IBM 2001 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

92

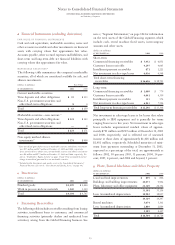

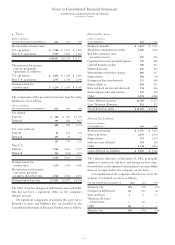

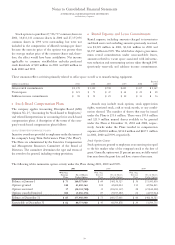

Investments Liability Liability

To tal and Other Liability as of as of

Pre-Tax Asset Write- Created Other Dec. 31, Other Dec. 31,

(dollars in millions) Charges*Downs in 1999 Payments Adjustments** 1999 Payments Adjustments** 2000

Technology Group

MD Actions:

DRAM

Equipment(1) $««««662 $««««662 $«««— $«— $«— $«««— $«««— $«— $«««—

Employee terminations:(2) (8)

Current 30 — 30 151833442615

Non current 137 — 137 — (21) 116 — (30) 86

Dominion investment(3) 171 171 ———————

MiCRUS investment(4) 152 — 152 — — 152 152 — —

STD Actions:

Equipment(5) 337 337 ———————

Employee terminations(6) 23 — 23 16— 7 7——

NHD Action:

Inventory write-downs and

contract cancellations(7) 178 178 ———————

Total 1999 actions $«1,690 $«1,348 $«342 $«31 $««(3) $«308 $«203 $««(4) $«101

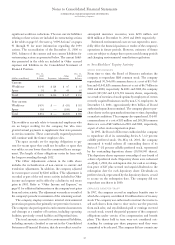

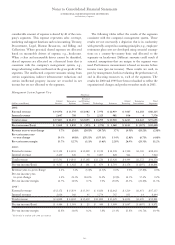

results of the company’s semiconductor business. They were

intended to enable the company to (1) reconfigure the assets

and capabilities of the division to allow more focus on the

faster-growth, higher-margin custom logic portion of the MD

business and (2) enhance its ability to more cost-effectively

manage a partnership agreement that was formed to produce

complementary metal oxide semiconductor (CMOS) based

logic components.

The company reduced its internal dynamic random

access memory (DRAM) capacity by converting its manufac-

turing facility in Essonnes, France, from DRAM to custom

logic. The company effected that conversion through a joint

venture with Infineon Technologies, which at the time was a

subsidiary of Siemens AG. Also related to DRAM, the com-

pany executed contracts with various banks and other

financing institutions to sell and lease back test equipment.

The company also participated in a 50/50 joint venture

(Dominion Semiconductor Company) with Toshiba Corpora-

tion to produce DRAM memory components. The company

entered into an agreement whereby Toshiba assumed the

company’s interest in Dominion effective December 1, 2000.

The company participated in the capacity output of

Dominion at a significantly reduced rate in the interim period.

The company held a majority interest in a joint venture

(MiCRUS) with Cirrus Logic Inc. (the partner) to produce

CMOS-based logic components for IBM and its partner based

on contractual capacity agreements. The partner indicated

that it would not require the output capacity that was pro-

vided for in the partnership agreement. The company

determined that the most cost-effective manner in which to

address the partner’s desire to exit the partnership agreement

was to acquire the minority interest held by that partner and

to cut back production. In the second quarter of 1999, the

company accrued related costs associated with the MiCRUS

operations. The liability created was primarily for lease

termination charges for equipment under the MiCRUS

operation. Since June 1999, related activities were under way

and were completed in June 2000. The liabilities accrued in

the second quarter of 1999 were utilized during the second

quarter of 2000. In June 2000, the company sold its MiCRUS

semiconductor operations to Philips Semiconductors, an

affiliate of Royal Philips Electronics.

The company also announced aggressive steps intended

to improve its competitive position in the markets that STD

serves by merging server hard disk drive (HDD) product

lines and realigning operations. The company integrated all

server HDDs into a single low-cost design platform that uses

common development and manufacturing processes. The

company transferred manufacturing assembly and test oper-

ations to Hungary and Mexico and completed these actions

by mid-2000.

The actions within NHD relate to a global alliance with

Cisco Systems, Inc. As a result of the announcement of the

alliance, demand for the router and switch products by both

existing and new customers deteriorated.

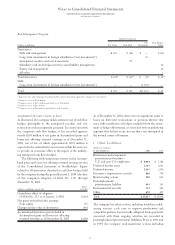

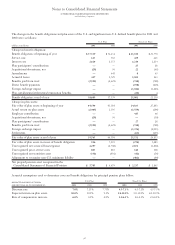

The following table identifies the significant components

of the pre-tax charge related to the 1999 actions and the

liability as of December 31, 2001 and 2000: