IBM 2001 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2001 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As a result of its ongoing research and development efforts,

the company was awarded the most U.S. patents in 2001 for

the ninth consecutive year, with a record 3,411 issued by the

U.S. Patent and Trademark Office. This represents nearly a 20

percent increase over its previous record of 2,886 set in 2000,

and the company becomes the first patent holder in history to

be granted more than 3,000 U.S. patents in a single year.

More than one-third of the technologies the company

patented last year are already being applied to its product

and service offerings. For example, magnetic recording media

with antiferromagnetically coupled (AFC) ferromagnetic films

as the recording layer is the company’s “pixie dust” patent.

Pixie dust is a new type of magnetic coating that is eventually

expected to quadruple the data density of current hard disk

drive products. In 2001, the company shipped more than

5.3 million disk drives manufactured with AFC.

Intellectual property and custom development income

include both sales and other transfers as well as license/royalty

bearing fee transfers. The sales and other transfers in 2001,

which included $280 million of pre-tax income from the trans-

fer of the company’s optical transceiver intellectual property,

declined from 2000 due to lower activity. These amounts can

vary from year to year. The amount of income from intellec-

tual property licensing/royalty-based fee transactions has

declined in recent years and may continue this trend in 2002.

See “Intellectual Property and Custom Development

Income,” on page 91 for additional information.

Other income and expense declined 64.2 percent in 2001

versus 2000 and increased 18.9 percent in 2000 versus 1999.

The decline in 2001 was primarily due to write-downs

($405 million) of certain equity investments for other-than-

temporary market declines. In addition, the company

realized lower gains from sales of securities and other

investments, lower interest income (other than from the

company’s Global Financing business transactions) and lower

net realized gains from certain real estate activities in 2001

versus 2000. The increase in 2000 versus 1999 was primarily

a result of higher net realized gains from certain real estate

activity and an increase in foreign currency transaction

gains, partially offset by lower interest income and lower

gains from sales of securities and other investments.

Effective January 1, 2001, interest expense is presented in

Cost of Global Financing in the Consolidated Statement of

Earnings if the related external borrowings to support the

Global Financing business were issued by either the com-

pany or its Global Financing unit (see pages 66 and 67 for a

discussion of Global Financing debt and interest expense).

In prior periods, the caption only included interest related to

direct external borrowings of Global Financing. Prior period

results have been reclassified to conform with the current

period presentation.

Interest expense, excluding amounts recorded in Cost of

Global Financing, declined 31.4 percent in 2001 from 2000

and 1.4 percent in 2000 versus 1999. The declines were pri-

marily due to lower average interest rates and a decline in

average debt outstanding in the periods.

The following table provides the total pre-tax (income)/

cost for retirement-related plans for 2001, 2000 and 1999.

(Income)/cost amounts are included as a reduction from/

addition to, respectively, the company’s cost and expense

amounts on the Consolidated Statement of Earnings.

Retirement-Related Benefits

(dollars in millions) 2001 2000 1999

Total retirement-

related plans $«(437) $«(327) $«83

Comprise:

Defined benefit

and contribution

pension plans (841) (728) (288)

Nonpension post-

retirement benefits 404 401 371

The additional income contributed by the defined benefit

plans of the company in 2001 was principally due to the long-

term investment returns generated by the pension trust assets.

As discussed in “Retirement-Related Benefits,” on pages 76

and 77, there will almost always be a difference in any given

year between the company’s expected return on plan assets

and the actual return. These differences are spread over time

in accordance with Statement of Financial Accounting

Standards (SFAS) No. 87, “Employers’ Accounting for

Pensions.” Although actual returns in 2001 were less than

expected returns in the U.S. pension plan, the cumulative

excess of actual returns over expected returns was $5.3 bil-

lion since 1986 (the year in which the company was required

to adopt SFAS No. 87). Each year’s difference is recognized

over a number of years following the year that each difference

arises. Therefore, the 2001 shortfall between actual and

expected returns in the U.S. will be recognized in the net

periodic pension calculation over the next five years along

with the excess actual versus expected returns in recent years

and any other differences arising in future years.

Although the income from defined benefit pension plans

represents a contribution to the company’s reported Income

before income taxes, these amounts are partially offset by the

costs of the company’s nonpension postretirement medical

benefits. Moreover, these amounts have positive implications

for the company’s employees, retirees and shareholders. The

returns that the fund has experienced over time resulted in

these benefits. As a result, despite the recent downturn in the

equity and financial markets, the trust funds have continued

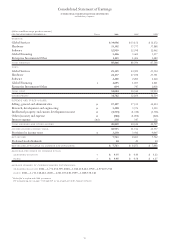

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION

and Subsidiary Companies

62