IBM 2001 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and China. This growth reflects a new subsidiary in Europe

related to a major services venture with Fiat SpA, and growth

in China to support a rapidly expanding I/T infrastructure.

The company’s complementary workforce is an approxi-

mation of equivalent full-time employees hired under

temporary, part-time and limited-term employment

arrangements to meet specific business needs in a flexible

and cost-effective manner.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

69

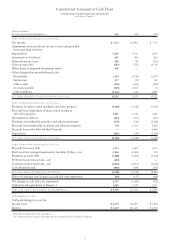

To tal Run-Out of 2001 Balance

2005 and

(dollars in millions) 1999*2000*2001 2002 2003 2004 beyond

Sales-type leases $««««771 $««««785 $÷÷791 $«236 $«273 $«220 $«62

Operating leases 609 396 334 172 95 44 23

Total residual value $«1,380 $«1,181 $«1,125 $«408 $«368 $«264 $«85

*Restated to include residual value associated with non-information technology (I/T) equipment. (Amounts were included in the narrative in prior years.)

instrument portfolio for these theoretical changes in the

level of interest rates are primarily driven by changes in the

company’s debt maturity, interest rate profile and amount. In

2001 versus 2000, the reported increase in interest rate sen-

sitivity is primarily due to reductions in the company’s

“receive fixed/pay floating” interest rate swap portfolio that

had been utilized in 2000 to more closely match the matu-

rity profile of the company’s fixed-rate debt.

Foreign Currency Exchange Rate Risk

At December 31, 2001, a 10 percent weaker U.S. dollar

against foreign currencies with all other variables held con-

stant would result in a decrease in the fair value of the

company’s financial instruments of $1,401 million as com-

pared with a decrease of $1,352 million at December 31,

2000. Conversely, a 10 percent stronger U.S. dollar against

foreign currencies with all other variables held constant

would result in an increase in the fair value of the company’s

financial instruments of $1,440 million compared to $1,435

million at December 31, 2000.

FINANCING RISKS

Financing is an integral part of the company’s total worldwide

offerings. Inherent in financing are certain risks, including

credit, interest rate, currency and residual value. The com-

pany manages credit risk through comprehensive credit

evaluations and pricing practices. To manage the risks associ-

ated with an uncertain interest rate environment, the

company pursues a funding strategy of substantially matching

the interest rate profile of its debt with the interest rate pro-

file of its assets. Currency risks are managed by denominating

liabilities in the same currency as the assets.

Residual value risk is managed by developing projections

of future equipment values at lease inception, reevaluating

these projections quarterly, and effectively deploying remar-

keting capabilities to recover residual values and potentially

earn a profit. The following table presents the recorded

amount of unguaranteed residual values for sales-type and

operating leases at December 31, 1999, 2000 and 2001. In

addition, the table below presents the run-out of the unguar-

anteed residual value over the remaining lives of these leases

at December 31, 2001.

Employees at IBM and its wholly owned subsidiaries in 2001

increased 3,573 from last year. Although the rate of growth

of the company’s workforce slowed in 2001, primarily due to

workforce rebalancing initiatives, the company continued to

hire at a strong pace. Global Services, for example, hired nearly

14,000 people in 2001. Acquisitions, particularly the Informix

database business, added to the 2001 workforce as well.

In less than wholly owned subsidiaries, the number of

employees increased from last year, particularly in Europe

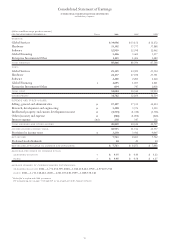

Accounting Estimates

Accounting under generally accepted accounting principles requires the use of estimates. The company’s note a, “Significant

Accounting Policies,” starting on page 75 describes the important estimates used by the company.

Employees and Related Workforce

Percentage Changes

2001 2000 1999 2001-00 2000-99

IBM/wholly owned subsidiaries 319,876 316,303 307,401 1.1 2.9

Less-than-wholly owned subsidiaries 25,403 21,886 17,176 16.1 27.4

Complementary 21,300 25,500 29,800 (16.5) (14.4)