IBM 2001 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

particularly in Asia Pacific, and in its Web hosting offerings.

Web hosting is an e-sourcing service that became a $1 billion

business in 2001. Integrated Technology Services grew its

revenue in support of server consolidations, business conti-

nuity services, and its OEM alliances. Global Services

revenue growth in support of non-IBM hardware deployment

continues to moderate due to the slowdown in personal

computer, telecommunications and networking equipment

providers. Business Innovation Services (BIS) revenue grew

but it was affected the most by the current economic environ-

ment. This business includes consulting and systems

integration. Despite a slowdown in the BIS market, especially

in the U.S., customers continued to deploy e-business applica-

tions such as customer relationship management and supply

chain management and to perform e-business integration of

their business processes and multiple applications.

Revenue comparisons in 2000 were adversely affected by

two events: the sale of the Global Network to AT&T in 1999

and the decline in Y2K services activity year over year. After

adjusting for those two factors, Global Services revenue

(excluding maintenance) increased 9 percent in 2000 versus

1999. (See “Divestitures,” on page 82 for additional informa-

tion about the Global Network sale.) In 2000, Integrated

Technology Services revenue was affected by the loss of

revenue due to the sale of the Global Network and BIS was

affected primarily by the decline in Y2K activity. BIS recov-

ered in the second half of 2000 as customers shifted from

mature offerings such as custom systems integration and

Y2K remediation to the company’s e-business offerings. BIS

revenue, exclusive of Y2K and custom systems integration,

experienced strong growth in 2000.

In 2001, the company signed contracts totaling $51 bil-

lion, including 39 contracts in excess of $100 million, six of

which exceeded $1 billion. These transactions contributed to

a services backlog at December 31, 2001, of $102 billion

compared with $85 billion at December 31, 2000. The com-

pany experienced an acceleration in contract signings in the

fourth quarter of 2001 and a strong pipeline of contracts at

December 31, 2001, that should have a positive effect on

Global Services revenue growth in 2002. Also, in 2002, the

annuity-like portions of Global Services, particularly out-

sourcing and maintenance, should mitigate the downturn in

other businesses until the economy recovers. To extend the

benefits of outsourcing, the company is in the forefront of

e-sourcing

—

the delivery of infrastructure, applications and

business processes over the Internet as a service. The company

intends to provide the infrastructure technologies that all

of these service providers will require, as well as to provide

many of the services themselves.

Global Services gross profit dollars increased 8.6 percent

in 2001 compared to 2000 and were essentially flat in 2000

versus 1999. The gross profit margin increased 0.8 points in

2001 versus 2000 and declined 0.9 points in 2000 versus

1999. The increases in both gross profit dollars and gross

profit margin in 2001 were a result of reduced labor and

parts costs across all geographies for maintenance offerings

and cost reductions across all services offerings. The decline

in gross profit margin in 2000 was primarily driven by lower

utilization rates in BIS and Integrated Technology Services

due to rapid hiring and retraining associated with rebalancing

skills toward e-business services. Also contributing to the

decline was a revenue shift to OEM alliances, which have a

lower gross profit margin. These declines were partially offset

by an improvement in the maintenance gross profit margin.

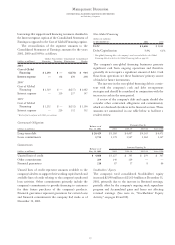

HARDWARE

(dollars in millions) 2001 2000 1999

Revenue $«33,392 $«37,777 $«37,888

Cost 24,137 27,038 27,591

Gross profit $«««9,255 $«10,739 $«10,297

Gross profit margin 27.7% 28.4% 27.2%

Hardware revenue declined 11.6 percent (8 percent at

constant currency) in 2001 versus 2000 and was essentially

flat (up 2 percent at constant currency) in 2000 compared

with 1999.

Effective in the first quarter 2001, the company made

changes in the organization of its Hardware segment. These

changes include the transfer of the xSeries (Intel-based)

servers from the Personal Systems segment to the Enterprise

Systems segment, and the transfer of the Printing Systems

Division from the Technology segment to the newly formed

Personal and Printing Systems segment, consisting of the

realigned Personal Computer Division, Retail Store Solutions

Division and the Printing Systems Division. All amounts

disclosed herein for all years presented have been reclassified

to conform with these changes.

In 2001, Enterprise Systems revenue declined 3.2 percent

from 2000, following an increase of 2.6 percent in 2000 ver-

sus 1999. zSeries revenue grew in 2001, the first full year of

revenue growth since 1989, a clear recognition of the unique

advantages mainframes offer to the company’s customers.

Total deliveries of zSeries computing power increased more

than 30 percent as measured in MIPS (millions of instructions

per second) versus 2000. In addition, revenue growth in stor-

age products was driven by high-end products (“Shark”).

pSeries revenue decreased in 2001 as the market for UNIX-

based servers declined substantially, but the new high-end

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies