IBM 2001 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

90

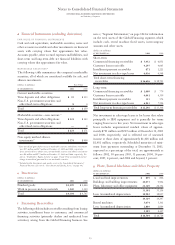

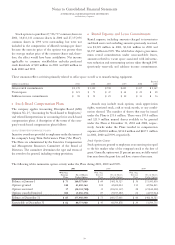

oTaxes

(dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2001 2000 1999

Income before income taxes:

U.S. operations $«««5,386 $«««5,871 $«««5,892

Non-U.S. operations 5,567 5,663 5,865

$«10,953 $«11,534 $«11,757

The provision for income

taxes by geographic

operations is as follows:

U.S. operations $«««1,455 $«««1,692 $«««2,005

Non-U.S. operations 1,775 1,749 2,040

Total provision for

income taxes $«««3,230 $«««3,441 $«««4,045

The components of the provision for income taxes by taxing

jurisdiction are as follows:

(dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2001 2000 1999

U.S. federal:

Current $««««348 $««««613 $«1,759

Deferred 341 286 (427)

689 899 1,332

U.S. state and local:

Current 62 192 272

Deferred 155 47 7

217 239 279

Non-U.S.:

Current 2,162 2,607 2,727

Deferred 162 (304) (293)

2,324 2,303 2,434

Total provision for

income taxes 3,230 3,441 4,045

Provision for social security,

real estate, personal

property and other taxes 2,761 2,766 2,831

Total provision for taxes $«5,991 $«6,207 $«6,876

The effect of tax law changes on deferred tax assets and liabil-

ities did not have a significant effect on the company’s

effective tax rate.

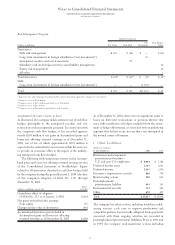

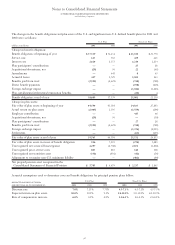

The significant components of activities that gave rise to

deferred tax assets and liabilities that are recorded on the

Consolidated Statement of Financial Position were as follows:

Deferred Tax Assets

(dollars in millions)

AT DE CEMBER 31: 2001 2000

Employee benefits $«««3,612 $«««3,673

Alternative minimum tax credits 1,282 1,424

Bad debt, inventory and

warranty reserves 907 953

Capitalized research and development 747 848

General business credits 700 655

Deferred income 656 837

Infrastructure reduction charges 466 617

Depreciation 386 376

Foreign tax loss carryforwards 325 489

Equity alliances 290 437

State and local tax loss carryforwards 238 246

Intracompany sales and services 127 149

Other 2,974 2,809

Gross deferred tax assets 12,710 13,513

Less: Valuation allowance 581 572

Net deferred tax assets $«12,129 $«12,941

Deferred Tax Liabilities

(dollars in millions)

AT DE CEMBER 31: 2001 2000

Retirement benefits $«««3,977 $«««3,447

Sales-type leases 2,159 2,450

Depreciation 971 1,179

Software costs deferred 318 306

Other 1,744 1,836

Gross deferred tax liabilities $«««9,169 $«««9,218

The valuation allowance at December 31, 2001, principally

applies to certain state and local, and foreign tax loss carry-

forwards that, in the opinion of management, are more likely

than not to expire before the company can use them.

A reconciliation of the company’s effective tax rate to the

statutory U.S. federal tax rate is as follows:

FOR THE YEAR ENDED DECEMBER 31: 2001 2000 1999

Statutory rate 35% 35% 35%

Foreign tax differential (5) (6) (2)

State and local 111

Valuation allowance

related items —(1) —

Other (1) 1—

Effective rate 30% 30% 34%