IBM 2001 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

67

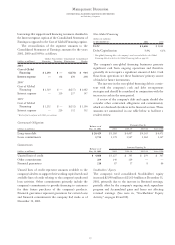

borrowings that supports such financing revenue is classified in

the Interest expense caption of the Consolidated Statement of

Earnings as opposed to the Cost of Global Financing caption.

The reconciliation of the segment amounts to the

Consolidated Statement of Earnings amounts for the years

2001, 2000 and 1999 is as follows:

Global Non-Global Consolidated Consolidated

(dollars in millions) Financing Financing Eliminations Results

2001

Cost of Global

Financing $«1,140 $««— $«(176) $««««964

Interest expense —«62 176 «238

2000*

Cost of Global

Financing $«1,319 $««— $«(237) $«1,082

Interest expense —110 «237 347

1999*

Cost of Global

Financing $«1,232 $««— $«(132) $«1,100

Interest expense —220 «132 352

*Reclassified to conform with 2001 presentation.

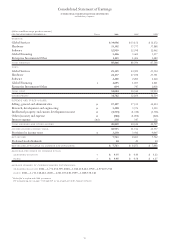

Stockholders’ Equity

The company’s total consolidated Stockholders’ equity

increased $2,990 million to $23,614 million at December 31,

2001, primarily due to the increase in Retained earnings,

partially offset by the company’s ongoing stock repurchase

program and Accumulated gains and losses not affecting

retained earnings. (See note m, “Stockholders’ Equity

Activity,” on pages 88 and 89).

Non-Global Financing

(dollars in millions)

AT DE CEMBER 31: 2001 2000

Debt*$«1,606 $«1,062

Debt/Capitalization 7.5% 6.1%

*Non-global financing debt is the company’s total external debt less the Global

Financing debt described in the Global Financing table on page 66.

The company’s non-global financing businesses generate

significant cash from ongoing operations and therefore

generally do not require a significant amount of debt. Cash

flows from operations are these businesses’ primary source

of funds for future investments.

The increase in the non-global financing debt is consis-

tent with the company’s cash and debt arrangement

strategies and should be considered in conjunction with the

increase in cash in the same period.

A review of the company’s debt and equity should also

consider other contractual obligations and commitments,

which are disclosed elsewhere in the financial section. These

amounts are summarized in one table below to facilitate a

reader’s review.

Contractual Obligations

Balance as of Payments Due In

(dollars in millions) Dec. 31, 2001 2002 2003-04 2005-06 After 2006

Long-term debt $«20,429 $«5,186 $«4,607 $«4,165 $«6,471

Lease commitments 5,734 1,378 1,927 1,062 1,367

Commitments

Balance as of Amounts Expiring In

(dollars in millions) Dec. 31, 2001 2002 2003-04 2005-06 After 2006

Unused lines of credit $«««4,088 $«3,127 $««««395 $««««259 $««««307

Other commitments 269 140 129 — —

Financial guarantees 218 87 37 8 86

Unused lines of credit represent amounts available to the

company’s dealers to support their working capital needs and

available lines of credit relating to the company’s syndicated

loan activities. Other commitments primarily include the

company’s commitments to provide financing to customers

for their future purchases of the company’s products.

Financial guarantees represent guarantees for certain loans

and financial commitments the company had made as of

December 31, 2001.