IBM 2001 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

84

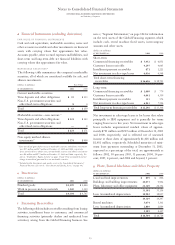

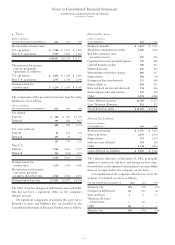

hInvestments and Sundry Assets

(dollars in millions)

AT DE CEMBER 31: 2001 2000

Deferred taxes $«««2,395 $«««2,968

Prepaid pension assets 9,407 6,806

Alliance investments:

Equity method 544 629

Other 574 909

Goodwill (less accum. amortization) 1,278 848

Marketable securities

—

non current 124 171

Software 963 782

Other assets 1,817 1,334

Total $«17,102 $«14,447

iSale and Securitization of Receivables

The company periodically sells receivables through the

securitization of loans, leases and trade receivables. The

company retains servicing rights in the securitized receiv-

ables for which it receives a servicing fee. Any gain or loss

incurred as a result of such sales is recognized in the period

in which the sale occurs.

During 2001, the company entered into an uncommitted

trade receivables securitization facility that allows for the

ongoing sale of up to $500 million of trade receivables. This

facility was put in place primarily to provide backup liquid-

ity and can be accessed on three days’ notice. The company

sold $179 million in trade receivables through this facility in

2001. In addition, the company sold $278 million of loans

receivable due from state and local government customers

through a securitization program established in 1990. No

receivables were sold in 2000 under this program. Net gains

and losses on these sales were insignificant.

Total cash proceeds of $460 million were received in

2001 from the sale and securitization of receivables.

At December 31, 2001, the total balance of assets securi-

tized and under the company’s management was $213 million,

all of which related to loans receivable. Servicing assets net

of servicing liabilities were insignificant.

The investors in the loans receivable securitizations have

recourse to the company via a limited guarantee. At year-end

2001, delinquent amounts from the receivables sold and net

credit losses were insignificant.

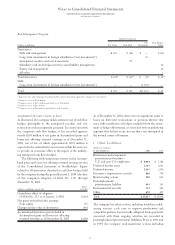

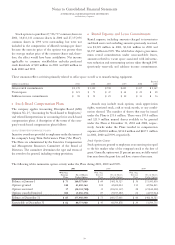

jBorrowings

SHORT-TERM DEBT

(dollars in millions)

AT DE CEMBER 31: 2001 2000

Commercial paper $«««4,809 $«««3,521

Short-term loans 1,564 3,975

Long-term debt: Current maturities 4,815 2,709

Total $«11,188 $«10,205

The weighted-average interest rates for commercial paper at

December 31, 2001 and 2000, were 1.9 percent and 6.7 per-

cent, respectively. The weighted-average interest rates for

short-term loans at December 31, 2001 and 2000, were 4.0

percent and 2.9 percent, respectively.

LONG-TERM DEBT

(dollars in millions)

AT DE CEMBER 31: Maturities 2001 2000

U.S. dollars:

Debentures:

6.22% 2027 $««««««500 $««««««500

6.5% 2028 700 700

7.0% 2025 600 600

7.0% 2045 150 150

7.125% 2096 850 850

7.5% 2013 550 550

8.375% 2019 750 750

Notes: 6.3% average 2002-2014 2,772 2,933

Medium-term note

program: 5.4% average 2002-2014 3,620 4,305

Other: 4.5% average 2002-2009 828 1,092

11,320 12,430

Other currencies

(average interest rate

at December 31, 2001,

in parentheses):

Euros (4.4%) 2002-2009 3,042 3,042

Japanese yen (1.1%) 2002-2014 4,749 4,845

Canadian dollars (5.8%) 2002-2011 441 302

Swiss francs (4.0%) 2002-2003 151 231

Other (6.1%) 2002-2014 726 275

20,429 21,125

Less: Net unamortized

discount 47 45

Add: SFAS No. 133 fair

value adjustment*396 —

20,778 21,080

Less: Current maturities 4,815 2,709

Total $«15,963 $«18,371

*In accordance with the requirements of SFAS No. 133, the portion of the company’s

fixed-rate debt obligations that is hedged is reflected in the Consolidated Statement

of Financial Position as an amount equal to the sum of the debt’s carrying value plus

a SFAS No. 133 fair value adjustment representing changes recorded in the fair value

of the hedged debt obligations attributable to movements in market interest rates.