IBM 2001 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

99

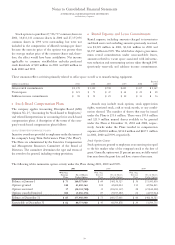

The company evaluates its actuarial assumptions on an

annual basis and considers changes in these long-term factors

based upon market conditions and the requirements of SFAS

No. 87, “Employers’ Accounting for Pensions.”

The change in the discount rate for the 2001 U.S. plan

year had an effect of an additional $9 million of net retire-

ment plan cost for the year ended December 31, 2001. The

change in expected return on plan assets and the discount

rate for the 2000 U.S. plan year had an effect of an additional

$195 million and $26 million of net retirement plan income,

respectively, for the year ended December 31, 2000. This

compares with an additional $46 million and $65 million of

net retirement plan cost for the year ended December 31,

1999, as a result of plan year 1999 changes in the rate of

compensation increase and the discount rate, respectively.

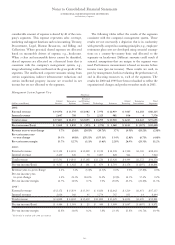

Funding Policy

It is the company’s practice to fund amounts for pensions

sufficient to meet the minimum requirements set forth in

applicable employee benefits laws and local tax laws. From

time to time, the company contributes additional amounts as

it deems appropriate. Liabilities for amounts in excess of

these funding levels are accrued and reported in the com-

pany’s Consolidated Statement of Financial Position. The

assets of the various plans include corporate equities, gov-

ernment securities, corporate debt securities and real estate.

Other

As described earlier in this note, the company provides

defined benefit pension plans in a number of countries. Page

98 includes an aggregation of the significant non-U.S. plans.

SFAS No. 132, “Employers’ Disclosures about Pensions and

Other Postretirement Benefits,” requires that companies

disclose the aggregate benefit obligation (BO) and plan

assets of all plans in which the BO exceeds plan assets. Similar

disclosure is required for all plans in which the accumulated

benefit obligation (ABO) exceeds plan assets. BO reflects the

present value of the pension obligation assuming salary

increases and is included in the table on the top of page 98.

The ABO reflects this obligation based upon current salary

levels (i.e., no salary increases). Accordingly, the ABO is a

subset of the BO and the plans listed under the Plans with an

ABO in excess of plan assets are also included in the amounts

for Plans with a BO in excess of plan assets. The aggregate

BO and plan assets are also disclosed for plans in which the

plan assets exceed the BO.

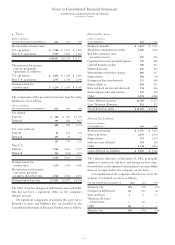

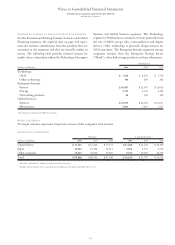

2001 2000

Benefit Plan Benefit Plan

(dollars in millions) Obligation Assets Obligation Assets

Plans with BO

in excess of plan

assets $«12,358 $«10,929 $«««4,209 $÷«3,919

Plans with ABO

in excess of plan

assets $«««3,041 $«««2,636 $««««««530 $÷÷÷400

Plans with assets

in excess of BO $«««9,443 $«10,602 $«16,941 $«20,915

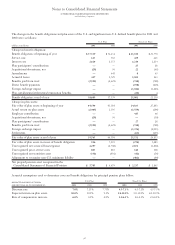

NONPENSION POSTRETIREMENT BENEFITS

The total cost of the company’s nonpension postretirement

benefits for the years ended December 31, 2001, 2000 and

1999, were $404 million, $401 million and $371 million,

respectively. The company has a defined benefit postretire-

ment plan that provides medical, dental and life insurance

for U.S. retirees and eligible dependents. The total cost of

this plan for the years ended December 31, 2001, 2000 and

1999, was $376 million, $374 million and $342 million,

respectively. Effective July 1, 1999, the company established

a “Future Health Account (FHA) Plan” for employees who

were more than five years away from retirement eligibility.

Employees who were within five years of retirement eligibil-

ity are covered under the company’s prior retiree health

benefits plan. Under either the FHA or the preexisting plan,

there is a maximum cost to the company for retiree health

care. For employees who retired before January 1, 1992, that

maximum became effective in 2001. For all other employees,

the maximum is effective upon retirement.

Certain of the company’s non-U.S. subsidiaries have similar

plans for retirees. However, most of the retirees outside the

U.S. are covered by government-sponsored and administered

programs. The total cost of these plans for the years ended

December 31, 2001, 2000 and 1999, was $28 million, $27 mil-

lion and $29 million, respectively. At December 31, 2001 and

2000, Other liabilities in the Consolidated Statement of

Financial Position include non-U.S. postretirement benefit

liabilities of $200 million and $208 million, respectively.