facilities were $11,383 mil-

lion and $9,103 million at December 31, 2001 and 2000,

respectively. In addition, at December 31, 2001 and 2000,

the company had in place other lines of credit, most of which

were uncommitted, of $6,860 million and $7,646 million,

respectively. The amounts unused and available under these

primarily uncommitted facilities at December 31, 2001 and

2000, were $4,738 million and $5,111 million, respectively.

At December 31, 2001 and 2000, the company had a total

balance of state and local government loans receivable secu-

ritized of $213 million and $136 million, respectively. For

additional information, see note i, “Sale and Securitization

of Receivables,” on page 84.

The changes in the company’s U.S. pension plan during

2001, including the increased benefits for retirees and the

1999 amendment to the plan, are not expected to have a

material effect on the company’s financial condition.

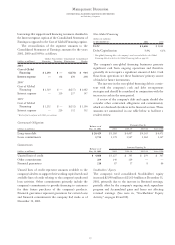

The major rating agencies’ ratings of the company’s debt

securities at December 31, 2001, appear in the table below:

Standard Moody’s

and Investors

Poor’s Service Fitch, Inc.

Senior long-term debt A+ A1 AA-

Commercial paper A-1 Prime-1 F-1+

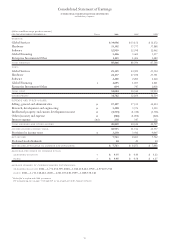

CASH FLOWS

The company’s cash flows from operating, investing and

financing activities, as reflected in the Consolidated State-

ment of Cash Flows on page 74, are summarized in the

following table:

(dollars in millions) 2001 2000 1999

Net cash provided from/

(used in):

Operating activities $«14,265 $««9,274 $«10,111

Investing activities (6,106) (4,248) (1,669)

Financing activities (5,309) (6,359) (8,625)

Effect of exchange rate

changes on cash and

cash equivalents (83) (147) (149)

Net change in cash and

cash equivalents $÷«2,767 $«(1,480) $«««««(332)

WORKING CAPITAL

(dollars in millions)

AT D E C EMBER 31: 2001 2000

Current assets $«42,461 $«43,880

Current liabilities 35,119 36,406

Working capital $÷«7,342 $«««7,474

Current ratio 1.21:1 1.21:1

Current assets decreased $1,419 million due primarily to

decreases in accounts receivable of $3,708 million, Inventories

of $461 million and Deferred taxes of $299 million, offset by

net increases of $2,671 million in Cash and cash equivalents

and current Marketable securities, and $378 million in

Prepaid expenses and other current assets. The decline in

accounts receivable was primarily attributable to lower

fourth quarter 2001 revenue volumes as compared to the

fourth quarter of 2000. The net increase in Cash and cash

equivalents and current Marketable securities was due pri-

marily to an increase in cash from operations and a reduction

in common stock transactions, mainly from lower stock

repurchases, partially offset by an increase in investment and

acquisition activities.

The company ended 2001 with Inventories of $4,304 mil-

lion, the lowest level since 1983, primarily as a result of lower

inventory levels within the Personal and Printing Systems

segment. The company’s inventory turnover ratio declined

to 5.8 in 2001 from 6.3 in 2000.

Current liabilities declined $1,287 million from year-end

2000, primarily due to decreases of $1,145 million in Accounts

payable, $644 million in Other accrued expenses and liabilities

and $293 million in Deferred income, offset by an increase

of $983 million in Short-term debt.

INVESTMENTS

The company’s investments for Plant, rental machines and

other property were $5,660 million for 2001, remaining

essentially flat.

In addition to software development expenses included

in RD&E expense, the company capitalized $655 million of

software costs during 2001, an increase of $90 million

from the 2000 period. The increase resulted from increases

in capitalized costs for both internal-use software and

licensed programs.

Investments and sundry assets were $17,102 million at

the end of 2001, an increase of $2,655 million from 2000,

primarily the result of increases in Prepaid pension assets

and Informix goodwill, offset by declines in Alliance invest-

ments and Deferred taxes. See note h, “Investments and

Sundry Assets,” on page 84 for additional information.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

65