IBM 2001 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

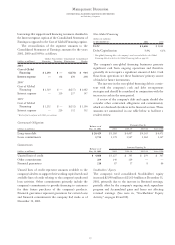

Consolidated Statement of Stockholders’ Equity

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

Accumulated

Gains and

(Losses) Not

Employee Affecting

Preferred Common Retained Treasury Benefits Retained

(dollars in millions) Stock Stock Earnings Stock Trust Earnings Total

1999*

Stockholders’ equity, January 1, 1999 $«247 $«10,121 $«10,141 $÷÷««(133) $«(1,854) $«÷«911 $«19,433

Net income plus gains and losses not

affecting retained earnings:

Net income 7,712 $«««7,712

Gains and losses not affecting retained

earnings (net of tax):

Foreign currency translation adjustments

(net of tax expense of $180)(549) (549)

Minimum pension liability adjustment 33

Net unrealized gains on marketable

securities (net of tax expense of $456)796 796

Total gains and losses not affecting

retained earnings 250

Subtotal: Net income plus gains and

losses not affecting retained earnings $«««7,962

Cash dividends declared

—

common stock (859) (859)

Cash dividends declared

—

preferred stock (20) (20)

Common stock issued under employee

plans (22,927,141 shares) 741 (1) 740

Purchases (6,418,975 shares) and sales (6,606,223 shares)

of treasury stock under employee plans

—

net (95) (50) (145)

Other treasury shares purchased, not retired

(70,711,971 shares) (7,192) (7,192)

Fair value adjustment of employee benefits trust 318 (308) 10

Increase due to shares issued by subsidiary 37 37

Tax effect

—

stock transactions 545 545

Stockholders’ equity, December 31,1999 $«247 $«11,762 $«16,878 $«««(7,375) $«(2,162) $«1,161 $«20,511

2000*

Net income plus gains and losses not

affecting retained earnings:

Net income 8,093 $«««8,093

Gains and losses not affecting retained

earnings (net of tax):

Foreign currency translation adjustments

(net of tax expense of $289)(538) (538)

Minimum pension liability adjustment 77

Net unrealized losses on marketable

securities (net of tax benefit of $506)(925) (925)

Total gains and losses not affecting

retained earnings (1,456)

Subtotal: Net income plus gains and

losses not affecting retained earnings $«««6,637

Cash dividends declared

—

common stock (909) (909)

Cash dividends declared

—

preferred stock (20) (20)

Common stock issued under employee

plans (17,275,350 shares) 615 1 616

Purchases (8,799,382 shares) and sales (9,074,212 shares)

of treasury stock under employee plans

—

net (259) 6 (253)

Other treasury shares purchased, not retired

(58,867,226 shares) (6,431) (6,431)

Fair value adjustment of employee benefits trust (439) 450 11

Increase due to shares remaining to be issued

in acquisition 40 40

Tax effect

—

stock transactions 422 422

Stockholders’ equity, December 31,2000 $«247 $«12,400 $«23,784 $«(13,800) $«(1,712) $«««(295) $«20,624