IBM 2001 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

88

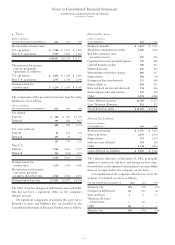

significant workforce reductions. The non current liabilities

relating to these actions are included in restructuring actions

in the table on page 87. See note q, “1999 Actions,” on pages

91 through 93 for more information regarding the 1999

actions. The reconciliation of the December 31, 2000 to

2001, balances of the current and non current liabilities for

restructuring actions are presented below. The current liabil-

ities presented in the table are included in Other accrued

expenses and liabilities in the Consolidated Statement of

Financial Position.

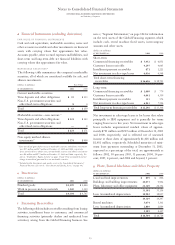

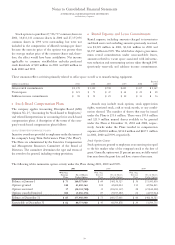

Dec. 31, Dec. 31,

2000 Other 2001

(dollars in millions) Balance Payments Adjustments Balance

Current:

Workforce $«148 $«128 $««««67 $«««87

Space 91 86 60 65

Total $«239 $«214 $««127 $«152

Non current:

Workforce $«470 $«««— $«««(85) $«385

Space 384 — (180) 204

Total $«854 $«««— $«(265) $«589

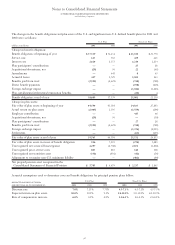

The workforce accruals relate to terminated employees who

are no longer working for the company, but who were

granted annual payments to supplement their state pensions

in certain countries. These contractually required payments

will continue until the former employee dies.

The space accruals are for ongoing obligations to pay

rent for vacant space that could not be sublet or space that

was sublet at rates lower than the committed lease arrange-

ment. The length of these obligations varies by lease with

the longest extending through 2012.

The Other Adjustments column in the table above

includes the reclassification of non current to current and

translation adjustments. In addition, the company adjusted

its vacant space accrual by $110 million. This adjustment is

recorded as part of the real estate activity included in Other

income and expense and is offset by a decline in real estate

gains in 2001. Refer to “Other Income and Expense,” on

page 91 for additional information on the company’s net gains

from real estate activity. The adjustment was made as a result of

the company’s periodic reassessment of the remaining accrual.

The company employs extensive internal environmental

protection programs that primarily are preventive in nature.

The company also participates in environmental assessments

and cleanups at a number of locations, including operating

facilities, previously owned facilities and Superfund sites.

The total amounts accrued for environmental liabilities,

including amounts classified as current in the Consolidated

Statement of Financial Position, that do not reflect actual or

anticipated insurance recoveries, were $238 million and

$248 million at December 31, 2001 and 2000, respectively.

Estimated environmental costs are not expected to mate-

rially affect the financial position or results of the company’s

operations in future periods. However, estimates of future

costs are subject to change due to protracted cleanup periods

and changing environmental remediation regulations.

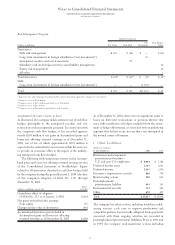

mStockholders’ Equity Activity

STOCK REPURCHASES

From time to time, the Board of Directors authorizes the

company to repurchase IBM common stock. The company

repurchased 50,764,698 common shares at a cost of $5.3 bil-

lion and 61,041,820 common shares at a cost of $6.7 billion in

2001 and 2000, respectively. In 2001 and 2000, the company

issued 1,923,502 and 2,174,594 treasury shares, respectively,

as a result of exercises of stock options by employees of certain

recently acquired businesses and by non-U.S. employees. At

December 31, 2001, approximately $4.6 billion of Board

authorized repurchases remained. The company plans to pur-

chase shares on the open market from time to time, depending

on market conditions. The company also repurchased 314,433

common shares at a cost of $31 million and 249,288 common

shares at a cost of $27 million in 2001 and 2000, respectively,

as part of other stock compensation plans.

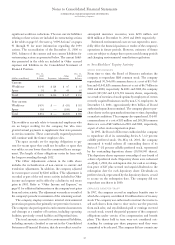

In 1995, the Board of Directors authorized the company

to repurchase all of its outstanding Series A 7-1⁄2 percent

callable preferred stock. On May 18, 2001, the company

announced it would redeem all outstanding shares of its

Series A 7-1/2 percent callable preferred stock, represented

by the outstanding depositary shares (10,184,043 shares).

The depositary shares represent ownership of one-fourth of

a share of preferred stock. Depositary shares were redeemed

as of July 3, 2001, the redemption date, for cash at a redemp-

tion price of $25 plus accrued and unpaid dividends to the

redemption date for each depositary share. Dividends on

preferred stock, represented by the depositary shares, ceased

to accrue on the redemption date. The company did not

repurchase any shares in 2000.

EMPLOYEE BENEFITS TRUST

In 1997, the company created an employee benefits trust to

which the company contributed 10 million shares of treasury

stock. The company was authorized to instruct the trustee to

sell such shares from time to time and to use the proceeds

from such sales, and any dividends paid or earnings received

on such stock, toward the partial payment of the company’s

obligations under certain of its compensation and benefit

plans. The shares held in trust were not considered out-

standing for earnings per share purposes until they were

committed to be released. The company did not commit any